You require the following to open long positions on the GBP/USD:

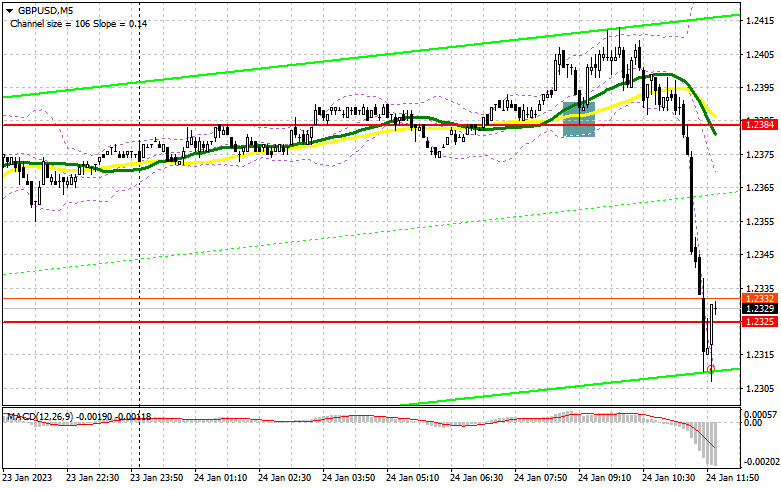

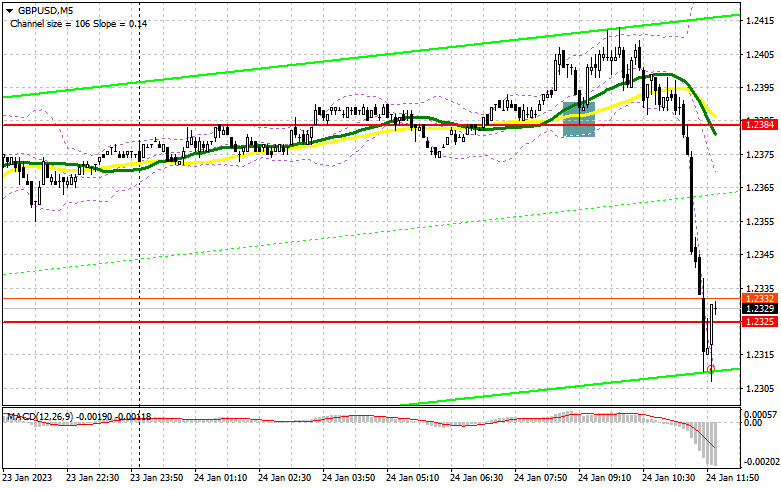

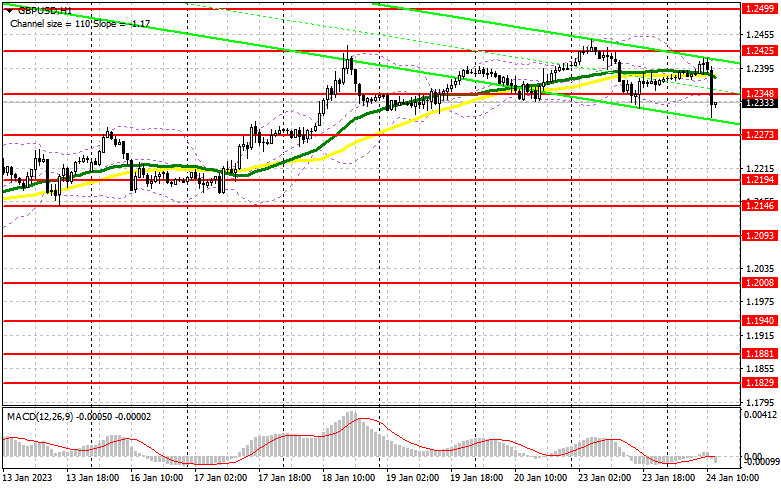

Only one indication to enter the market was produced in the morning. Let's analyze the 5-minute chart to see what transpired there. We were able to receive a good buy signal thanks to the drop and the development of a false breakdown in the area of 1.2384, which caused the pound to rise by 20 points but fell short of the morning objective. Then, during the second test of 1.2384, a breakdown of this level occurred, and the pressure on the pair was reinforced by the lack of reliable information on activities in the UK. The technical situation had fully changed by the afternoon.

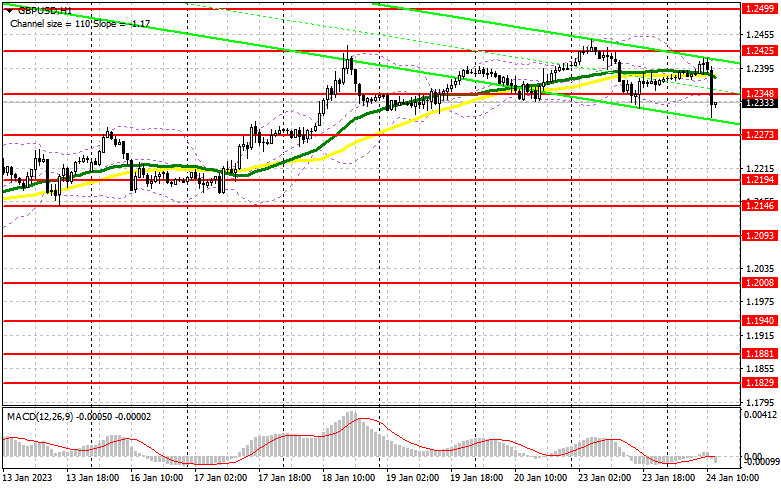

We anticipate similar updates on the manufacturing sector business activity index, the services sector business activity index, and the composite index of the US PMI during the American session. Strong data will cause the pound to once again trade downward, so I will focus exclusively on the nearest support level of 1.2273. The only way we can expect bullish momentum to build and a return to 1.2348, the intermediate barrier set in the early half of the day, is if there is a false collapse there. The demand for the pound will increase if prices remain above this range since bulls will have another chance to push prices up to the monthly high of 1.2425. At 1.2499, where I fix profits, an exit above this range with a top-down test will open up growth opportunities. The bulls will not influence the situation if they are unable to handle their responsibilities and miss 1.2273. The pressure on GBP/USD will rise, which will cause the market's direction to change and the emergence of a bear market. Because of this, I suggest that you hold off on making any purchases and instead begin long positions on a downturn and a false breakdown close to the minimum price of 1.2194. To achieve a correction of 30-35 points within a day, I will buy GBP/USD right away on the recovery only from 1.2146.

