Trade Review and Tips for the British Pound

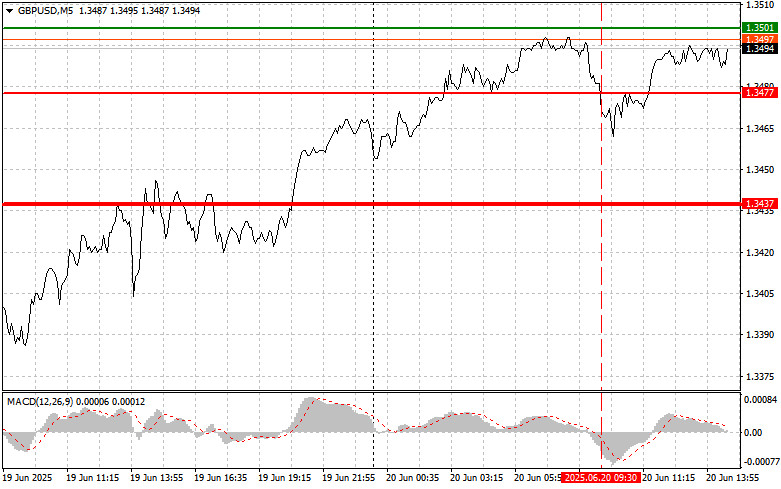

The test of the 1.3477 price level in the first half of the day occurred when the MACD indicator had already moved significantly below the zero mark, which limited the pair's downward potential. For this reason, I did not sell.

The unexpected and sharp decline in UK retail sales became a catalyst for the drop in the British pound. Investors and analysts closely watch retail sales data as it serves as an important indicator of consumer spending, a key driver of economic growth. Weak retail sales figures point to declining consumer confidence and the potential for a slowdown in economic activity. A decrease in retail sales directly impacts the national currency's value. When consumers cut back on spending, businesses earn less, which can lead to lower profits and reduced investment. Investors, concerned about the negative economic outlook, begin to pull out of British assets, reducing demand for the pound and thereby causing it to weaken.

The Philadelphia Fed Manufacturing Index and the Leading Economic Indicators Index are not expected to have major market impact, but local volatility triggered by their release is quite possible. The Philly Fed Index, for instance, may provoke a short-term reaction, especially if the reading deviates significantly from forecasts. However, such a reaction will likely be quickly offset by broader factors, such as overall market sentiment and expectations regarding future monetary policy. The Leading Indicators Index, although designed to forecast future trends, rarely has a strong influence on current market behavior. Investors typically consider it as one of many analytical tools rather than a direct trading signal. Thus, the U.S. session will likely be marked by consolidation, with moderate volatility and no sharp changes in currency dynamics.

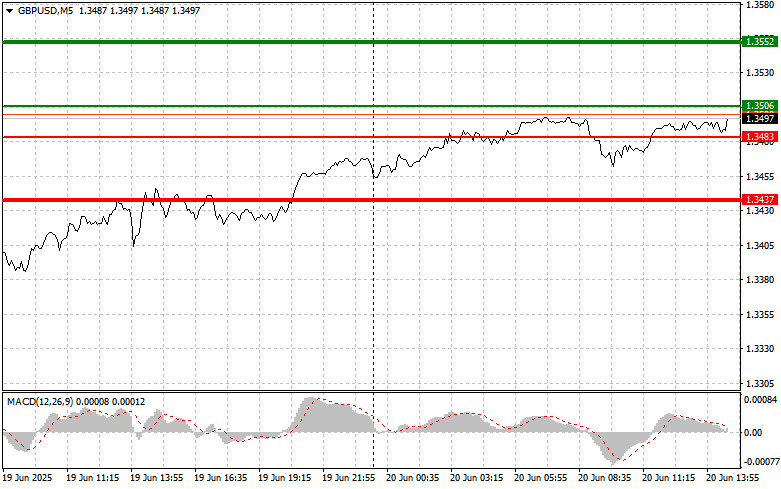

As for the intraday strategy, I will mainly rely on the execution of Scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy the pound today if the entry point at 1.3506 (green line on the chart) is reached, targeting a rise toward 1.3552 (thicker green line on the chart). At 1.3552, I will exit long positions and open shorts in the opposite direction, expecting a 30–35 point pullback. Today's pound strength is likely to remain within the bounds of a correction. Important: Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.3483 level while the MACD indicator is in oversold territory. This will limit the downside potential of the pair and trigger an upward reversal. A rise toward the opposite levels of 1.3506 and 1.3552 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound today after a breakout below the 1.3483 level (red line on the chart), which is expected to result in a quick drop in the pair. The key target for sellers will be 1.3437, where I will exit short positions and open longs in the opposite direction, expecting a 20–25 point rebound. Sellers are unlikely to show strong momentum. Important: Before selling, make sure the MACD indicator is below the zero line and just beginning to decline from it.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of the 1.3506 level while the MACD indicator is in the overbought zone. This will limit the pair's upside potential and trigger a reversal downward. A decline toward the opposite levels of 1.3483 and 1.3437 can be expected.

Chart Legend:

- Thin green line – Entry price for long positions

- Thick green line – Target price to set Take Profit or manually fix profit, as further growth above this level is unlikely

- Thin red line – Entry price for short positions

- Thick red line – Target price to set Take Profit or manually fix profit, as further decline below this level is unlikely

- MACD Indicator – When entering the market, it is important to follow overbought and oversold zones

Important:

Beginner Forex traders must be very cautious when deciding to enter the market. It is best to stay out of the market before key fundamental reports are released to avoid sudden price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-losses, you may quickly lose your entire deposit, especially if you don't use money management and trade large volumes.

And remember, successful trading requires a clear plan—like the one presented above. Making spontaneous decisions based on the current market situation is an inherently losing strategy for intraday traders.