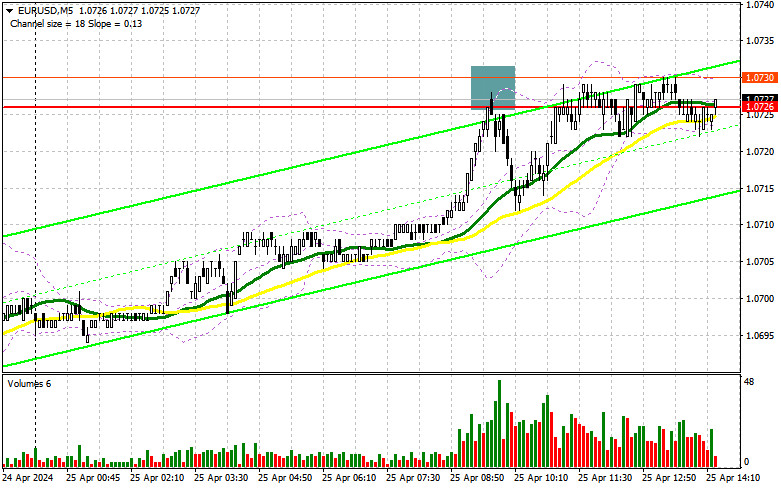

In my morning forecast, I pointed out the level of 1.0726 and planned to make decisions based on it for market entry. Let's take a look at the 5-minute chart and analyze what happened there. Growth and the formation of a false breakout led to a signal to sell the euro, resulting in a 15-point drop in the pair, which was the end of it all. The technical picture was reviewed for the second half of the day.

To open long positions on EURUSD, the following is required:

