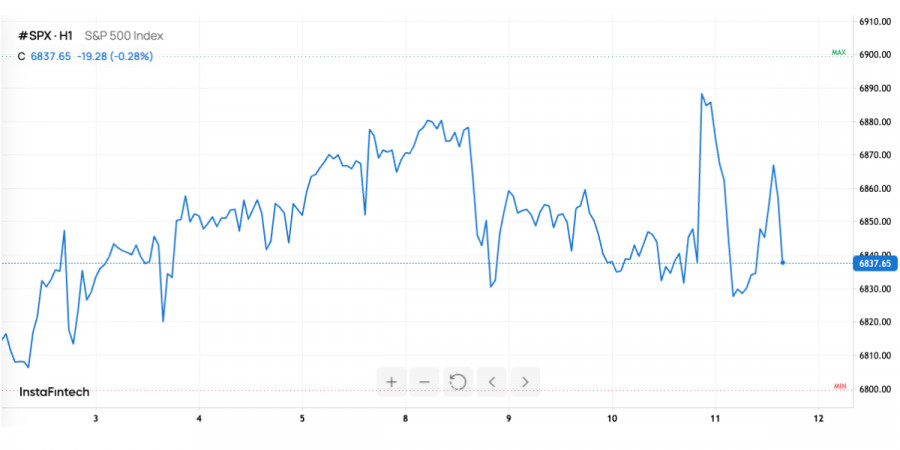

The U.S. stock market is entering the end of 2025 on a positive note. The Federal Reserve's decision to make its final rate cut of the year significantly boosted investor sentiment: the indices rose sharply, with the Dow Jones Industrial Average gaining almost 500 points in a single session, while the S&P 500 and Nasdaq also saw strong gains. The familiar phrase "Santa Claus rally" has reemerged in the news, referring to the traditional pre-holiday increase when markets, amid soft policies, seasonal optimism, and capital flowing into riskier assets, tend to rise more than fall.

At first glance, the picture looks almost ideal: rates are falling, indices are significantly above the levels at the start of the year, and the Fed's rhetoric sounds softer than it did six months ago. However, if you take a step back from the emotions, it becomes apparent that this growth is much more cautious and layered than it may seem at first glance. Investors are pleased—but they are keeping one eye on the chart and the other on statistics and corporate earnings.

The Fed rate cut is the key driver of the current movement. The cost of borrowed capital is decreasing, lowering yields on "safe havens" like Treasury securities, making risk assets more attractive. This is a classic market reaction: when the central bank adopts a softer stance, stocks typically respond with growth.

However, any rate is not just a number; it is a signal for the future. Investors are now carefully reading between the lines. There are several key points to consider.

The first is the finality of the cycle. The central bank has indicated that this reduction is the last for the current year, but has not made a firm commitment that 2026 will follow the same trajectory. The market is trying to guess whether this was a confident start to a new long period of low rates or a careful attempt to support the economy without overdoing liquidity.

The second point is the focus on 2026. The stock market thrives on expectations, and possible additional easing of monetary policy, stimulus programs through the budget, tax solutions, and the political cycle are already partially priced in. Investors are assessing whether companies can maintain current profit levels if economic growth slows and business expenses continue to rise.

The third point is the structure of growth. The rally amid a dovish Fed is not uniform across all sectors: those most sensitive to cheap money—technology, consumer sectors, and high-yield stories—are benefiting the most. But this is also where the main risks of overheating are concentrated.

In simple terms, the market is currently in a state of pleasant, yet very rational optimism. There is joy over the rate cut, but there are no illusions that it solves all problems immediately.

Technology and AI: A Magnet for Capital

The year 2025 has firmly established the technology sector, particularly companies related to artificial intelligence, as magnets for capital. Investors are accustomed to stories of exponential growth emerging from this sector and are willing to pay generously for the "future." However, any story about the "future" faces a simple question: what about real money here and now?

Last week's reports served as a harsh reminder of this. Oracle's report starkly illustrated how a disconnect between expectations and reality can quickly dampen enthusiasm. The company is actively investing in AI, increasing spending on infrastructure, cloud solutions, computational power, and partnerships. However, profit growth is not keeping pace with rising costs.

The market took notice—and reacted immediately. The company's stock fell, and this movement became not just a local story for one issuer but a signal for the entire sector. Asian markets are particularly attentive to this, where large corporations and funds have already largely built their strategies around AI and related technologies.

From this, an important conclusion follows: even under conditions of a dovish Fed and high liquidity, the fundamental reality of business has not vanished. If a company does not demonstrate proportional growth in revenue and profits, the market is increasingly unwilling to overlook this simply for the sake of a trendy narrative.

The technology sector remains both the main driver of growth and a potential source of turbulence. Any major company announcing that monetization of AI is progressing more slowly than expected could trigger a chain reaction of sell-offs—especially in areas where inflated expectations are already priced in.

Cautious Optimism: The Market Grows, But Checks Every Step

Despite the nervousness surrounding individual stories, the overall picture for U.S. indices remains positive. The Dow Jones, S&P 500, and Nasdaq are holding firmly above their starting levels for the year, and the reaction to the Fed news showed that buyers still have both the capital and the willingness to take risks.

Importantly, the demand for stocks is being shaped differently today. Investors are no longer buying everything indiscriminately amid "cheap money." The market has become more selective. More weight is given to companies with sustainable cash flows, understandable business models, and reasonable growth prospects. In places where profit becomes overly dependent on trends or very long-range forecasts, volatility only increases.

It is also worth noting that the current growth is largely underpinned by expectations regarding the U.S. economy. Markets are anticipating a soft landing scenario: inflation is brought under control, unemployment remains stable, and corporate profits increase at steady, if not explosive, rates. If this scenario begins to break down, the market will react quickly.

Thus, today's optimism can be described as conditional. This is not the euphoria of a cycle's start when everything rises on the faith of endless growth. It is cautious upward movement with constant risk management and readiness for a sharp change in sentiment.

What This Means for 2026

The key question that both traders and long-term investors are currently asking is: how sustainable is this rise, and what will it lead to next year?

On one hand, a combination of soft Fed policy, cheaper credit, and still-strong consumer demand creates a decent starting point for continued growth. If corporate profits confirm expectations and the U.S. economy avoids sharp deceleration, the market has a chance to smoothly transition from a "Santa Claus rally" to a moderately bullish start in 2026.

On the other hand, there are sufficient risks among them:

- Overheating in certain segments, especially in AI and high-tech companies;

- Possible disappointment in the pace of monetization of expensive technologies;

- Structural imbalances in commodity and debt markets;

- Political and fiscal factors that may alter the trajectory of taxes and government spending.

Essentially, the market is currently walking on thin ice: it receives support from the Fed and positive economic expectations from below, but is pressured from above by the need to back up high multiples with real results.