Analysis of macro data:

There will be much more macro data on Thursday than in the last three days combined. The eurozone inflation report will be published, which will determine the euro's movements and the prospects for tightening the European Central Bank's monetary policy. Inflation reports on Germany, France, Spain, and Italy were published in the past few days, and each data showed a significant slowdown. Therefore, we can expect the eurozone Consumer Price Index to fall. The market is anticipating a slowdown to 6.3-6.5% annually. If the actual value is lower, it may trigger a new decline in the euro.

In addition, the European Union will release its unemployment report, which is secondary in importance. The United States will also release reports on jobless claims, the ADP report on the labor market, and the ISM Manufacturing Purchasing Managers' Index. The Manufacturing PMI has the potential to affect the pair's movement during the US trading session. The first two reports may only pique the interest of traders in case the actual value significantly deviates from the forecast.

Fundamental events:

There will also be fundamental events on Thursday. ECB President Christine Lagarde will deliver her second speech. Take note that she did not provide traders with any interesting information on Wednesday. However, we might receive some important information on Thursday, especially since Luis de Guindos and other ECB representatives have already made a series of interesting statements this week. In particular, it was mentioned that the interest rate may increase more than once in 2023.

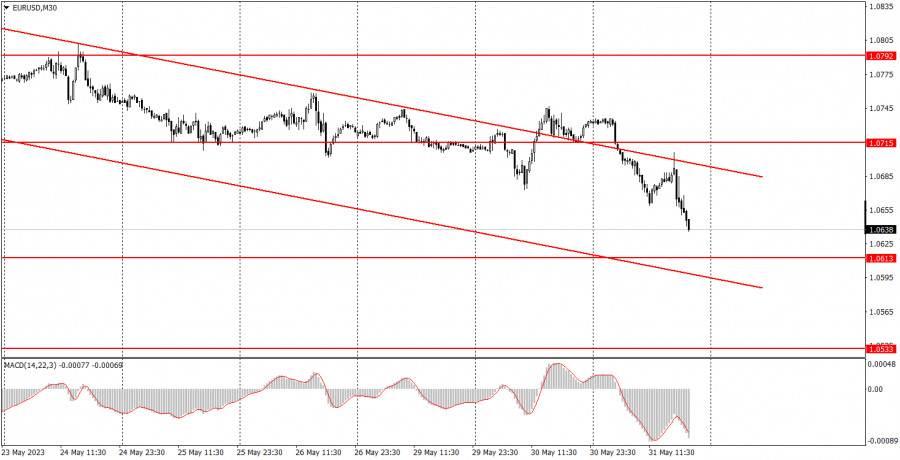

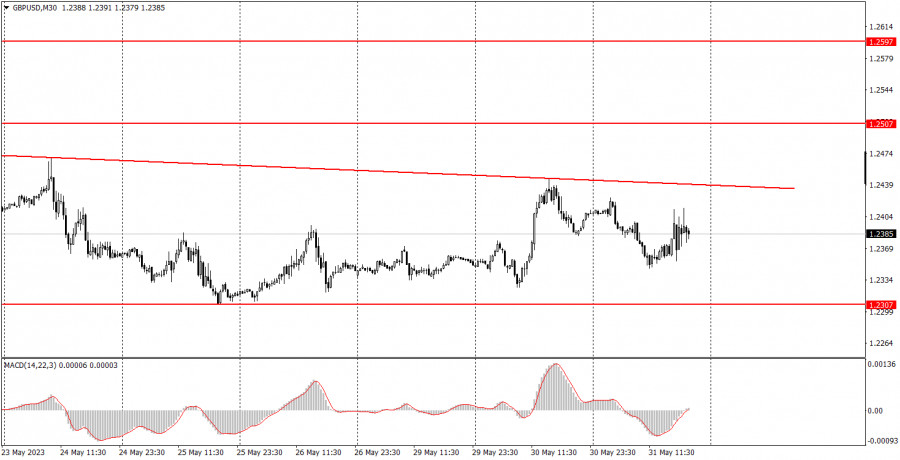

In the United States, there will be a speech by Patrick Harker, a member of the Federal Reserve's Monetary Committee, which is also very interesting for the same reasons. Several members of the Committee have stated this week that the Fed's rate may increase again in June, which has likely provided additional support to the US currency as the market had not priced in further tightening. The more such statements there are, the higher the probability of further dollar appreciation. Moreover, the downtrends persist in both pairs.

General conclusions:

On Thursday, there will be plenty of important events, which can lead to frequent reversals and corrections with pullbacks. You should pay attention to the eurozone inflation report and the ISM index in the United States. Harker's speech will take place late in the evening. Overall, we expect sufficiently volatile movements, but the pairs can move in different directions. Trading should be approached with caution.

Basic rules of the trading system:

1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break). The shorter this period, the stronger the signal.

2) If two or more trades were opened at some level following false signals, i.e. those signals that did not lead the price to Take Profit level or the nearest target levels, then any consequent signals near this level should be ignored.

3) During the flat trend, any currency pair may form a lot of false signals or do not produce any signals at all. In any case, the flat trend is not the best condition for trading.

4) Trades are opened in the time period between the beginning of the European session and until the middle of the American one when all deals should be closed manually.

5) We can pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5-15 pips), then this is a support or resistance area.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines.

Important speeches and reports that are always reflected in the economic calendars can greatly influence the movement of a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners should remember that every trade cannot be profitable. The development of a reliable strategy and money management are the key to success in trading over a long period of time.