Additionally, adjustments were made to the GBP/USD currency pair on Tuesday night and for the majority of Wednesday. The pound has been declining for four days, just like the euro, so an upward correction was anticipated. It worked out very nicely that Fed Chairman Jerome Powell's speech last night, which caused a market uproar, was completely typical. However, traders "stepped away" from this event relatively quickly after recognizing Powell did not offer anything novel or definitive. Powell stated, "We can raise the rate higher than projected if the labor market remains strong." And if it is not as strong? Remember that the nonfarm payroll report has been declining significantly over the last year. It did not fall to dangerously low levels, nonetheless. As a result, following Powell's remarks, the US dollar did not increase. An upward correction has started at this point and might last through the weekend and to the moving average line. The pair confidently passed the key line on the 24-hour TF, giving the pound a higher chance of declining than the euro.

The UK economy is the primary factor driving a potential decline in the pound. The British economy can endure a protracted period of recession. In actuality, it has already begun. The negative estimates have been updated, according to Andrew Bailey's statement from the last meeting. The current prediction is that the recession will only last 5 quarters, not 8 and that the GDP decline in 2023 and 2024 will be no greater than 1% overall. The economic downturn, however, may be far less pronounced or nonexistent in the United States or the European Union. Furthermore, it is utterly unclear what to do about inflation, which is still above 10% and is taking its time approaching the BA target level. There is no use in even bringing up the basic inflation given the lack of a decrease in the primary inflation. Remember that core inflation is almost unchanged in the US and the EU, which raises serious concerns that the consumer price index in all of its forms may come to an end. However, as none of the indicators genuinely apply to Britain, there is no such issue.

Huw Pill: BA is prepared to make a decision.

On Monday, Huw Pill, the Bank of England's chief economist, attempted to respond to a query regarding inflation and monetary policy. In the same interview, he stated that the Bank of England is prepared to act swiftly to return inflation to the desired level. However, he also suggested that rates may be close to reaching their high. At present, the rate is 4%, and, therefore, it should continue to increase since inflation does not reduce at all. Mr. Pill stated that he is confident that inflation would reach the desired level but cautioned the regulator against "doing too much" because inflation takes 18 months to respond to changes in monetary policy. What does this statement mean? The Fed mentioned a 4-month delay in the inflation's response to rates last year. If the lag was 18 months, the Fed is no longer able to raise the rate because it can easily return to 2% in a year and a half. But who can predict what will occur in a year and a half and during these 1.5 years? We think Pill's rhetoric only says one thing: the Bank of England is not prepared for future strong tightening.

Andrew Bailey hinted at this last week when he stated he anticipated a significant decline in inflation in 2023. In other words, BA anticipates that the rate of inflation will start to fall naturally. Or as a result of declining energy prices. Why, then, has inflation fallen quickly for three months in the European Union, where the rate is lower, but slowly and only for two months in Britain (at a higher peak value)? Additionally, Pill admitted that compared to Europe, Britain had a larger likelihood of experiencing "sustainably high" inflation.

