The euro and dollar held steady, traders around the world are waiting for Federal Reserve Chairman Jerome Powell to explain.

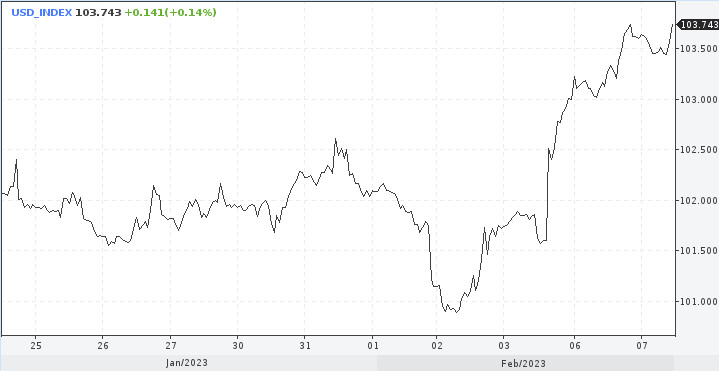

The U.S. currency index opened Tuesday near 103.50. There was a slight bearish correction after rising more than 2% over the past three sessions. Investors reconsidered the outlook for monetary policy as stronger-than-expected jobs data indicated the Fed might continue tightening. Although Powell's remarks on disinflation during last week's meeting signaled a dovish pivot. Markets are cautiously awaiting Powell's speech.

Traders are eager to find out whether they will eventually get clues about the central bank's plans.

The dollar rebounded, but it may return to a bearish trend and none other than Powell can send it that way. The US currency is about 10% below last September's highs. Analysts for the most part expect the dollar to weaken further this year.

"At the heart of the bearish dollar view is the call that the Fed will shift to a reflationary stance in the second half of 2023, US short dated yields will fall and those yield differentials will move against the dollar," commented ING.

So far, the greenback looks enthusiastic. An intermediate obstacle is 103.88. If it doesn't hold, nothing will prevent the bulls from reaching the 2023 high at 105.63.

Euro trends

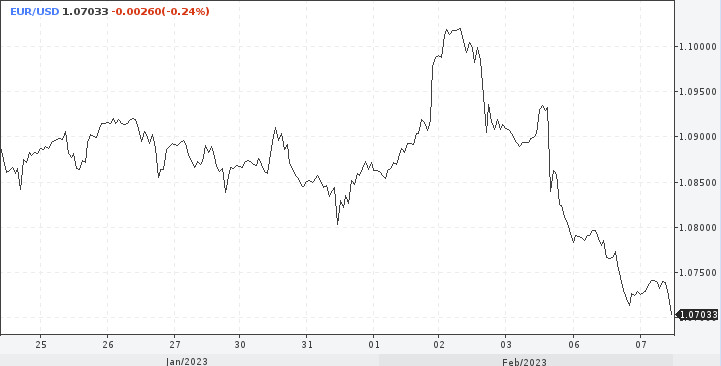

Fundamentally the Euro is looking more and more attractive with lower gas prices. If the story with the opening of China continues to develop in a positive direction, together this could lead to sustained growth in the EUR/USD pair throughout the year. Major growth should occur in the second quarter, as a sharp decline in U.S. inflation is expected during this period.

Sustained EUR/USD gains beyond 1.15 may be harder to achieve in the second half – especially if US debt ceiling negotiations are pushed to the limit," ING also noted.

Now EUR/USD traders are at a crossroads near the intraday high of 1.0740 and the quote may bounce after Powell's comments. However, further declines look more likely.

The UOB suggests that the EUR/USD could fall to 1.0615 in the near term.

"We expected EUR to drop below 1.0755 yesterday and we held the view that 'the next support at 1.0700 is unlikely to come under threat'. Our view was not wrong even though EUR dropped close to 1.0700 (low has been 1.0708). While conditions remain oversold, EUR could dip below 1.0700 before stabilization is likely," according to markets Strategist Quek Ser Leang and Senior FX Strategist Peter Chia at UOB Group.

It is unlikely that the next major support at 1.0615 will come into play today. Resistance is at 1.0750, followed by 1.0785. Climbing above this area is a signal that the euro has stabilized after the declines.

If EUR/USD traders remain bearish after crossing 1.0700, it will be important to keep an eye on the support line from late last November, located near 1.0650.

A drawdown below 1.0650 would make it vulnerable to a renewal of the yearly low, which is currently located around 1.0480.

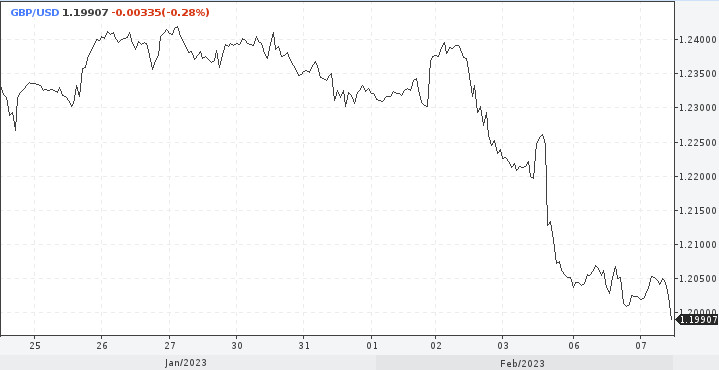

Vulnerability of the pound

The pound looks depressed. Since the dollar is the driving force behind currencies like the euro and the pound, a sharp reversal of the index might indicate that some market trends can change.

The GBP/USD's capitulation to the 1.2000 area raises a lot of questions. Does it mean that the pound reached a high at 1.2400? We should keep an eye on the dollar's trend and the nearest events, which can seriously influence it. Overall, the GBP/USD pair retains the risk of further declines, the mark below 1.2000 is considered.

Any drawdown beyond this value implies trading in the lower part of the 1.1980-1.2060 range. There is no serious justification for the movement below 1.1980, at least, considering the current trends in the market. However, on Tuesday evening, a lot can change during the US session. Traders will probably play back Powell's comments.

It is unlikely to be as heated as last week. First of all, Powell has nothing principally new to say. Secondly, the week should be some respite for the currency market after the Fed meeting and the Nonfarm, and ahead of the release of the U.S. inflation report. That will happen next Tuesday.

If CPI turns out to be stronger than forecast, the dollar will continue to rise. That said, another decline below the consensus would result in a weaker rate. Investors are more inclined to view the labor market numbers as a short-term blip. The theory of a slowing economy and an end to Fed rate hikes will play out in new colors.

As for the pound, it remains to be seen whether meaningful support at 1.1845 will come into play. Overall, only a break above 1.2150 would indicate that the weakness that began at the end of last week is over.