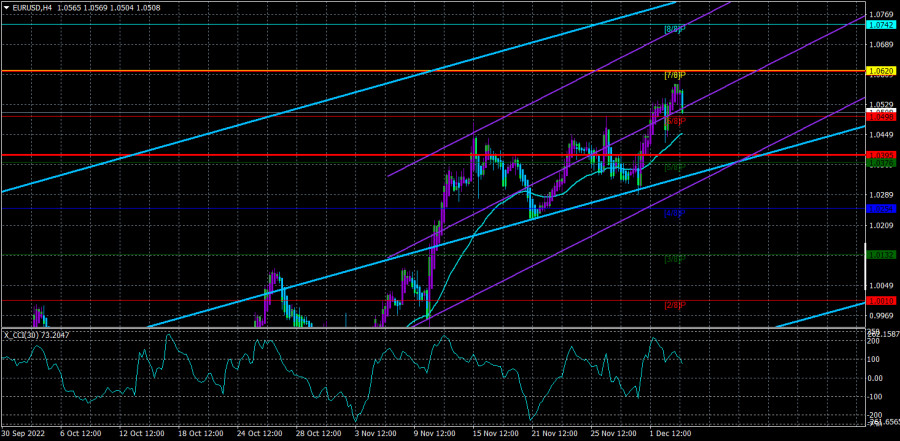

The EUR/USD currency pair on Thursday maintained its previous movement pattern. Once more, the price could not surpass the moving average line, which is now giving rise to grave concerns. Recall that the moving average differs from a reinforced concrete line like Senkou Span B or Kijun-sen. Rather, it serves as a guideline for a short-term trend. However, overcoming it has no sacramental truth if the trend movement abruptly stops (there is no regular updating of highs or lows). The pair, however, cannot fall a few dozen points below the moving average line. What does this mean? Are no bears present at all, or is a significant fall anticipated?

As strange as it may sound, we are still waiting for the US currency to strengthen after two weeks of anticipating a downward correction. Since there aren't any macroeconomic statistics this week, the euro hasn't had any grounds for growth in the last three to four weeks. Even reports like the GDP are now being worked out by the market, which previously chose to ignore them due to the complete lack of information. As a result, at this point, the pair is unable or unwilling to adjust even a few hundred points. We are sick of stating that traders have already anticipated events like the US midterm elections and changes to the ECB or Fed's monetary policy on numerous occasions. Yes, the Fed will meet next week, but what will the market gain from it if it already knows that rates will increase by 0.5% rather than 0.75% as they did at the previous four meetings? Undoubtedly, a lot of time has been spent working out this factor. Furthermore, since the rate of inflation in the EU has yet to slow down, it is still too early to anticipate a change in the ECB's attitude. As a result, we do not anticipate any modifications to the monetary strategy from the European regulator. If so, why has the value of the euro currency increased in recent weeks if the rate increase of 0.75% hasn't also been planned for a long time?

What can the pair be anticipated to do in December?

It is reasonable to assume that it will now experience the same downward correction. The only option left for traders is to fix at least some of the long positions because all potential drivers of the growth of the European currency have already been identified. Although we do not rule out the possibility that the euro will continue to rise over the coming years, this growth is occurring too quickly and sharply. It has risen by 1,000 points in just two months. Remember that 2,800 points made up the entire downward trend, which lasted two years. This means that by March or April of the following year, the European currency will fully recover its losses from the previous two years. This is not possible. It is possible to comprehend why strong and long-term growth should be anticipated from the pair if there were good reasons for this, such as a sharp improvement in the global geopolitical situation or a stronger ECB rate hike than the Fed. But which global factors currently support the euro?

Threatening to last for many years is the geopolitical conflict in Ukraine. For the parties to the conflict and the entire world, no one can predict when a new escalation will start and how it will end. The Fed's rate will undoubtedly increase to 5%, possibly even higher, and will stay there for at least one and a half to two years. The ECB rate, however, is covered with much less information. Most likely, it will also keep expanding, but as we already mentioned, not all EU nations can bear the burden on their own economies. As a result, the ECB will adopt a less aggressive monetary policy than the Fed. If so, then the dollar, not the euro, is also growing as a result of this.

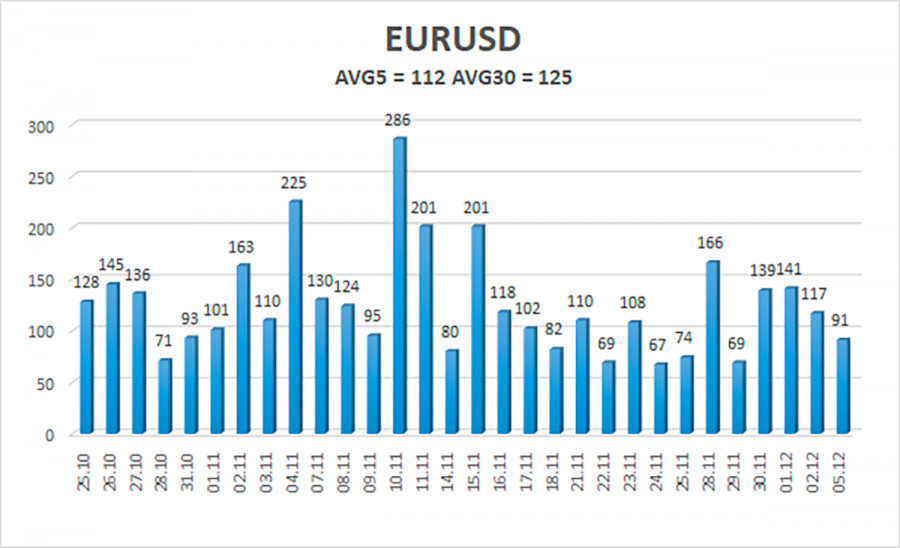

As of December 9, the euro/dollar currency pair's average volatility over the previous five trading days was 115 points, considered "high." As a result, we anticipate that the pair will fluctuate on Friday between 1.0444 and 1.0643. A downward reversal of the Heiken Ashi indicator will indicate a new attempt to correct it.

Nearest levels of support

S1 – 1.0498

S2 – 1.0376

S3 – 1.0254

Nearest levels of resistance

R1 – 1.0620

R2 – 1.0742

R3 – 1.0864

Trading Suggestions:

The EUR/USD pair is still moving upward. Therefore, before fixing the price below the moving average, we should consider long positions with targets of 1.0623 and 1.0612. No earlier than fixing the price below the moving average line with targets of 1.0376 and 1.0254 will sales become relevant.

Explanations of the illustrations:

Linear regression channels help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.