In the upcoming week, the GBP/USD currency pair may also move fairly significantly. However, it is hard to predict where the pair will be by the end of the week given the sheer amount of really significant events and publications that are scheduled. There is no confidence in increasing the BA rate by 0.5% to start. Since inflation is still sky-high, the British regulator should logically keep tightening monetary policy as quickly as possible. At the same time, we have regularly seen Bank of England officials make hints about a potentially severe recession. The rate increase will cause the economy to expand more slowly, which, when combined with higher taxes and a sharp rise in the cost of living in the UK, might have fatal results. Whether the UK's choice to leave the EU was the right one remains to be seen, but several social studies indicate that the number of Brexit supporters is declining. In other words, the majority of people in the UK now regret that their nation left the EU.

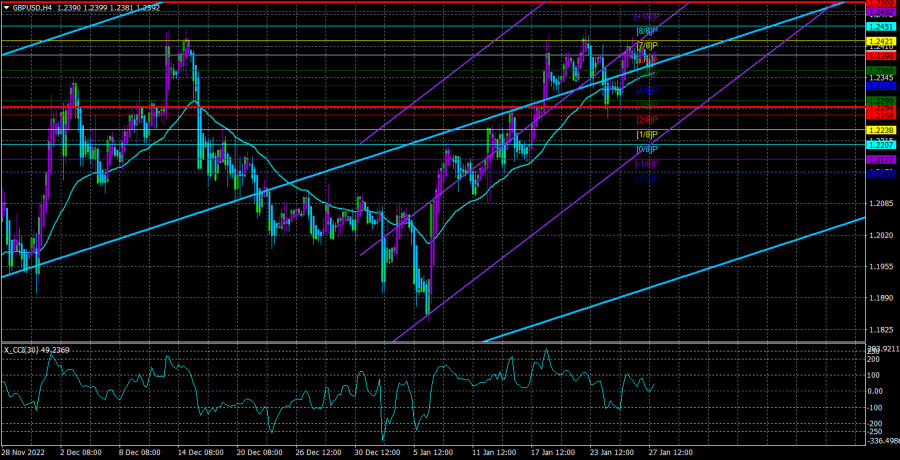

Therefore, it is difficult for us to predict the additional expansion of the pound in practice. In just a few months, it has already increased by 2,100 points. On the strength of this, will it keep growing? Additionally, we are currently observing the construction of a "double top," which is a configuration that occurs very infrequently. When it has already developed and the pair has descended a respectable distance, it is best to judge it. The formation may end at any time. Today, the pound will rise by 100 points without forming any patterns on the chart. However, it is "brewing" right now, and if 1.2451 holds, we anticipate a 500–600 point decline. In essence, we anticipate it regardless. The CCI indicator has already shown that the pound is overbought at this time, in our opinion.

Similar to the European Union, Britain continues to use inflation as its primary indicator, but the regulator is unable to boost the rate as much as is necessary to achieve price stability. The rate is now close to 4%, which would be a record high. At the same time, inflation hasn't even dropped below 10% yet. Therefore, we anticipate that the British regulator will adopt the most circumspect stance, focusing instead on when inflation will return to its target level of 2% rather than economic growth or inflation itself. This indicates that the rate will increase going forward, but very gradually to avoid shocking consumers and markets again. Once again, it is hard to predict what will happen to the pound. It is doubtful that the pound will climb at this time even if the rate grows cumulatively for an additional year or a year and a half. We think the time of rapid expansion has already come to an end. The pair can then run 500–600 points alternatively in both directions throughout a long period of consolidation or a new decline.

This week, we are not anticipating any macroeconomic data from outside. Non-farm is probably going to keep falling but still be at a very good level. Even if it increases to 3.6%, the jobless rate will still be close to its 50-year lows. Therefore, it is unlikely that the dollar will receive considerable support from these statistics, but there won't be much pressure either. The week is going to be extremely turbulent, but traders' perceptions will ultimately determine how the pair performs.

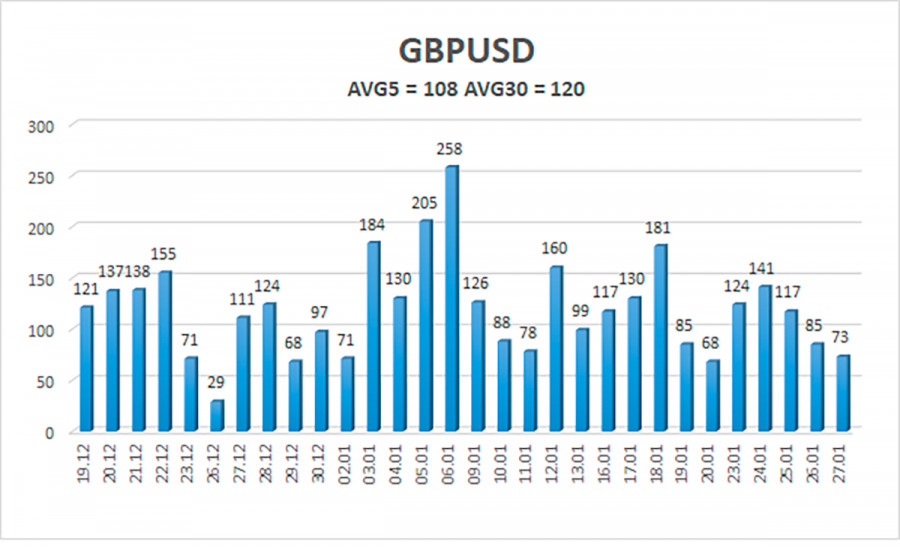

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 108 points. This number is the "average" for the dollar/pound exchange rate. So, on Monday, January 30, we anticipate movement that is contained within the channel and is constrained by the levels of 1.2284 and 1.2500. A new round of downward movement is indicated by the Heiken Ashi indicator turning downward.

Nearest levels of support

S1 – 1.2390

S2 – 1.2329

S3 – 1.2268

Nearest levels of resistance

R1 – 1.2451

R2 – 1.2512

R3 – 1.2573

Trading Suggestions:

In the 4-hour timeframe, the GBP/USD pair is still above the moving average. Therefore, until the Heiken Ashi turns down, it is possible to hold long positions with targets of 1.2451 and 1.2500. If the price is locked below the moving average line, short trades can be opened with targets of 1.2284 and 1.2268.

Explanations for the illustartions:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

The short-term trend and the direction in which you should trade at this time are determined by the moving average line (settings 20.0, smoothed).

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.