You require the following to open short trades on the GBP/USD:

The bears completed the challenges, making use of shaky information about the UK. Following a decline in service sector activity and an even bigger decline in the composite PMI index, sellers of the pound have become fairly aggressive. At this point, taking back control of the 1.2273 level is the main concern. It's important not to overlook the 1.2348 intermediate resistance's protection either. Only the creation of a false breakdown around 1.2348 will provide a signal to open short positions in the event of an upward move on weak US data, with the possibility of a new and more active slide down to 1.2273. Bullish sentiment will be countered by a breakthrough and reversal test from the bottom up of this range, which will result in a sell signal and a move to 1.2194. The area around 1.2146 will be my farthest target; this is where I'll set the profit. Even though the bullish trend will not continue, there is still a chance that the GBP/USD will rise given the option of growth and the absence of bears at 1.2348 in the afternoon. In this instance, the sole entry opportunity for short positions is a false breakout in the vicinity of 1.2425. If there isn't any activity there, I'll sell GBP/USD right away at its highest price of 1.2499, but only if I believe the pair will fall back by 30-35 points over the day.

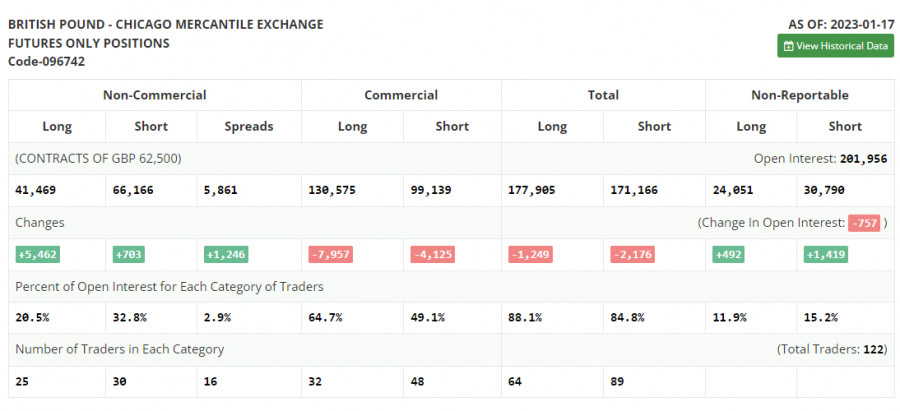

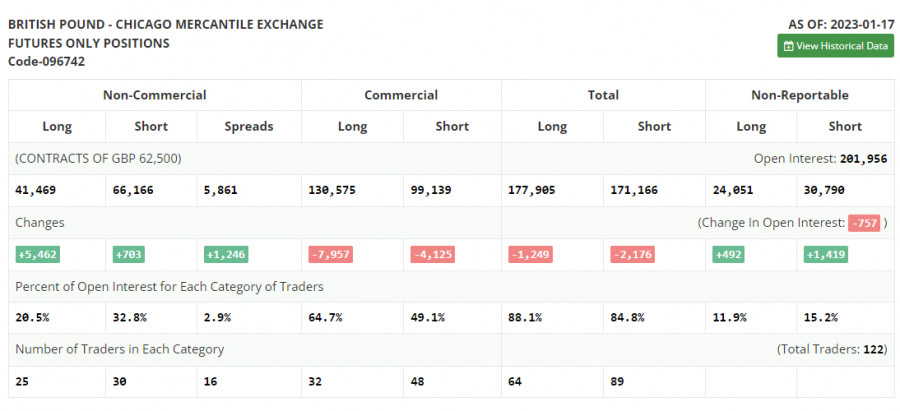

In the COT report (Commitment of Traders) for January 17, short and long positions increased. It is important to realize that the Federal Reserve System's formerly effective aggressive strategy is no longer working and that the economy's slowing down and a steep drop in retail sales are the first indications of a possible recession by the end of this year. At the same time, the Bank of England in the UK is still dealing with high inflation, although, according to the most recent report, it has fallen. This is not sufficient to somehow sway the regulator's opinion. Rates are projected to continue rising quickly, which will aid the pound in making up for losses it suffered when paired with the US dollar last year. According to the most recent COT report, long non-commercial positions immediately increased by 5,468 to the level of 41,469, while short non-commercial positions increased by 703 to 66,166, resulting in a decrease in the negative value of the non-commercial net position to -24,697 from -29,456 a week earlier. We will continue to closely study the UK's economic data to make inferences about the Bank of England's future policies because such negligible adjustments have little impact on the power dynamic. In contrast to 1.2182, the weekly ending price increased to 1.2290.

Signals from indicators

Moving Averages

The fact that trading is below the 30- and 50-day moving averages suggest that bears are trying to regain control.

Notably, the author considers the time and prices of moving averages on the hourly chart H1 and departs from the standard definition of the traditional daily moving averages on the daily chart D1.

Bands by Bollinger

The indicator's upper bound, which is at 1.2400, will serve as resistance in the event of an increase.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.