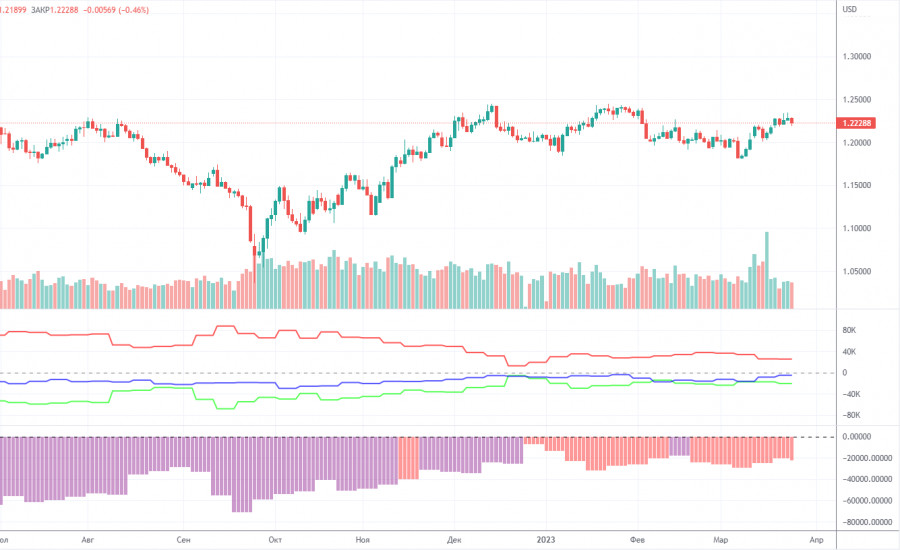

5M chart of GBP/USD

On Tuesday, GBP/USD returned to 1.2342. So far, there has been no breakthrough. This means that the pair could rebound and form a "double top" pattern, which in turn will allow us to expect the pound's decline. It is still important for the pair to overcome the uptrend line, but consolidating above 1.2342 will cross everything out. So now everything depends on 1.2342. Bank of England Governor Andrew Bailey's two speeches on Monday and Tuesday did not give any crucial new information to the traders, but they could detect some hawkish notes. Bailey admitted that the central bank will continue to hike rates, but suggests that rates shouldn't rise to pre-crisis high. Consequently, the range of 5-5.25% seems like the most possible peak for the time being. However, that was already clear even without Bailey's speeches, given the current level of inflation in the UK.

The first trading signal was formed in the middle of the US trading session. This was the time when traders had to think about leaving the market. However, this signal did not form until the evening, so traders should not have opened any positions on Tuesday if they listened to my advice.

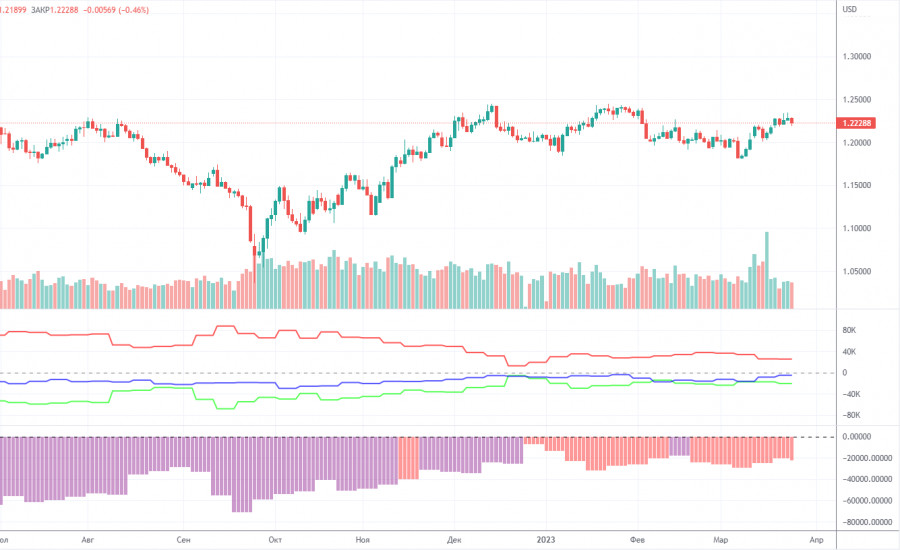

COT report:

For the British pound, the Commodity Futures Trading Commission has caught up with the lost time and has now released reports exactly on time. The last report available is for March 21. According to that report, the non-commercial group closed 3,700 long positions and 500 short ones. Thus, the net position of non-commercial traders decreased by 3,200 but continues to grow. The net position indicator has been steadily growing over the past months but the mood of major traders still remains bearish. Although the pound sterling is growing against the dollar (in the medium term), it is very difficult to answer the question why it is doing this from a fundamental point of view. It is quite possible that the pound sterling may slump in the near future. Formally, it has already begun its downward movement but so far it looks more like a flat. Notably, both major pairs are moving similarly at the moment. However, the net position for the euro is positive and even implies the imminent completion of the upward momentum, whereas for the pound it is negative, which gives rise to expectations of further growth. But at the same time, the pound has already grown by 2100 points, which is a lot, and without a strong bearish correction the continuation of the growth will be absolutely illogical. The non-commercial group opened a total of 49,000 shorts and 28,000 longs. We remain skeptical about the long-term growth in the British currency and expect it to fall deeper.

1H chart of GBP/USD

On the one-hour chart, GBP/USD has overcome the trend line, but it has already consolidated above the critical line and it seems that it is ready to resume the uptrend. Therefore, even a strong sell signal can't help pull down the pair just yet. The pound doesn't even need the support of a fundamental background. Only one more rebound from 1.2342 may trigger a new fall, which would be quite logical. On March 29, it is recommended to trade at the key level of 1.1927, 1.1965, 1.2143, 1.2185, 1.2269, 1.2342, 1.2429-1.2458, 1.2589. The Senkou Span B (1.2175) and Kijun Sen (1.2269) lines can also generate signals. Rebounds and breakouts from these lines can also serve as trading signals. It is better to set the Stop Loss at breakeven as soon as the price moves by 20 pips in the right direction. The lines of the Ichimoku indicator can change their position throughout the day which is worth keeping in mind when looking for trading signals. On Wednesday, there are no more important events planned for the UK, but the pound is doing fine without them. In the US, the calendar of macroeconomic events is also absolutely empty. Thus, volatility is unlikely to rise and the nature of the pair's movement will change.

Indicators on charts:

Resistance/support - thick red lines, near which the trend may stop. They do not make trading signals.

Kijun-sen and Senkou Span B are the Ichimoku indicator lines moved to the hourly timeframe from the 4-hour timeframe. They are also strong lines.

Extreme levels are thin red lines, from which the price used to bounce earlier. They can produce trading signals.

Yellow lines are trend lines, trend channels, and any other technical patterns.

Indicator 1 on the COT chart is the size of the net position of each trader category.

Indicator 2 on the COT chart is the size of the net position for the Non-commercial group of traders.