5M chart of GBP/USD

On Monday, GBP/USD followed the EUR/USD pair. In terms of "technique", such a movement was quite logical, because there is still a flat and "swing" on the higher charts. Therefore, the pair does not need the appropriate factors to exhibit the movement in one direction or the other. The pound may easily go up another 200-250 pips and appear near the upper limit of the horizontal channel in the daily chart. And on the lower chart, GBP can climb 500-600 points, which seems to be a strong trend. That is why yesterday we didn't even need any basis for such a movement. There were none. Technically, the euro could pull the pound up, but its grounds for its own growth were also questionable. Anyway, please remember that we can also observe a swing movement.

Speaking of trading signals, they weren't quite clear. Initially, the pound sharply rose several times and settled above and below 1.2185. It could be considered in conjunction with 1.2143, but it was not obvious. Therefore, it is not certain that traders have opened the necessary long position in order to profit from the upward movement during the day. Unfortunately, sometimes such ambiguous situations happen.

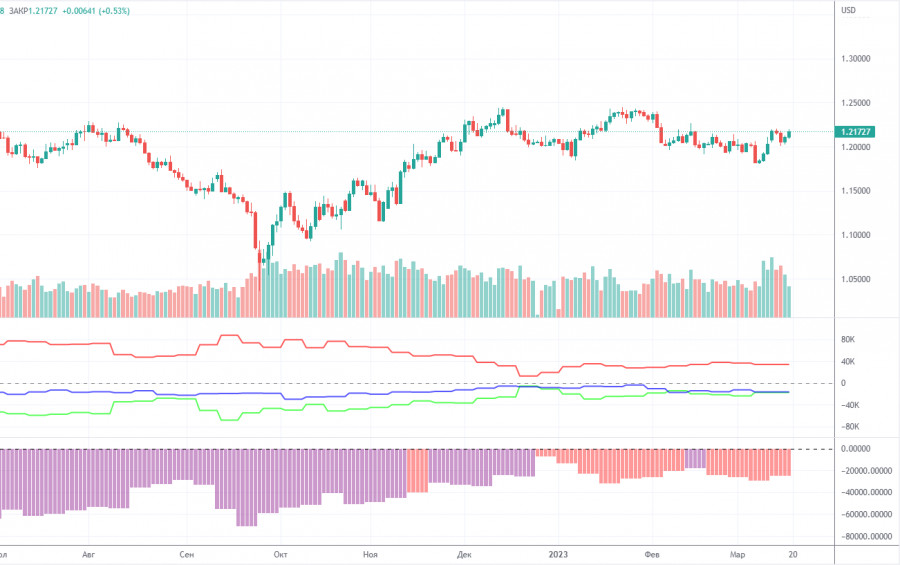

COT report:

For the British pound, the COT reports are still coming out very late, with the CFTC continuing to catch up on the chart. The last report available is for March 7. According to that report, the non-commercial group opened 7,500 long positions and 1,200 short ones. Thus, the net position of non-commercial traders increased by 6,300 and continues to grow. The net position indicator has been steadily growing over the past months but the mood of major traders still remains bearish. Although the pound sterling is growing against the dollar (in the medium term), it is very difficult to answer the question why it is doing this from a fundamental point of view. It is quite possible that the pound sterling may slump in the near future. Formally, it has already begun its downward movement but so far it looks more like a flat. Notably, both major pairs are moving similarly at the moment. However, the net position for the euro is positive and even implies the imminent completion of the upward momentum, whereas for the pound it is negative. But at the same time, the pound has already grown by 2100 points, which is a lot, and without a strong bearish correction the continuation of the growth will be absolutely illogical. The non-commercial group opened a total of 66,000 shorts and 46,000 longs. We remain skeptical about the long-term growth in the British currency and expect it to fall deeper.

1H chart of GBP/USD

On the one-hour chart, GBP/USD continues to trade higher, supported by the trend line. However, it continues to move within the horizontal channel on the 24-hour chart, which, we should remember, is 600 pips wide. Therefore, the pound still has the potential for growth, but only technically. From a fundamental perspective, we have been waiting for the pound to fall, but at the moment there is a trend line, which supports the growth at least a little bit. So, at least, until it settles below the trend line, the pound might continue growing. On March 21, it is recommended to trade at the key level of 1.1927, 1.1965, 1.2143, 1.2185, 1.2269, 1.2342, 1.2429-1.2458, 1.2589. The Senkou Span B (1.2003) and Kijun Sen (1.2146) lines can also generate signals. Rebounds and breakouts from these lines can also serve as trading signals. It is better to set the Stop Loss at breakeven as soon as the price moves by 20 pips in the right direction. The lines of the Ichimoku indicator can change their position throughout the day which is worth keeping in mind when looking for trading signals. On Tuesday, there are no important events or reports planned for the UK or the US again. The pair may continue to move at an average pace with an upward bias based on technique.

Indicators on charts:

Resistance/support - thick red lines, near which the trend may stop. They do not make trading signals.

Kijun-sen and Senkou Span B are the Ichimoku indicator lines moved to the hourly timeframe from the 4-hour timeframe. They are also strong lines.

Extreme levels are thin red lines, from which the price used to bounce earlier. They can produce trading signals.

Yellow lines are trend lines, trend channels, and any other technical patterns.

Indicator 1 on the COT chart is the size of the net position of each trader category.

Indicator 2 on the COT chart is the size of the net position for the Non-commercial group of traders.