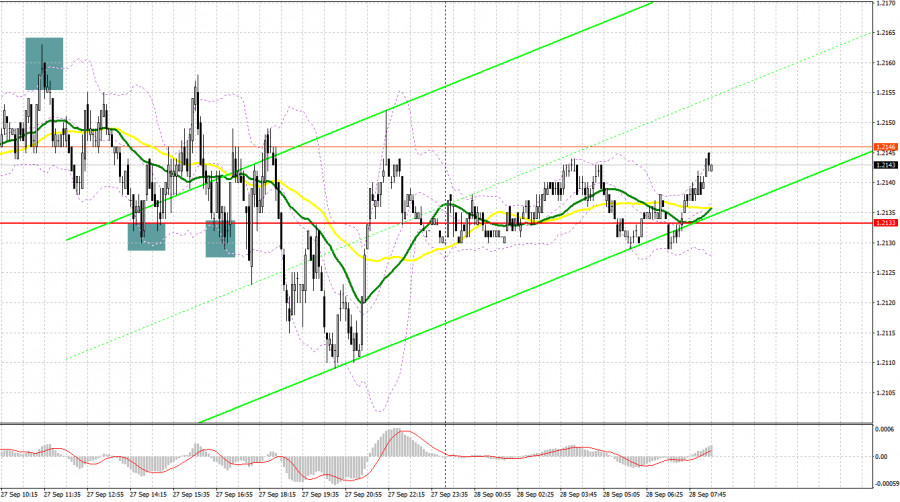

Yesterday, the pair formed several entry signals. Let's see what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.2158 as a possible entry point. A rise and a false breakout near 1.2158 formed a sell signal, resulting in a 30-pip drop. In the afternoon, despite the good US data, bulls repeatedly defended the support level at 1.2133, where I advised you to buy the pound. Although the pair initially rose by more than 30 pips, the second one turned out to be smaller, ultimately leading to the breakthrough of 1.2133 and the renewal of monthly lows.

For long positions on GBP/USD:

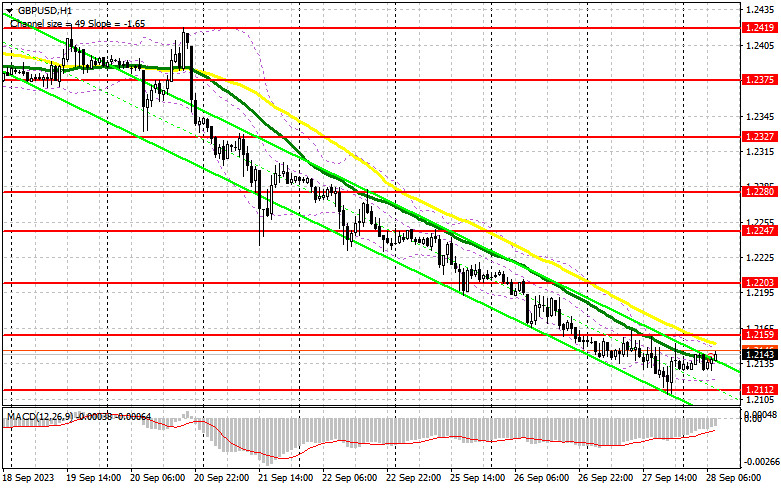

The light economic calendar exerts pressure on the pair, as many traders and economists expect more problems in the UK economy due to reduced activity and falling retail sales. On the other hand, it will have a good impact on inflation, which the Bank of England is so actively fighting against, but the pound is unlikely to benefit from this in the short term. For this reason, bulls are not distinctly active, and therefore, I advise you not to rush with long positions. For now, buyers need to defend the new low of 1.2112, which is where the pound was actively bought on Wednesday. A false breakout on this mark will provide an initial entry point for long positions against the bear market, aiming for a correction to the nearest resistance at 1.2159. This level is marked by moving averages that favor the sellers. A breakout and stabilization above 1.2388 will give the bulls a chance to build an upward correction and also bolster buyer confidence, signaling long positions aiming for 1.2203. The more distant target is the 1.2247 area, where I will be taking profits. If there is another dip to 1.2112 without buyer activity, pressure on the pound will increase, aiming for new monthly lows. In that case, only the defense of 1.2072 and a false breakout there will signal long positions. I plan to buy GBP/USD immediately on a rebound only from the 1.2028 low, aiming for a daily correction of 30-35 pips.

For short positions on GBP/USD:

Bears need to defend the nearest resistance at 1.2159. Ideally, a false breakout at this mark will serve as a sell signal with the prospect of another drop to a new monthly low of 1.2112. A breakout and an upward retest of this range will strike a significant blow to the bulls and open a downward path to the 1.2072 support. The more distant target remains the 1.2028 area, where I will be taking profits. If GBP/USD rises and there is no activity at 1.2159, buyers will get a chance for a correction. In that case, I will postpone selling the pair until a false breakout at 1.2203. If there is no downward movement there, I will sell the pound immediately on a rebound from 1.2247, aiming for a downward correction of 30-35 pips.

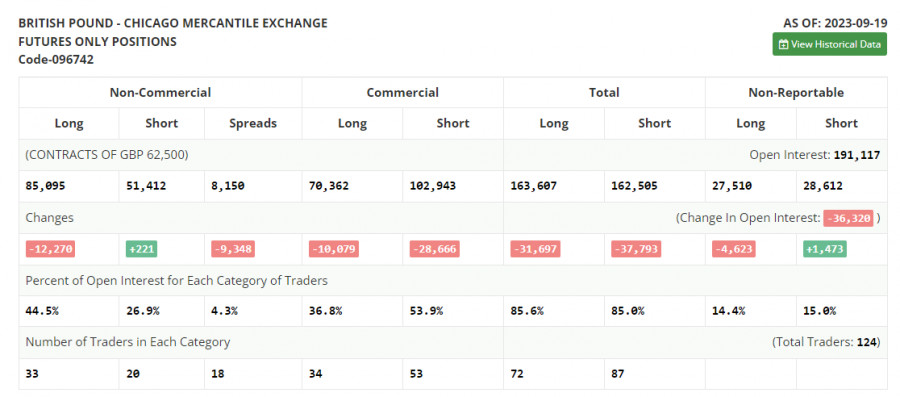

COT report:

The COT report (Commitments of Traders) for September 19 indicated a decrease in long positions and a slight increase in short positions. This shows that although there are fewer buyers of the pound, there is no distinct increase in the number of sellers. The UK inflation data influenced the Bank of England's decision, which left the rates unchanged, surprising many people. Traders took this news as negative, as the central bank is apparently at the peak of its rate hike cycle, which reduces the appeal of the pound. Given that the UK economy could even show a sharp slowdown in Q3, it's no wonder why the pound is actively falling against the US dollar. The latest COT report indicates that non-commercial long positions decreased by 12,270 to 85,095, while non-commercial short positions increased by only 221 to 51,412. As a result, the spread between long and short positions narrowed by 9,348. The weekly closing price dropped to 1.2390 against 1.2486.

Indicator signals:

Moving Averages

Trading below the 30- and 50-day moving averages indicates a further downtrend in the pair.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the pair grows, the upper band of the indicator near 1.2159 will act as resistance.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.