The euro is unwilling to lose ground ahead of the FOMC policy meeting. Policymakers are inclined to another moderate rate hike. Bearing in mind the inflation data and GDP data released recently, the rate-setting committee has several scenarios. Which one they will choose? We will find out tonight.

Fed Chairman Jerome Powell highlighted the need for further monetary tightening in his latest landmark speeches. He denied the rumors that the FOMC could decide to lower interest rates at the year's end. The US rate-setting committee is widely expected to raise the federal funds rate by 25 basis points today, increasing its target to a range of 4.5%-4.75%. This move will mean that the Fed officials are softening their hawkish rhetoric after a sharp rate hike by half a percentage point in December. Previously, the central bank had increased interest rates 4 times one after another by 75 basis points at a time.

This time, the Federal Reserve will not present any economic forecasts. So, traders are anticipating Jerome Powell's press conference following the meeting. His comments will shed light on the Fed's further agenda for monetary tightening. If the Chairman drops hints about a dovish reversal, demand for risky assets will remain high, especially in contrast to the ECB's and the Bank of England's hawkish rhetoric. Such a fundamental background will enable further growth of the euro and the pound sterling.

Meanwhile, market participants are speculating about the ultimate level for the key interest rate in the course of the cycle of rate hikes. A lot of experts project that it might exceed 5.0%, but some analysts are certain that the interest rate will peak at 5.0%. The policy decision will be announced in Washington today at 14:00pm ET. Jerome Powell will speak in front of journalists half an hour later.

As I told you earlier, a series of economic data revealed that inflation pressure has been easing in the US and economic growth has been slowing down. These are signs that the Fed's aggressive monetary tightening has already derailed the normal pace of economic growth. Nevertheless, the labor market is still showing resilience, thus forcing the Federal Reserve to go ahead with rapid rate hikes and extend the cycle of borrowing cost increases.

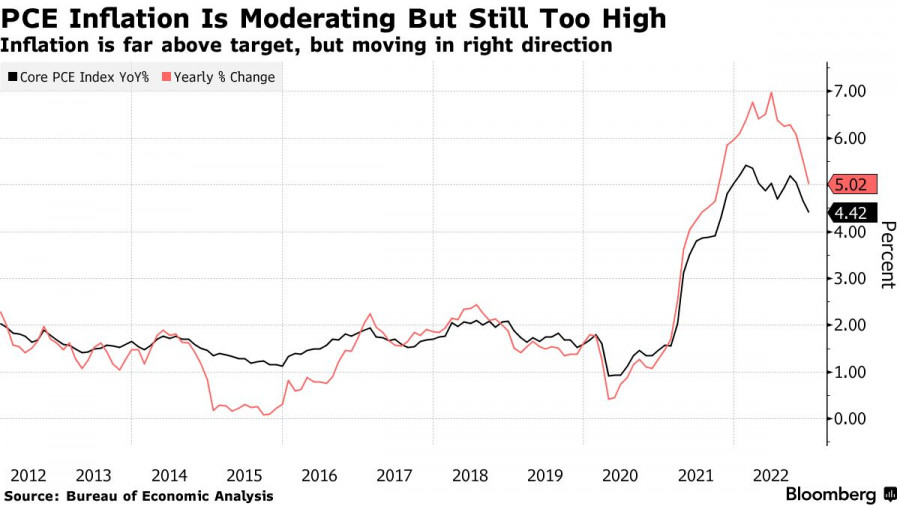

Another thing to pay attention to is whether Powell will refer to the Fed's forecasts made in December. Back in December 2022, Fed officials expected interest rates to grow to 5.1% in 2023. If Powell expands on recent inflation data which indicated a faster-than-expected slowdown in headline inflation, he will signal a dovish reversal in the Fed's rhetoric. According to the last inflation report, the PCE price index, the Fed's preferred measure of inflation, rose by 5% in December from a year ago. It is the slowest pace since 2021 but still way above the official target at 2% on year.

Some analysts think that the FOMC is running the risk of sending a too dovish signal if the committee dares to revise its rhetoric. The question is whether the policymakers will venture to raise interest rates at a slower pace from now on.

As for the Federal Reserve's balance sheet, some policymakers, including the Federal Reserve Bank of New York President. John Williams stated recently that it has been scaled down as planned. Such programs act as a buffer for financial markets as long as liquidity is being withdrawn.

Let's discuss the technical picture of EUR/USD. Demand for the euro ash weakened, though there is still a chance for EUR/USD to update one-month and one-year highs. For this, the currency pair has to settle above 1.0840 which will enable the price to spike to 1.0880. Above this level, the instrument will be able to climb to 1.0910 easily. If so, the way will be open to top the level of 1.0970. In case EUR/USD declines, the price may break the support of 1.0840. This will step up selling pressure and push the currency pair down to 1.0805. In this case, the price could hit a low of 1.0770.

When it comes to GBP/USD, the pound sterling remains under pressure. The bulls will be able to assert their strength if they manage to push the price up above 1.2330. Only a breakout of the resist ace at 1.2380 will cement hope for a recovery to 1.2440. Once this level is hit, GBP/USD will gain enough bullish momentum to jump to 1.2490 and 1.2550. The currency pair could come under selling pressure again after the bears take out the level of 1.2280. This will challenge the bullish force and push the instrument down to 1.2230 and 1.2170