Analysis of transactions and trading advice for the euro

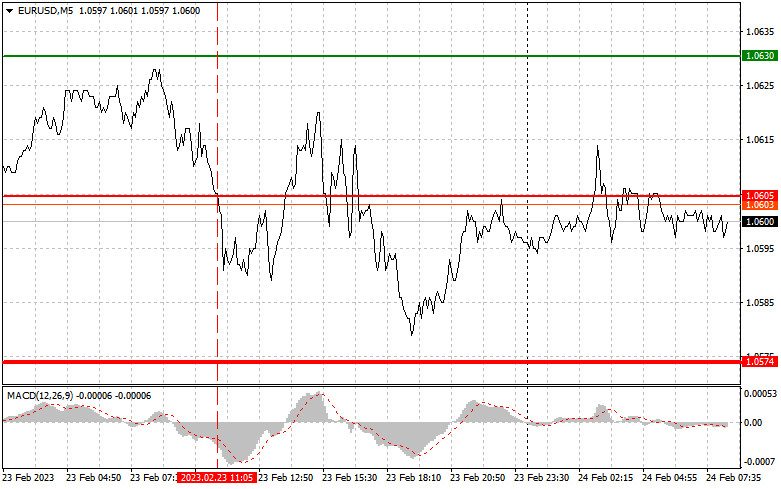

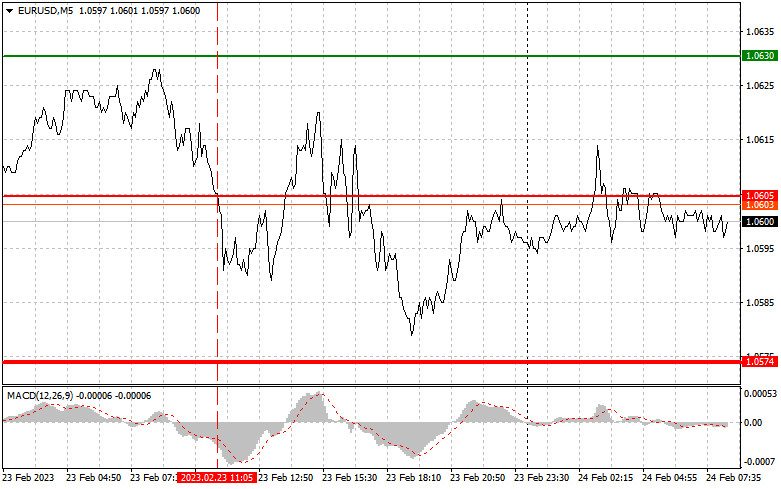

The MACD indicator started to decline significantly from zero around the time of the 1.0605 price test, so even in such a bear market, I dared not sell the euro. There were no other typical entry points that would have allowed us to at least see something.

Strong data on the eurozone from yesterday that showed the need for the central bank to raise interest rates further went ignored. The consumer price index for the eurozone increased in January, although this did not in any way help the euro. However, the number of initial applications for unemployment benefits, which were far lower than experts had anticipated, brought back demand for the dollar, which increased following the speech of FOMC member Rafael Bostic. Data on changes in the GDP volume and the leading indicator of the German consumer climate are released today throughout the first half of the day. The growth of indicators and Joachim Nagel's speech, an ECB board member, may hypothetically help the euro. I'm anticipating a lot of interesting data in the afternoon, including strong statistics on housing sales in the main US market, changes in the level of household spending that could cause another strengthening of the dollar against the euro, and the primary index of personal consumption expenditures. The University of Michigan's consumer sentiment index and inflation expectations data are of secondary significance.

Buy Signal

Scenario #1: Today, you can buy euros at 1.0609 (the green line on the chart) and wait for the price to rise to 1.0653. I advise selling euros in the other direction at 1.0653 and exiting the market, expecting a movement of 30-35 points from the entrance position. Even with the disappointing German statistics, you can still anticipate the pair's rise as an upward correction after the week. Important! Make sure the MACD indicator is above zero and just starting to increase from it before making a purchase.

Scenario #2: If the price reaches 1.0585 today, it is also viable to purchase euros, but at this point the MACD indicator should be in the oversold area, limiting the pair's potential for further decline and causing a market upward reversal. Growth to the opposing levels of 1.0609 and 1.0653 is to be anticipated.

Sell signal

Scenario #1: You can sell the euro once it reaches 1.0585 (the red line on the chart). The 1.0548 level will be the target, and at that moment I advise exiting the market and purchasing euros right away in the opposite direction (counting on a movement of 20–25 points in the opposite direction from the level). The first half of the day may see the pressure on the pair continue. Important! Make sure the MACD indicator is below zero and just starting its decline from there before you decide to sell.

Scenario #2: Selling the euro today is also an option if the price reaches 1.0609, but at this point the MACD indicator should be overbought, limiting the pair's potential upward movement and causing the market to reverse downward. We might anticipate a drop to the opposing levels of 1.0585 and 1.0548.

Listed on the chart:

The price at which you can purchase a trading instrument is shown by the thin green line.

As further growth is improbable beyond this level, the thick green line represents the predicted price at which you can place a take-profit order or set your profit levels.

The price at which a trading instrument may be sold is shown by the thin red line.

Given that an additional decrease is unlikely below this level, the thick red line is the predicted price at which you can place a take-profit order or fix your gains.

MACD signal. It's vital to follow overbought and oversold zones while entering the market.

Important. When deciding to enter the forex market, novice traders must be extremely cautious. To avoid being subjected to sudden variations in the exchange rate, it is recommended to avoid the market before the release of significant fundamental reports. Always use stop orders to limit losses if you choose to trade during the news announcement. Without stop orders, you run the risk of losing your entire deposit very rapidly, especially if you trade frequently but do not employ money management.

And keep in mind that a clear trading plan, such as the one I provided above, is essential for effective trading.

An intraday trader's spontaneous trading decisions based on the state of the market are initially a losing technique.