The GBP/USD currency pair traded relatively calmly on Wednesday, though the day before, it had posted a substantial decline in the second half of the session—more than 100 pips. As previously noted, such a sharp and unexpected dollar strengthening could have only been caused by two events. First, "peacemaker Trump" is reportedly aiming to formally involve the U.S. in a war against Iran, which would only heighten geopolitical tensions in the Middle East. Second, by Wednesday evening, there were exactly 24 hours left until the Federal Reserve's meeting, meaning the market might have started pricing in the outcome in advance. And since the Fed had no plans to cut the key rate, there were formal grounds for the dollar to rise.

However, we do not believe the market decided this time to react to the Fed maintaining rates at current levels. Let's recall that in 2025, the Fed has not cut the rate even once, nor does it intend to. In this article—as per tradition—we won't be reviewing the results of the Fed meeting, as we believe that at least a full day must pass for the market to digest and respond rationally. Often, the market reacts emotionally during the announcement and Powell's speech, only to return to its previous levels the next day.

On the other hand, the Bank of England meeting is scheduled today, which carries similar weight to the Fed meeting. However, we believe that weight is minimal. For four consecutive months, the market has been ignoring not just macroeconomic data but fundamental factors altogether—especially any that conflict with the selling of the U.S. dollar. Even though the BoE has already cut rates twice this year while the Fed hasn't acted at all, this would typically support the dollar. But the market seems to ignore this reality.

Thus, today, when the BoE is 99% likely to leave monetary policy unchanged, the British pound may even rise. Moreover, there is currently no basis for a rate cut in June. A month earlier, UK inflation had increased to 3.5%; in May, it dropped by just 0.1%. So, this figure currently exceeds the target by more than one and a half times. The BoE will unlikely go for a third rate cut this year under such conditions.

A trade agreement between the UK and the U.S. has been signed, but it holds more significance for Britain than for America. The UK avoided harsh tariffs and received a sort of "conditional suspension." Meanwhile, the U.S. is more focused on trade deals with the EU and China, where no progress has been made.

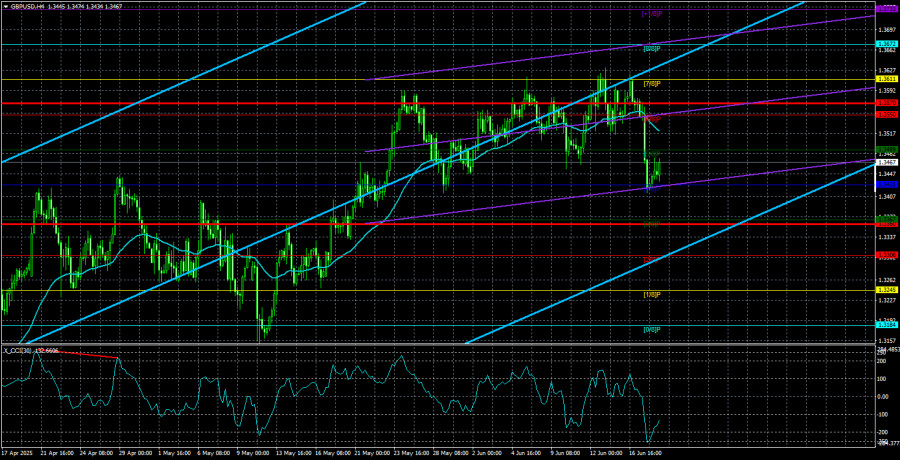

The British pound has consolidated below the moving average line, which suggests a continuation of the decline. Still, believing in or predicting further downward movement remains extremely difficult. The dollar seems significantly oversold and has been falling for five consecutive months, but it's still the dollar. Even Trump cannot entirely strip it of its status as the world's reserve currency in just five months.

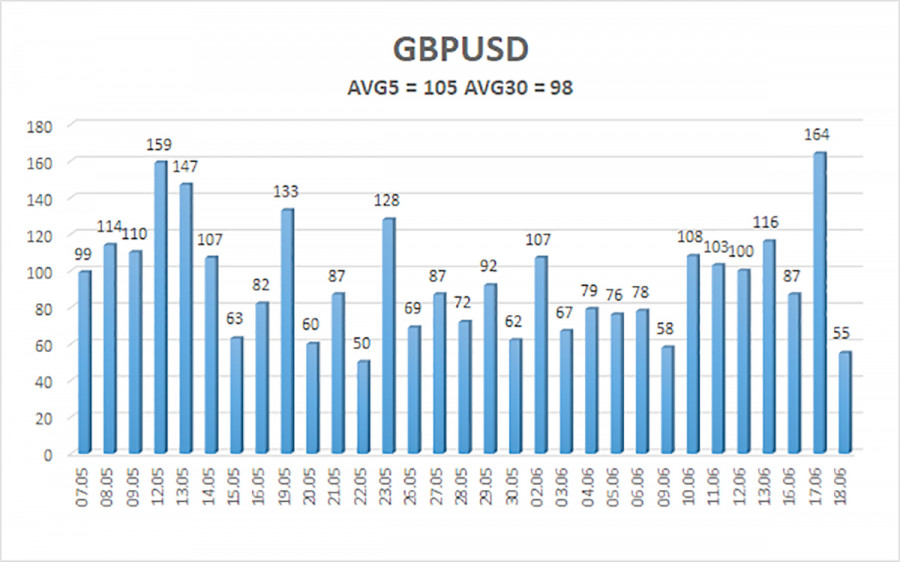

The average volatility of the GBP/USD pair over the past five trading days is 105 pips. For this pair, this is considered "moderate." On Thursday, June 19, we expect the pair to move within a range limited by 1.3360 and 1.3570. The long-term regression channel points upward, indicating a clear bullish trend. The CCI indicator entered the oversold area earlier this week, which could trigger a resumption of the uptrend.

Nearest Support Levels:

S1 – 1.3428

S2 – 1.3367

S3 – 1.3306

Nearest Resistance Levels:

R1 – 1.3489

R2 – 1.3550

R3 – 1.3611

Trading Recommendations:

The GBP/USD pair maintains its uptrend and continues to rise. There is plenty of news supporting this movement. Every new decision by Trump is perceived negatively by the market, while positive news from the U.S. is scarce. Thus, long positions targeting 1.3611 and 1.3672 are currently far more relevant when the price is above the moving average than short ones. A consolidation below the moving average allows for considering shorts with targets at 1.3428 and 1.3360, though the probability of upward movement is much higher than a decline. Occasionally, the U.S. dollar may show minor corrections. For further growth, clear signs of the end of the global trade war are needed.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.