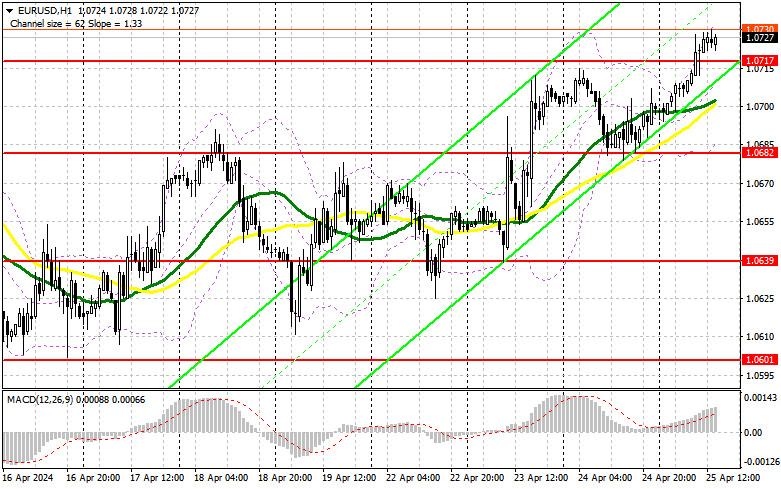

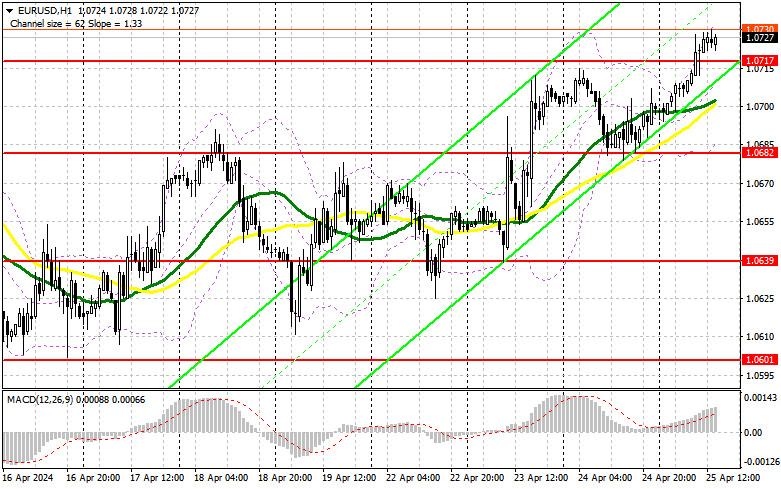

German data pushed the euro up in the first half of the day, but significant growth of the pair did not occur. Ahead are GDP data, and I will act as follows: good statistics will lead to a sharp decline in the euro and a rise in the US dollar, so I do not expect any significant buyer activity around 1.0717. Only a false breakout there, along with weak US data, will provide an entry point for long positions capable of pushing the euro towards the significant resistance at 1.0754. A breakout and a new high above this range will lead to the formation of a new bullish market and a buy signal with a chance to surge to 1.0779. The ultimate target will be the maximum at 1.0798, where I will take profit. In the scenario of a decline in EUR/USD and the absence of activity around 1.0717, as well as US GDP growth above economists' forecasts, pressure on the euro within the bearish trend will return. In this case, I will enter the market only after a false breakout around the next support at 1.0639. I plan to open long positions immediately on a rebound from 1.0601 with a target of a 30-35 point upward correction within the day.

To open short positions on EURUSD, the following is required:

Euro sellers have all the chances for a further decline in the pair, but, as you understand, strong US statistics are needed for this. In case of growth, bears will have to show themselves around 1.0754, and a test there may occur soon. Formation of a false breakout there will be an excellent scenario for entering short positions with a target of a decline to around 1.0717. A breakout and consolidation below this range, along with a reverse bottom-up test, will provide another selling point, with the pair moving towards 1.0682, which will return to the bearish trend. There, I expect more active involvement of large buyers. The ultimate target will be the minimum at 1.0639, where I will take profit. In case of upward movement of EUR/USD in the second half of the day, as well as the absence of bears at 1.0754, bears will say goodbye to hopes of regaining control of the market. In this case, I will postpone sales until testing the next resistance at 1.0779. There, I will also sell, but only after an unsuccessful consolidation. I plan to open short positions immediately on a rebound from 1.0798 with a target of a 30-35 point downward correction.

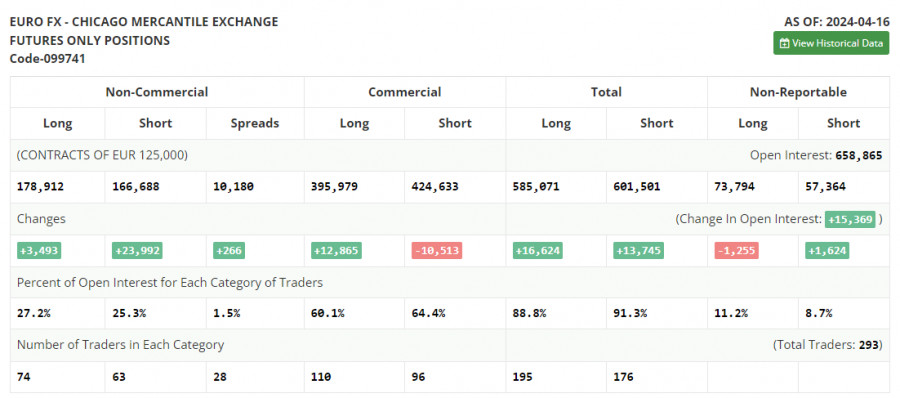

In the COT report (Commitment of Traders) as of April 16, there was an increase in both long and short positions. Obviously, after the European Central Bank meeting and the soft tone of its policymakers, as well as the latest inflation data in the US, which continued to rise, it isn't easy to imagine that buyers of the European currency will show activity in the near future. Obviously, the higher the chances of maintaining a tough stance by the Federal Reserve, the stronger the US dollar will become against a number of other world currencies. For this reason, I am betting on further development of the bullish trend for the US dollar and a decline in the euro. The COT report indicates that long non-commercial positions increased by 3,493 to 178,912, while short non-commercial positions jumped by 23,992 to 166,688. As a result, the spread between long and short positions increased by 226.

Indicator Signals:

Moving Averages

Trading is above the 30 and 50-day moving averages, indicating further pair growth.

Note: The author considers the periods and prices of moving averages on the hourly chart H1 and differs from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decline, the lower boundary of the indicator, around 1.0682, will act as support.

Description of Indicators

- Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

- Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands (Bollinger Bands). Period 20.

- Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between the short and long positions of non-commercial traders.