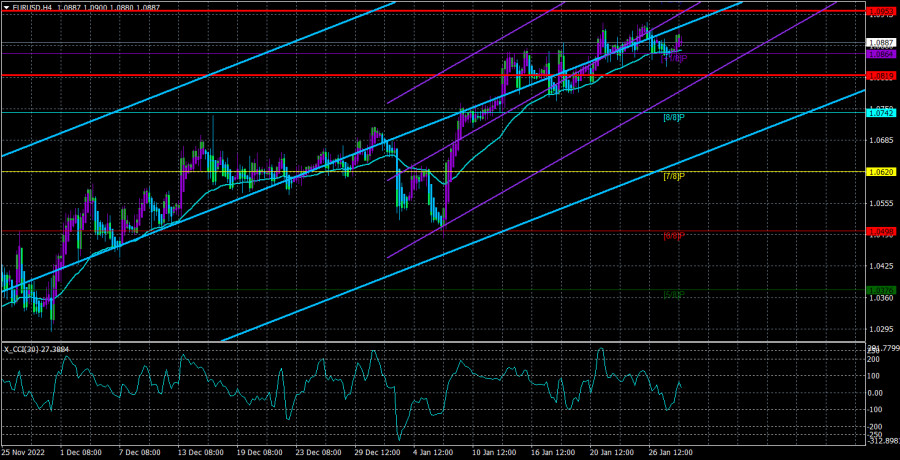

The EUR/USD currency pair began the week as uninteresting as possible. However, it is evident from the illustration above that the pair has been trading in this manner for several weeks. It is merely on the flat and close to the local maximum. There has emerged a paradoxical situation where traders are unable to make additional acquisitions and are unwilling to sell or fix profits on long positions. However, there should still be a solution to this problem. And this week is probably not the best time.

This week will be filled with activities and macroeconomic reports. We don't want to say it again, as analysts and experts have only been discussing rates for the past two weeks. This matter is, in our opinion, already resolved. The ECB will increase its rate by 0.5%, while the Fed will do so by 0.25%. We allocate 2% of the chance to a "surprise" of some kind. It is hard to plan for every scenario, but an improbable turn of events should never be fully ruled out. So, we're getting ready for the most likely situation. Additionally, it asserts that the market has already completely factored in both the ECB rate increase and the Fed rate increase. It turns out that only Jerome Powell or Christine Lagarde can deliver unexpected news. However, Ms. Lagarde has talked five or six times recently, and Mr. Powell and his colleagues covered all of their ground two weeks ago. Simply put, none of these individuals had any new facts to modify their statements. One would anticipate that monetary policies would be modestly modified if new inflation reports had been published over the previous week. However, there were no noteworthy reports, so there is also no justification for changing the tone.

A surprise from the ECB is still possible.

95% of what is mentioned above is accurate. There is one "but," though, and it cannot be entirely disregarded. The ECB meeting will take place on Thursday, while a new report on inflation in the European Union will be revealed on Wednesday. Thus, Lagarde's rhetoric could still vary slightly. There are some pretty clear-cut explanations for this. The truth is that news of Spain's accelerating inflation broke yesterday. Since they essentially have no impact on market mood, we typically do not take into account certain macroeconomic statistics of specific EU member states. However, the rising inflation in Spain raises the possibility that the rest of Europe may follow the lead. After all, forecasts for the Spanish CPI pointed to a new fall. And given that the ECB frequently increases rates and that oil and gas prices have decreased noticeably recently, a reduction was the most plausible scenario.

However, the effect of declining energy prices has already been seen. Either the ECB rate is increasing too slowly, it is increasing slowly, or it is generally an accident. Whatever it was, there is a chance that European inflation may either slow down only slightly (0.1–0.2%) or not at all. And in this instance, we shall get the most crucial answer: by how much does the ECB have the option of raising the key rate? Keep in mind that everyone now believes that the next three meetings will increase by 1.25%. What will happen then? The ECB will have to propose tougher measures to restrain price growth if inflation stops decreasing. The euro currency could gain a new growth component if it achieves this. The euro may fall if the ECB does not tighten its rhetoric in response to Wednesday's poor data, as market players will realize that the European regulator cannot raise the rate as much as necessary.

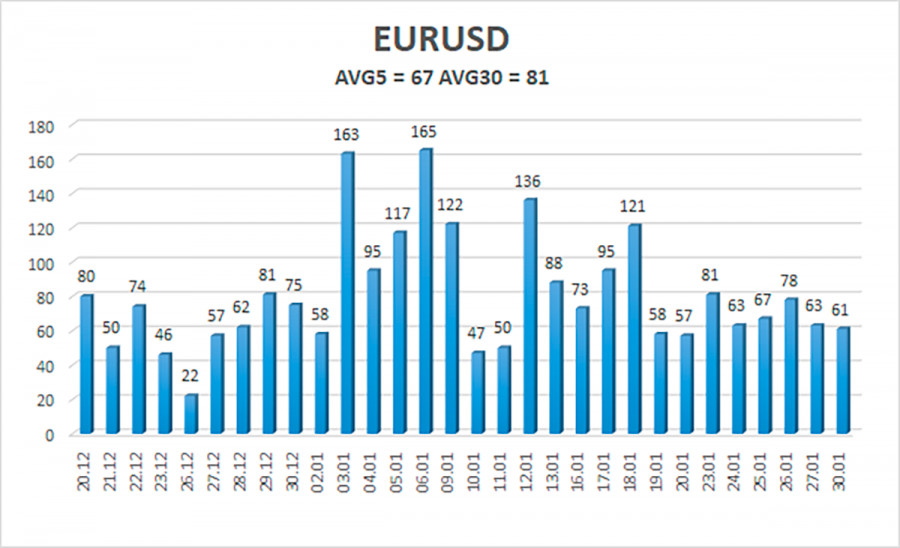

As of January 31, the euro/dollar currency pair's average volatility over the previous five trading days was 67 points, which is considered "normal." So, on Tuesday, we anticipate the pair to trade between 1.0819 and 1.0953. A new round of downward movement will be signaled by the Heiken Ashi indicator reversing downward.

Nearest levels of support

S1 – 1,0864

S2 – 1.0742

S3 – 1.0620

Nearest levels of resistance

R1 – 1.0986

Trading Suggestions:

The EUR/USD pair is still moving upward. In the case of a price recovery from the moving average or when the Heiken Ashi indicator reverses upwards at this time, long positions with targets of 1.0953 and 1.0986 might be taken into consideration. With targets of 1.0819 and 1.0742, short positions can be opened after the price is fixed below the moving average line. The flat is still going at this point, which is something to consider.

Explanations for the illustrations:

Channels for linear regression - allow us to identify the present trend. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.