Last week, the Australian dollar slammed the onslaught of sellers: despite extremely weak and disappointing data on the country's inflation growth, the AUD/USD pair did not allow the bears to consolidate below the key support level of 0.7000. Even the rumors about a possible reduction in the interest rate of the RBA could not provide a new impetus to the downward movement. The bulls of the AUD/USD pair "held defensively" for several days, until the dollar weakened its grip due to rather contradictory data on US GDP growth. As a result, the pair finished the trading week in the middle of the 70th figure, and did not give the price outpost to the bears.

It should be noted here that the 0.70 mark is a very strong level of support. Over the past year and a half, sellers have more than five times stormed this target, but each time to no avail. In September 2015 and January 2016, the bears of the pair were able to stay above the aforementioned mark for more than one week, although then the aussie showed significant growth, up to the 80th figure. And if we talk about a longer-term period, the last time the price was below the 70th level was back at the end of 2008, when the world financial crisis broke out - then the pair fell to the boundaries of the 59th figure. However, at the beginning of 2009, the price again exceeded the threshold of the 70th mark.

All this suggests that the AUD/USD bears have now come to a too complex and psychologically important level of support, for overcoming of which the corresponding fundamental factors will be needed. Negative macroeconomic reports in this case will not help, especially since US data (which is ambiguous) offsets the weakness of the Australian releases. The events of last week eloquently confirmed this fact - in the AUD/USD pair's context, weak inflation in Australia was "compensated" by an extremely weak increase in the price index of US GDP.

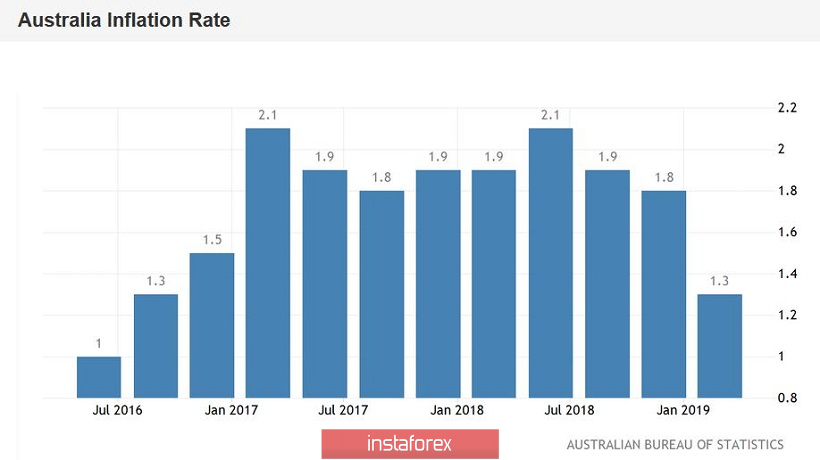

Australia's consumer price index suddenly dropped to zero (on a monthly basis), while experts expected a decline to just 0.2%. In annual terms, the indicator growth slowed to 1.3%, although the overall forecast was at 1.5% (from 1.8% in the fourth quarter of last year). Core inflation rose by only 0.2% during the first quarter (after seasonal adjustments) - this fact again disappointed market participants, who expected the growth of the key indicator by 0.4%. On an annualized basis, baseline quarterly inflation fell to 1.4%, well below the lowest target value of the Australian regulator. The published figures led to rumors of a reduction in the interest rate by the end of the current year. Some of the experts even allowed monetary policy easing at the next meetings - that is, on May 7 or June 4. It is worth recalling that at the beginning of this year, one of the largest banks in Australia - Westpac - part of the "big four" banks in the country, surprised traders by allowing the Australian regulator to double the rate until the end of 2019.

At that time, this assumption looked quite bold, although the prerequisites for softening the position of the RBA, of course, were back in January. First of all, the growth dynamics of the Australian economy is alarming. So, if in the first quarter of 2018 Australia's GDP was at the level of 1.1% (quarterly), in the second quarter it fell to 0.9%, in the third quarter - to 0.3%, and finally in the fourth - to 0.2%. Similar dynamics is also observed in annual terms of the indicator: I quarter - 3.2%, II - 3.1%, III - 2.7% and IV - 2.3%. The latest release was not only worse than forecast, but also set a certain anti-record: in quarterly terms, the indicator showed the weakest growth since the third quarter of 2016.

Despite such trends, the Reserve Bank of Australia at its last meeting did not follow the example of its colleagues from the RBNZ, who actually announced a reduction in the interest rate. At the same time, the minutes of the April meeting of the RBA made it clear that the issue of easing the monetary policy of the RBA is not removed from the agenda, despite the significant wait-and-see attitude of the regulator. In this context, reducing Australian inflation only increases the likelihood of the central bank representatives to soften their rhetoric.

Nevertheless, despite such prospects, the AUD/USD pair continues to stay above the 0.70 mark and on Friday even showed correctional growth to 0.7060, reacting to the decline in the price index of US GDP to 0.9%. This suggests that rumors of monetary policy easing are not able to divert the aussie below the 0.7000 mark. Last Thursday, the pair showed an impulsive decline to 0.6990, but on the same day returned to the previous range, ignoring the panic sentiments of traders.

Thus, in the medium term, long positions on the pair can be considered when the price approaches the bottom of the 70th figure, with a target level of 0.7105 (the lower limit of the Kumo cloud on the daily chart). However, on the eve of the May meeting (which will be held on the 7th), it is necessary to exercise caution and, if possible, not to open any positions. If the head of the RBA, Philip Lowe, really confirms his intention to lower the rate this year, the aussie can impulsively pierce a key support level and gain a foothold in the 69th figure for some time.