The GBP/USD currency pair began the new week as uninteresting as possible. Since volatility has significantly decreased, traders have adopted a wait-and-see strategy. Since experts are still divided about how much the Bank of England rate will be raised this Thursday, if this behavior is appropriate in the case of the euro, it is even more appropriate in the case of the pound. Discussing the macroeconomic background of Monday and Tuesday is pointless because not a single significant report was released during this period. The British pound fell by roughly 50–60 points yesterday, but it also managed to stay inside the side channel, which is visible even on the 4-hour TF. Formally, a "double top" is formed as a result. The only thing left to do is estimate how much the pound will depreciate.

We have already stated that we anticipate a decline in the value of the euro. Therefore, it will be highly logical and reasonable if both of the key instruments of the foreign currency market move in the same direction during the upcoming few weeks. However, if the Bank of England increases the rate by 0.25%, it can avoid this. To be honest, the likelihood of a rate increase of 0.25 percent or 0.50 percent is currently 50/50. It is therefore quite challenging to determine which of these options traders have already factored into the current exchange rate of the pound sterling. The most aggressive course of action was chosen logically, given that the pound has been rapidly increasing lately. There is no definitive answer to this query; nevertheless, it is also possible that the market will cause the Fed's rate hike to be delayed. A stronger tightening will come as a pleasant surprise to the market if it is priced into an option with a 0.25 percent increase. The pound will, however, have a much greater chance of breaking the "double top" formation and continuing to rise as a result of this conclusion. You should exercise the utmost caution on Thursday as a result. If we are almost certain that the euro currency will fall, we can expect the pound to fall dramatically by around 60%.

The medium-term prospects of the British pound are also still highly unclear. If we ignore the rates, the British economy is in a very dire state. In the sense that the economy could experience a severe recession in 2023 that could last more than a year. There is no method to "extinguish" inflation. The BA cannot continuously raise the rate. We don't see any reason why the pound shouldn't continue to increase in value at the same rate it has for the past few months. It should be observed that the pound increased by 2,100 points or 50% of the two-year downward trend. We believe it is both excessive and abrupt. By the way, it has already been decided to slow down the tightening of the Fed's monetary policy. We would assert that there are no solid justifications for a new expansion of either the euro or the pound.

Separately, we'd want to discuss how the market might respond to all of the events scheduled for the second half of the week. Similar circumstances have already occurred recently when three Central Bank meetings were held in three days and statistics on nonfarm employment and unemployment in the United States were made public. The market's response was then lower than many had anticipated. So perhaps this time. It should be acknowledged that events will be layered on top of one another in terms of how quickly the market reacts to them. Late tonight, the Fed meeting's outcomes will be made public. European markets won't be able to determine them until the following morning. The outcomes of the ECB and BA meetings will also be made public in the morning. And as we previously learned above, the British regulator's intentions remain uncertain. In other words, not only will the most significant events be placed on top of one another, but the events' contents may also be unexpected. We recommend starting with the option with the euro and pound falling in value, but remember to set a stop loss. They will be very beneficial to traders throughout the next few days.

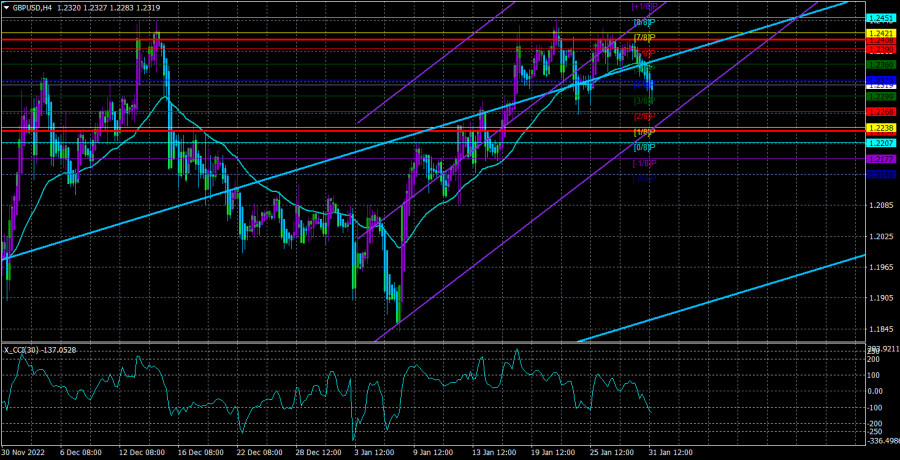

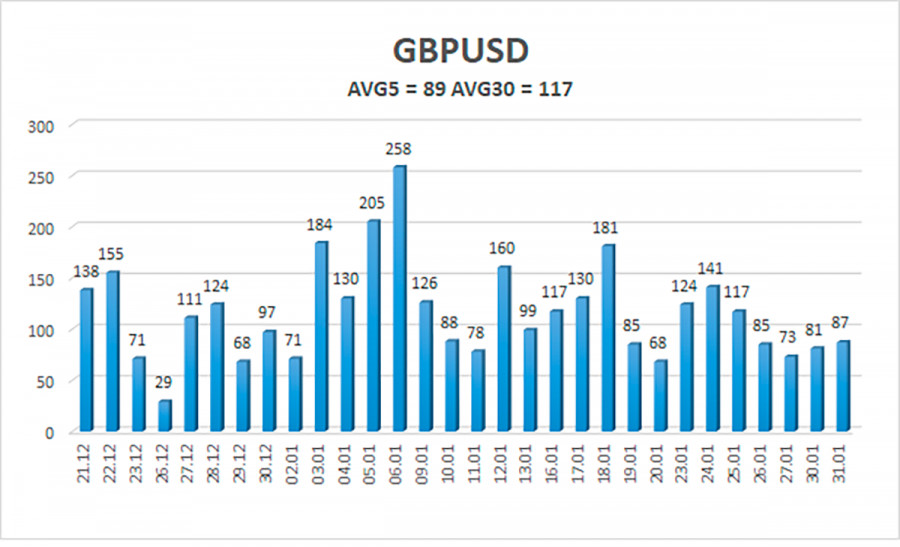

Over the previous five trading days, the GBP/USD pair has displayed an average volatility of 89 points. This number is the "average" for the dollar/pound exchange rate. Thus, we anticipate movement inside the channel on Wednesday, February 1, with movement being limited by levels of 1.2230 and 1.2408. A new attempt to continue the upward trend is indicated by the Heiken Ashi indicator's upward reversal.

Nearest levels of support

S1 – 1.2299

S2 – 1.2268

S3 – 1.2238

Nearest levels of resistance

R1 – 1,2329

R2 – 1.2360

R3 – 1.2390

Trading Suggestions:

In the 4-hour timeframe, the GBP/USD pair has been consolidating below the moving average. With targets of 1.2268 and 1.2230, it is now possible to maintain short positions. If the price is fixed above the moving average line, you can start trading long with targets of 1.2408 and 1.2451. Furthermore, the pair has been flat in recent weeks.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.