Regarding the Fed's interest rates, we should reflect on what happened in the previous year, when the regulator was just starting to tighten monetary policy. The regulator's assumptions at the beginning of the year assumed that the rate would need to be increased to 3.5%, and analysts deemed this scenario to be "hawkish." Because US inflation remained elevated in the first half of the year, FOMC members frequently increased the planned peak value of the interest rate. It wasn't until the end of the summer that it started to decline, and at first it did so quite slowly. The Fed made multiple decisions to raise rates by 75 basis points, which started to pay off when paired with falling energy prices. The inflation rate is 6.5%. It's too early, in my opinion, for the Fed to switch to a policy of maintaining rates because this value doesn't represent a significant enough slowdown. Large bank analysts, however, hold a different opinion.

According to Commerzbank economists, the rate will increase by 25 points in February before the regulator takes a break. Some FOMC members stated in January that the rate should rise further, but since inflation has performed well over the past six months, some of them permitted a pause in the rate increase in March. The weakening of the Fed's monetary policy may signal a further decrease in demand for US currency, which has been declining in recent months. Naturally, the market was unaware of the Fed's rate decrease today. As a result, the dollar situation is currently "thin." What the market has precisely taken into account and what it is going to simply gain back are both unknown. But considering the ECB's plans to increase the rate by 50 basis points at least twice more, it seems unlikely that the US dollar will benefit if the Fed takes a vacation in March.

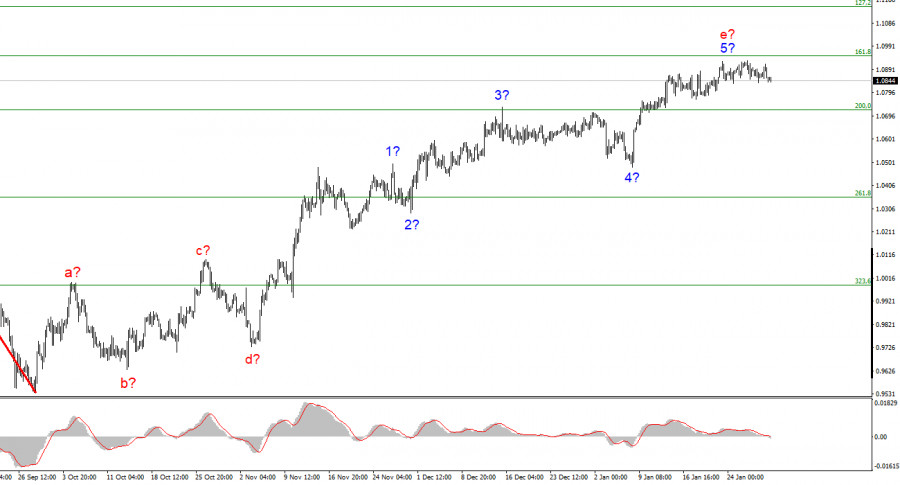

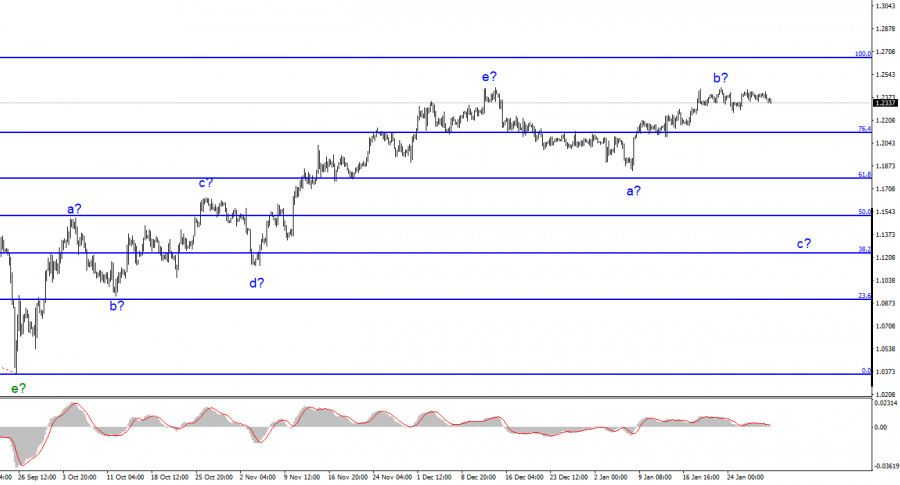

Wave analysis disagrees with the news context yet again. The US economy is still declining, according to economists' observations based on business activity indices and data on nonfarm payrolls. It is impractical to approach rates harshly when inflation is falling at the same time. Everything points to the US dollar receiving minimal support in the near future. However, I still believe that we should focus on more than just the news context. I think it's reasonable to anticipate the upward trend segment's completion as we get up to each significant Fibonacci level. For the euro, this level is now 1.0953. The British pound considered the peaks of waves e and b. This Friday, a new report on payrolls will be made public. The dollar will once more be on the edge of a new decline if the indicator drops once more. American citizens continue to face a challenging yet hopeful situation.

I draw the conclusion that the upward trend section's development is about finished based on the analysis. As a result, sales with targets close to the predicted level of 1.0350, or 261.8% Fibonacci, can now be taken into consideration. You can put your stop loss above 1.0953. The potential for complicating and extending the upward section of the trend remains quite strong, as does the likelihood of this happening. The market will be ready to finish the wave e when an attempt to break through the 1.0953 level fails.

The development of a new downward trend section is predicated on the wave pattern of the pound/dollar pair. Currently, sales with targets at the level of 1,1508, or 50.0% Fibonacci, might be taken into account. You can set a stop loss order above the peaks of waves e and b. The upward section of the trend is probably over; however, it might yet take a longer form than it does right now. However, you must exercise caution while making sales because the pound tends to rise.