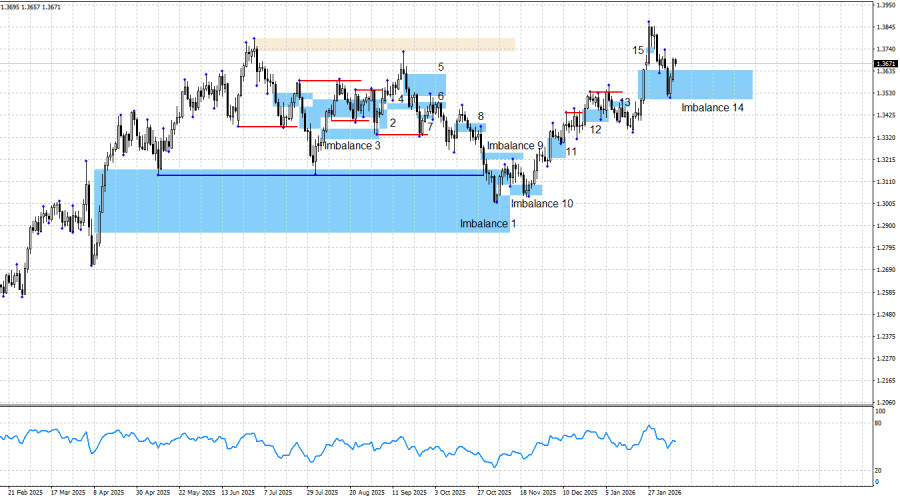

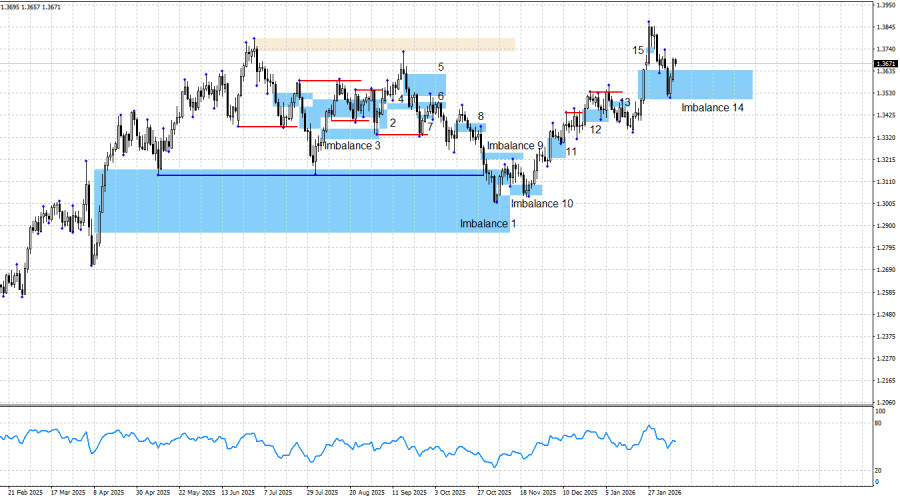

The GBP/USD pair has fully filled the latest bullish imbalance and reacted from its lower boundary. As a result, a new bullish signal has also formed for the pound, exactly as I expected. Most importantly, buy signals appeared almost simultaneously in both the pound and the euro. This significantly increases the probability of further growth in both currency pairs.

However, events this week may develop not only rapidly, but also not according to plan. I would like to remind you that the Nonfarm Payrolls and unemployment rate reports will be released as early as tomorrow, followed by the inflation report on Friday. These three reports account for about 90% of the influence on the FOMC and its monetary policy decisions. Therefore, these reports may trigger strong reactions from traders, who will essentially receive clues about what to expect from the Fed at upcoming meetings.

Of course, everyone is expecting a slowdown in inflation, as well as weak labor market and unemployment data. However, I would caution traders against drawing hasty conclusions and making trading decisions based solely on these expectations. There have been many situations in the market when all factors point in one direction, while price moves in the opposite direction. Buy signals are in place and should be worked with, but on Wednesday and Friday traders must be prepared for any outcome.

The bullish trend in the pound remains intact, and this is confirmed by the chart picture. Since November 5 alone, traders have already had at least three opportunities to open long positions. During this period, the pound has risen by 640 points when measured from the swing low to the current price level. Bullish signals are forming regularly, while bearish patterns have not appeared for quite some time. In my view, this is a case where there is no need to reinvent the wheel.

The news background on Tuesday was fairly weak. Last week, bears attacked quite aggressively, supported by the Bank of England and strong U.S. ISM business activity indices in the services and manufacturing sectors. This week, no such gifts have been given to the bears. On the contrary, the bulls may receive several. One already came from China on Monday, when Beijing banned commercial banks from purchasing U.S. Treasury bonds. Several more are lined up: Nonfarm Payrolls, the unemployment rate, and the Consumer Price Index.

In the United States, the overall news background remains such that nothing but a decline of the dollar can be expected in the long term. The situation in the U.S. remains quite difficult. U.S. labor market data continue to disappoint. Three of the last four FOMC meetings ended with dovish decisions. The latest labor market data suggest that the pause in monetary easing will be short-lived.

Donald Trump's military aggression, threats toward Denmark, Mexico, Cuba, Colombia, Iran, EU countries, Canada, and South Korea, the initiation of criminal proceedings against Jerome Powell, a new government shutdown, and the scandal involving the U.S. elite related to the Epstein case all perfectly complement the current picture of political and structural crisis in the country. In my view, bulls have everything they need to continue their offensive throughout 2026.

A bearish trend would require a strong and stable positive news background for the U.S. dollar, which is difficult to expect under Donald Trump. Moreover, the U.S. president himself does not need a strong dollar, as the trade balance would remain in deficit in that case. That is why I still do not believe in a bearish trend for the pound. Too many risk factors continue to weigh heavily on the dollar. What exactly are the bears planning to use to push the pound lower?

If new bearish patterns emerge, a potential decline in the pound sterling could be reconsidered, but at the moment there are none.

News Calendar for the U.S. and the UK:

- United States – ADP Employment Change (weekly) (13:15 UTC)

- United States – Retail Sales Change (13:30 UTC)

On February 11, the economic calendar contains three events, two of which could leave a strong impression on traders. The impact of the news background on market sentiment on Wednesday will be significant, particularly in the second half of the day.

GBP/USD Forecast and Trading Advice:

For the pound, the picture remains bullish, and a new buy signal has been formed. Bulls have launched a new offensive that threatens to be quite long and serious. Since the bullish trend is indisputable, traders are left with only one option: trade to the upside using clear patterns and clear signals. Imbalance 14, as expected, provided such an opportunity.

I considered the 1.3725 level as a potential upward target, and this level was reached. However, the pound may rise much higher in 2026 — there are no limits. The nearest attractive target appears to be the 1.4246 level, the peak of June 2021.