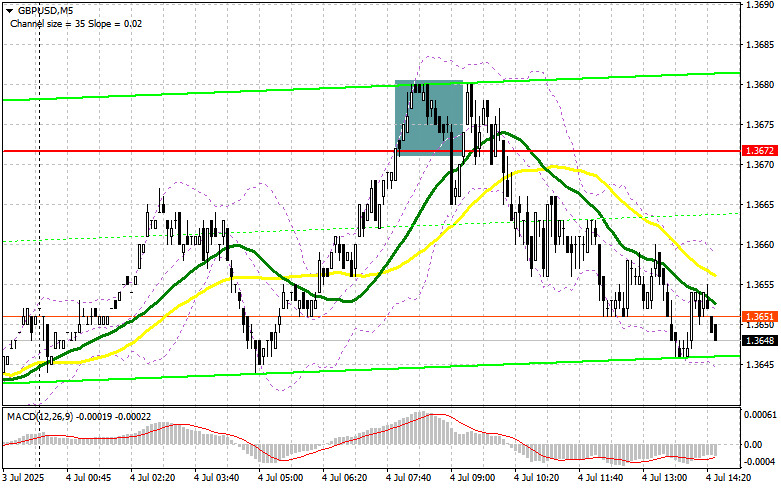

In my morning forecast, I highlighted the 1.3672 level as a key decision point for entering the market. Let's look at the 5-minute chart and analyze what happened. A rise and the formation of a false breakout around 1.3672 created a good entry point for selling the pound, which resulted in a 30-point decline in the pair. The technical outlook has been revised for the second half of the day.

To open long positions on GBP/USD:

The British pound attempted to rise following positive UK Construction PMI data, but apparently it wasn't strong enough to trigger larger-scale buying in a low-liquidity market during a holiday. There are no U.S. statistics scheduled for the American session, and all exchanges are closed due to the Independence Day holiday. Therefore, don't expect major GBP/USD moves.

If the pound declines, I plan to act only around the key support level of 1.3637. A false breakout there would provide a good entry point for long positions with a target of returning to resistance at 1.3677. A breakout and retest of this range from above, combined with weak statistics, would confirm a new long entry with the potential to reach 1.3707. The ultimate target would be 1.3746, where I will take profit.

If GBP/USD drops and buyers remain inactive around 1.3637 during the second half of the day, pressure on the pound could intensify. In that case, only a false breakout around 1.3602 would be a valid signal for opening long positions. I also plan to buy GBP/USD on a rebound from 1.3565, targeting a 30–35 point intraday correction.

To open short positions on GBP/USD:

Sellers have adopted a wait-and-see approach, and active selling is unlikely in the second half of the day. The key task is to protect the 1.3677 resistance level, which the pair failed to break above earlier. A false breakout there, similar to the one described above, would give a good short entry point aiming for a decline to 1.3637.

A breakout and retest of that range from below would trigger stop-loss orders and open the path to 1.3602. The ultimate target would be 1.3565, where I plan to take profit.

If demand for the pound picks up in the second half of the day and bears remain inactive around 1.3677—just below the moving averages that currently favor sellers—GBP/USD could see a sharper rise. In that case, it would be better to postpone selling until a test of the 1.3707 resistance level. I will consider short positions there only after a false breakout. If no downward movement occurs there either, I'll look for a short entry on a rebound from 1.3746, targeting an intraday correction of 30–35 points.

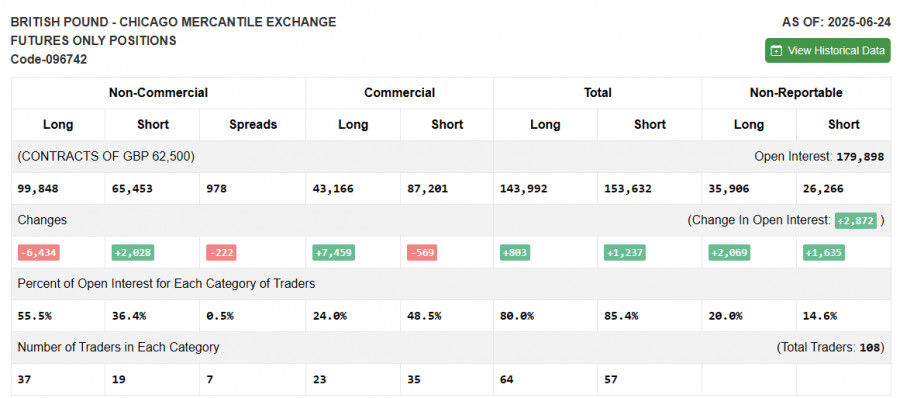

COT Report (Commitments of Traders) – June 24:

The COT report showed an increase in short positions and a decrease in long ones. The British pound continues to demonstrate a strong upward trend, supported by recent UK GDP and inflation data. The prospect of an earlier rate cut by the U.S. Federal Reserve exerts negative pressure on the U.S. dollar. Several upcoming U.S. labor market reports will likely determine the next direction for GBP/USD.

According to the latest COT report, long non-commercial positions declined by 6,434 to 99,848, while short non-commercial positions increased by 2,028 to 65,453. As a result, the net position spread narrowed by 222.

Indicator Signals:

Moving AveragesTrading is occurring below the 30- and 50-day moving averages, indicating potential for further downside in the pair.

Note: The moving average periods and prices are based on the author's analysis of the H1 chart and may differ from classic daily (D1) moving averages.

Bollinger BandsIf the pair declines, the lower band near 1.3625 will act as support.

Indicator Descriptions:

- Moving Average (MA): identifies the current trend by smoothing out price volatility and noise

- Period 50 (yellow)

- Period 30 (green)

- MACD (Moving Average Convergence/Divergence):

- Fast EMA – period 12

- Slow EMA – period 26

- Signal SMA – period 9

- Bollinger Bands:

- Non-commercial traders: speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain criteria

- Long non-commercial positions: total long open interest held by non-commercial traders

- Short non-commercial positions: total short open interest held by non-commercial traders

- Net non-commercial position: the difference between long and short non-commercial positions