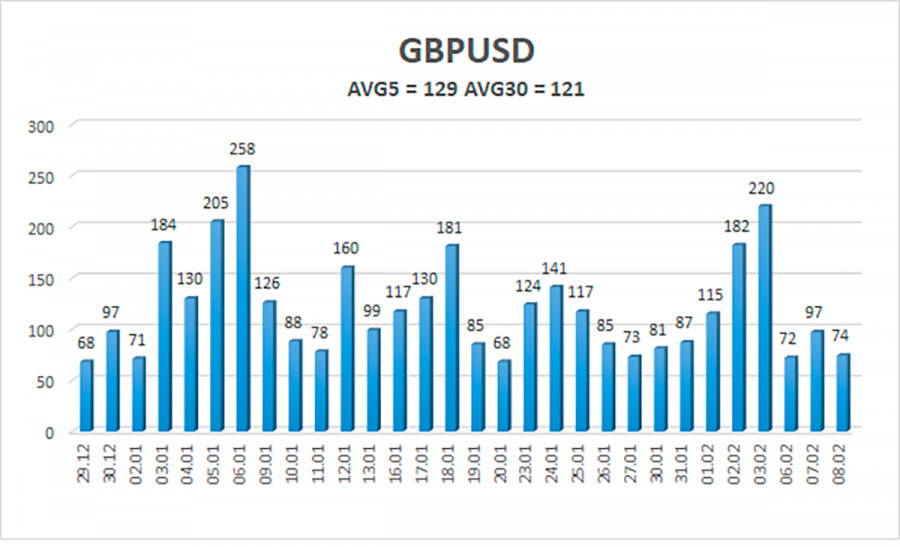

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 129 points. This figure is "high" for the dollar/pound exchange rate. As a result, on Thursday, February 9, we anticipate movement that is limited by the levels of 1.1939 and 1.2197. The Heiken Ashi indicator's downward turn again will indicate that the downward momentum has resumed.

Nearest levels of support

S1 – 1.2024

S2 – 1.1963

S3 – 1.1902

Nearest levels of resistance

R1 – 1.2085

R2 – 1.2146

R3 – 1.2207

Trading Suggestions:

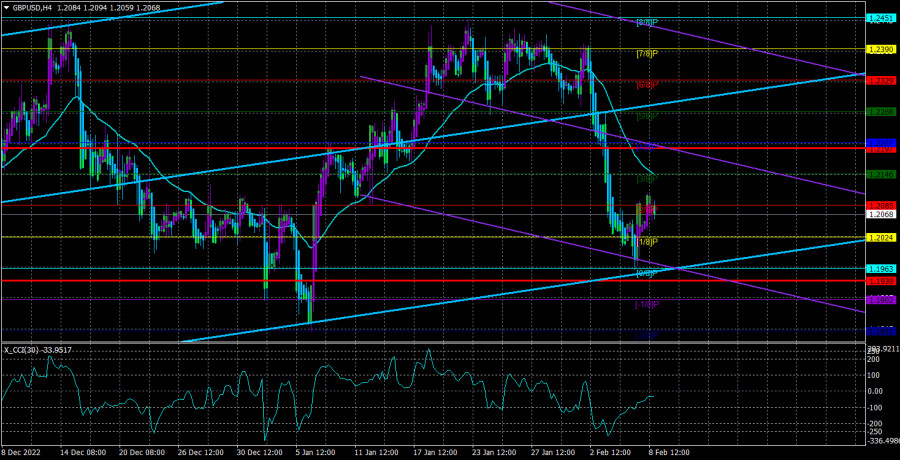

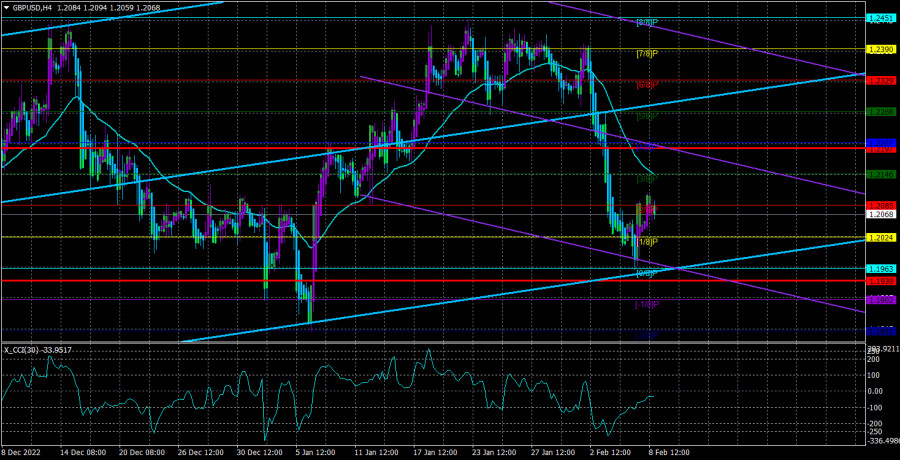

In the 4-hour timeframe, the GBP/USD pair began a slight correction. Therefore, in the event of a downward reversal of the Heiken Ashi indicator, we can now consider additional short positions with targets of 1.1963 and 1.1939. If the price is stable above the moving average line, you can start trading long with targets of 1.2207 and 1.2268.

Explanations for the illustrations:

Channels for linear regression - allow us to identify the present trend. The trend is now strong if they are both moving in the same direction.

The short-term trend and the direction in which you should trade at this time are determined by the moving average line (settings 20.0, smoothed).

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.