signal strength 1 of 5

The Triple Bottom pattern has formed on the chart of #TSLA M5. Features of the pattern: The lower line of the pattern has coordinates 299.81 with the upper limit 299.81/296.14, the projection of the width is 563 points. The formation of the Triple Bottom pattern most likely indicates a change in the trend from downward to upward. This means that in the event of a breakdown of the resistance level 294.18, the price is most likely to continue the upward movement.

The M5 and M15 time frames may have more false entry points.

See Also

- All

- Double Top

- Flag

- Head and Shoulders

- Pennant

- Rectangle

- Triangle

- Triple top

- All

- #AAPL

- #AMZN

- #Bitcoin

- #EBAY

- #FB

- #GOOG

- #INTC

- #KO

- #MA

- #MCD

- #MSFT

- #NTDOY

- #PEP

- #TSLA

- #TWTR

- AUDCAD

- AUDCHF

- AUDJPY

- AUDUSD

- EURCAD

- EURCHF

- EURGBP

- EURJPY

- EURNZD

- EURRUB

- EURUSD

- GBPAUD

- GBPCHF

- GBPJPY

- GBPUSD

- GOLD

- NZDCAD

- NZDCHF

- NZDJPY

- NZDUSD

- SILVER

- USDCAD

- USDCHF

- USDJPY

- USDRUB

- All

- M5

- M15

- M30

- H1

- D1

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

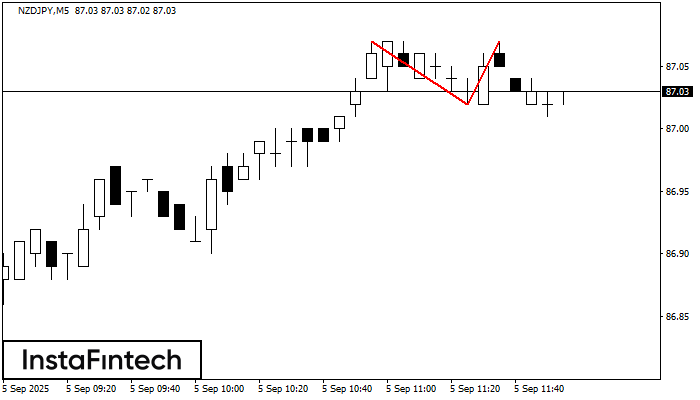

The Double Top pattern has been formed on NZDJPY M5. It signals that the trend has been changed from upwards to downwards. Probably, if the base of the pattern 87.02

The M5 and M15 time frames may have more false entry points.

Open chart in a new windowAccording to M30, NZDUSD is shaping the technical pattern – the Inverse Head and Shoulder. In case the Neckline 0.5860/0.5861 is broken out, the instrument is likely to move toward

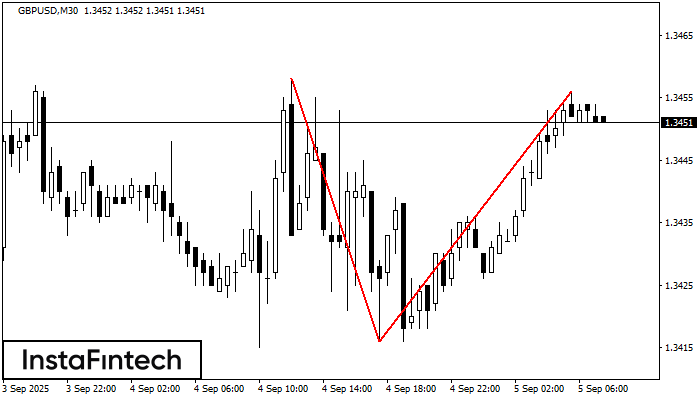

Open chart in a new windowThe Double Top reversal pattern has been formed on GBPUSD M30. Characteristics: the upper boundary 1.3458; the lower boundary 1.3416; the width of the pattern is 40 points. Sell trades

Open chart in a new window