On Friday, the EUR/USD currency pair finally displayed a movement that could be characterized as reasonable and did not require decoding. Several significant reports that were released in the United States on Friday all performed better than expected. Some - a lot. Therefore, the strengthening of the US dollar was ultimately justified, and we did not need to "search for" the causes of such a movement. Remember how the market responded illogically to the Fed and ECB meetings a day or two earlier? Both central banks increased interest rates and maintained their "hawkish" stance. And as a result, the dollar fell first, followed by the euro. Naturally, we clarified that the market had already determined the meetings' well-known outcomes. Therefore, everything is rational. But despite what it may seem like, this conclusion is far from obvious.

Back to the reports from Friday. With a forecast of 185–190 thousand, there were 517 thousand non-farms in January. With growth predicted to reach 3.6%, the unemployment rate dropped to 3.4%. With growth forecasts of 50.4-50.6, the ISM business activity index for the services sector improved from 49.2 points to 55.2 points. After such a collection of facts, wages ceased to be of interest to anyone. These statistics have demonstrated that the American economy is in a better state than some analysts have claimed. A recession may be avoided even at the current, high level of the Fed rate. On the one hand, it releases the Fed from its restrictions, which is excellent for the dollar. However, because the Fed has almost achieved the rate's high value, it is already irrelevant for the US dollar. However, a strong economy is preferable to a weak one. As a result, the US dollar may continue to benefit. Formally, the euro may continue to increase in the months to come. After all, compared to the Fed rate, the ECB rate may exhibit a more significant increase in 2023. However, the pair should now adjust lower by a few hundred points. The upward trend will then resume without any opposition.

What surprises await us in the upcoming week?

Let's now take a look at the week's schedule of events. Let's assume right away that there won't be many significant publications or events. Regarding the number of significant events, last week set a milestone, but it won't be this way every week. On Monday, the European Union will host the next address by ECB President Christine Lagarde, who has spoken five or six times in the past two weeks. We don't anticipate anything interesting from her because it's obvious that she can't make a big deal out of everything at every performance. Additionally, a retail sales report (not the most crucial report) will be released. And that's it for this week. There will also be speeches by Luis de Guindos and Isabelle Schnabel, both of the ECB Monetary Committee, but these are only side events. Additionally, following the European regulator's meeting last week.

As a result, macroeconomics and the foundation are largely absent in the European Union this week. This suggests that although volatility may drop significantly, the pair may still move south. The CCI indicator last week hit the overbought level, which happens very infrequently and is a hint for a trend reversal. This is a significant technical point. Additionally, there was a consolidation below the moving average line, changing the local trend from upward to negative. However, the price is still above the crucial line on the 24-hour TF, so this resistance can stop the decline in quotes. Or at the very least, make it wait. In theory, since the underlying background no longer prevents it, now will be a favorable time to fall. We anticipate a further 300–400 point decrease in the value of the euro. Additionally, it will be seen that new figures on inflation or GDP will be published, based on which it will be feasible to predict how central banks will act in March.

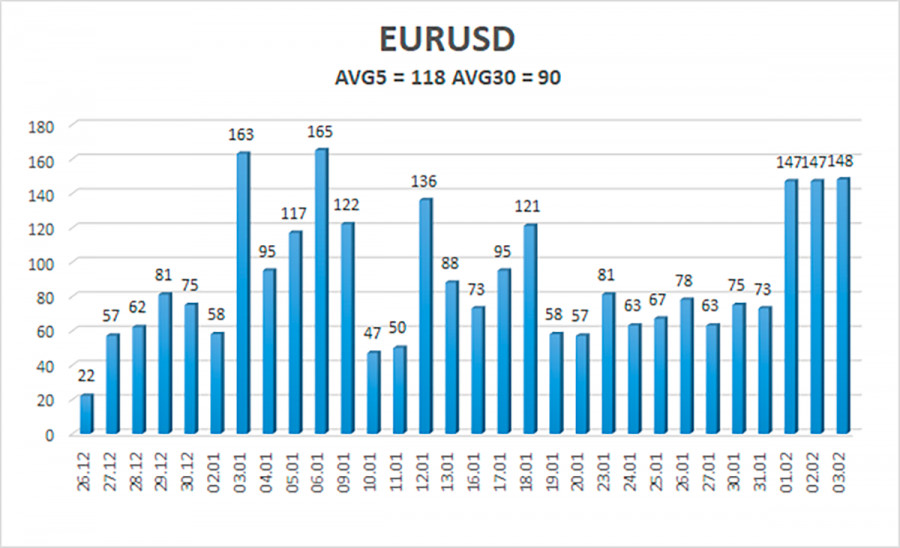

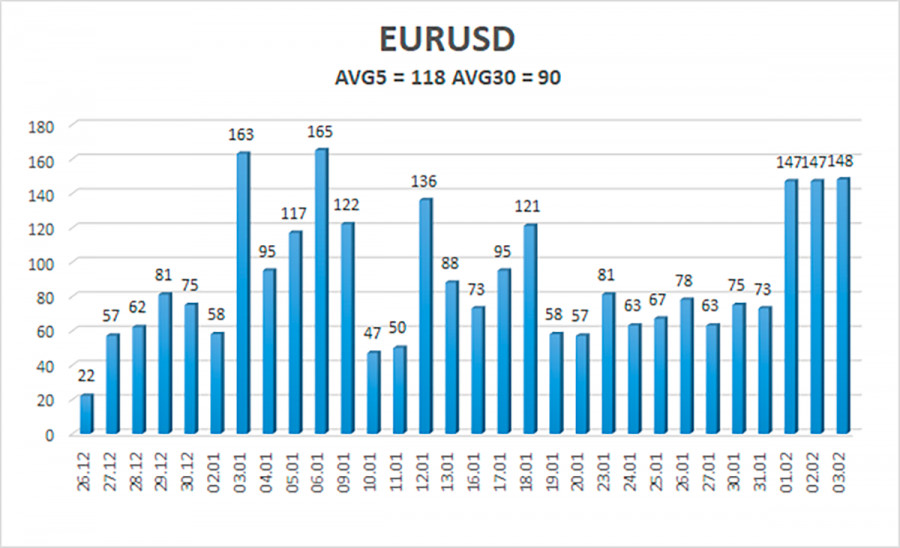

As of February 6, the euro/dollar currency pair's average volatility over the previous five trading days was 118 points, which is considered to be "high." So, on Monday, we anticipate the pair to trade between 1.0677 and 1.0913. The Heiken Ashi indicator's upward reversal will signal a round of corrective movement.

Nearest levels of support

S1 – 1.0742

S2 – 1.0620

S3 – 1.0498

Nearest levels of resistance

R1 – 1.0864

R2 – 1.0986

R3 – 1.1047

Trading Suggestions:

Below the moving average, the EUR/USD pair has been consolidated. Until the Heiken Ashi indication turns up, you can continue to hold short positions with targets of 1.0742 and 1.0677. After the price is fixed back above the moving average line, long positions can be initiated with a target of 1.0986.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.