signal strength 1 of 5

According to the chart of M5, NZDCHF produced the pattern termed the Inverse Head and Shoulder. The Head is fixed at 0.4833 while the median line of the Neck is set at 0.4843/0.4842. The formation of the Inverse Head and Shoulder Pattern clearly indicates a reversal of the downward trend. In means that in case the scenario comes true, the price of NZDCHF will go towards 0.4857.

The M5 and M15 time frames may have more false entry points.

See Also

- All

- Double Top

- Flag

- Head and Shoulders

- Pennant

- Rectangle

- Triangle

- Triple top

- All

- #AAPL

- #AMZN

- #Bitcoin

- #EBAY

- #FB

- #GOOG

- #INTC

- #KO

- #MA

- #MCD

- #MSFT

- #NTDOY

- #PEP

- #TSLA

- #TWTR

- AUDCAD

- AUDCHF

- AUDJPY

- AUDUSD

- EURCAD

- EURCHF

- EURGBP

- EURJPY

- EURNZD

- EURRUB

- EURUSD

- GBPAUD

- GBPCHF

- GBPJPY

- GBPUSD

- GOLD

- NZDCAD

- NZDCHF

- NZDJPY

- NZDUSD

- SILVER

- USDCAD

- USDCHF

- USDJPY

- USDRUB

- All

- M5

- M15

- M30

- H1

- D1

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

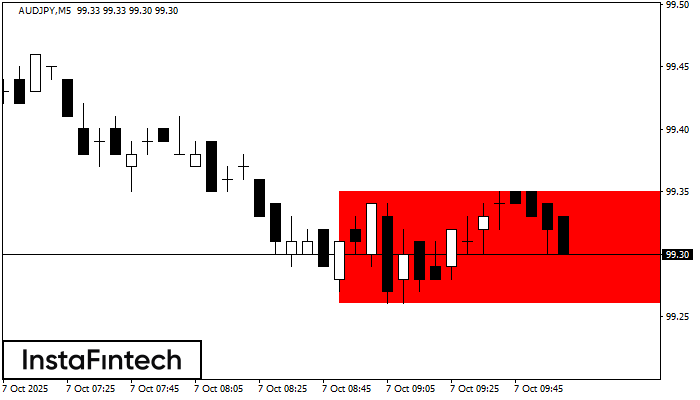

According to the chart of M5, AUDJPY formed the Bearish Rectangle. The pattern indicates a trend continuation. The upper border is 99.35, the lower border is 99.26. The signal means

The M5 and M15 time frames may have more false entry points.

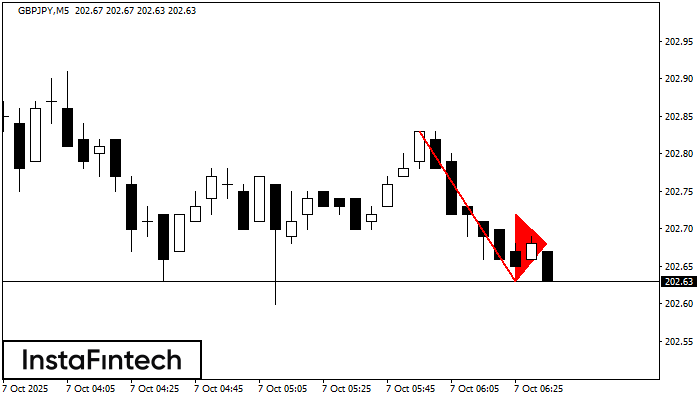

Open chart in a new windowThe Bearish pennant pattern has formed on the GBPJPY M5 chart. The pattern signals continuation of the downtrend in case the pennant’s low of 202.63 is broken through. Recommendations: Place

The M5 and M15 time frames may have more false entry points.

Open chart in a new windowThe Bearish pennant pattern has formed on the GBPAUD M5 chart. This pattern type is characterized by a slight slowdown after which the price will move in the direction

The M5 and M15 time frames may have more false entry points.

Open chart in a new window