The EUR/USD currency pair resumed its downward movement on Tuesday, which fully corresponds to our expectations. A few days earlier, the pair made another attempt to halt the decline, aided by the weak US ISM Non-Manufacturing PMI. However, as it turned out on Tuesday, the market did not make a big deal. The ISM index is just one of many macroeconomic indicators reflecting the state of a particular economy. For example, the Non-Farm Payrolls data released last Friday is much more important than the ISM in the current circumstances. The US economy is slowing down, but who didn't expect that? Remember that the Federal Reserve fights high inflation by raising interest rates. Naturally, the economy will react negatively to these developments.

As mentioned, the interest rate differentials between the ECB and the Federal Reserve are important for the market. Since both central banks are nearing the end of their tightening cycles, the market has long priced in certain final rate levels for both banks. The ECB has two more rate hikes ahead, while the Federal Reserve will not raise rates further. Therefore, any "unplanned" change in either bank's rates can trigger a rally in the currency market. And for now, surprisingly, the Federal Reserve is closer to surprising the market. Two weeks ago, some Federal Reserve's monetary committee members started discussing a rate hike in June, which can already be considered "unplanned." Several committee members also stated that rates could be tightened once every two meetings. However, whether it's one rate hike or more, it indicates an increase, not a pause.

Thus, the US dollar, which initially did not anticipate such developments, may continue to rise. If we add the overall oversold condition of the dollar and its unfair decline from March 15th to May 4th, the probability of further downward movement remains high. Perhaps with some corrections, but the movement toward parity should continue.

Klaas Knot speaks about tightening again

On Tuesday, ECB representative Klaas Knot spoke at the European Union. He said, "The central bank will continue to raise rates until it sees that inflation can return to 2% soon." He also stated that inflation is too high, and reducing core inflation will be more challenging than headline inflation. According to Knot, the economy is starting to respond to tightening monetary policy. From these statements, several conclusions can be drawn. First, Knot's rhetoric appears excessively hawkish. It's worth noting that most market participants have priced in at most two rate hikes of 0.25%, and the fact that the pace of tightening is slowing down indicates the proximity to the end of the tightening cycle.

Second, in the European Union, there are 27 countries, and the ECB must consider the economic situation in each of them. We have previously mentioned that inflation in Spain has dropped to 3%, so further tightening of monetary policy is not required in that country. However, the ECB can only raise rates for Germany and raise them for Spain. Those countries where inflation is declining may face an excessive slowdown. And then the same "carousel" will start as before the pandemic, when the consumer price index could not be pushed up to 2% for a decade.

Third, if the economy begins to respond to the tightening policy, economic growth may turn negative soon, especially if rates continue to rise. And they will continue to rise. The Eurozone GDP has been at "zero" for two consecutive quarters. Therefore, economic contraction is not a fantasy, considering that everyone expected a full-scale recession just six months ago. At the same time, the US economy is growing, and the Fed's interest rate is much higher. The basis for further strengthening of the dollar is undeniable.

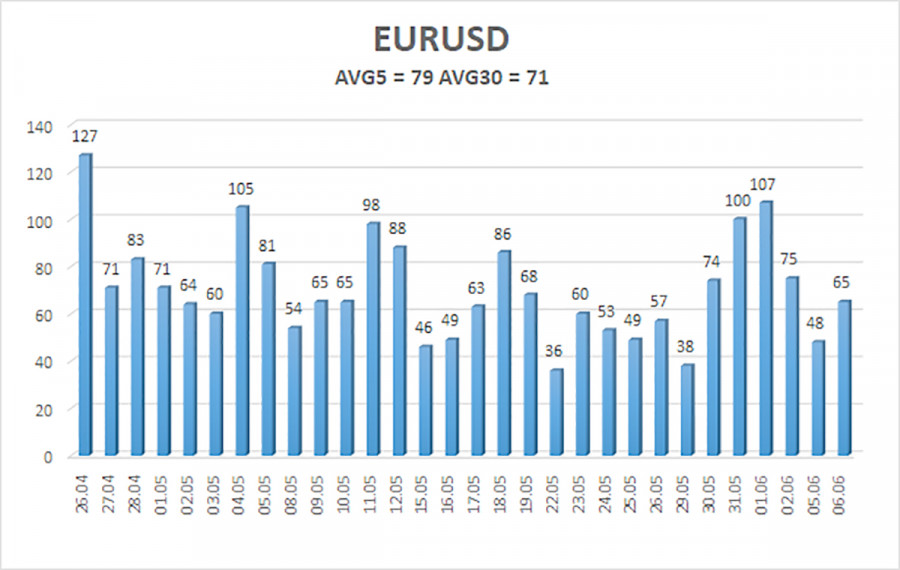

The average volatility of the euro/dollar currency pair for the past five trading days as of June 7th is 79 points, characterized as "average." Therefore, we expect the pair to move between the levels of 1.0605 and 1.0763 on Wednesday. An upward reversal of the Heiken Ashi indicator will indicate a possible resumption of an upward trend.

Nearest support levels:

S1 - 1.0681

S2 - 1.0620

Nearest resistance levels:

R1 - 1.0742

R2 - 1.0803

R3 - 1.0864

Trading recommendations:

The EUR/USD pair continues to stay below the moving average line. It is advisable to remain in short positions with targets at 1.0620 and 1.0605 until the Heiken Ashi indicator reverses upwards. Still, there is also a high probability of a flat trend. Long positions will become relevant only if the price reverses above the moving average line, with targets at 1.0763 and 1.0803.

Explanation of illustrations:

Linear regression channels - help determine the current trend. If both channels point in the same direction, it indicates a strong trend.

Moving average line (settings 20,0, smoothed) - determines the short-term trend and direction for trading.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will trade in the next 24 hours, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) indicates an upcoming trend reversal in the opposite direction.