Analysis of trades and advice for trading the pound

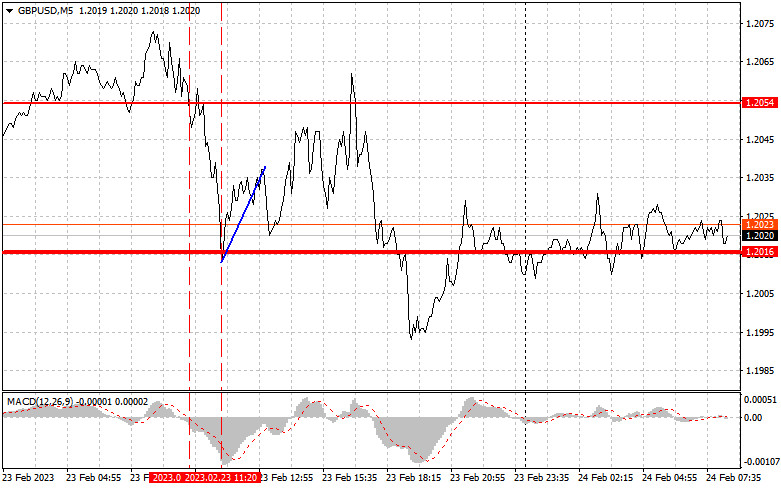

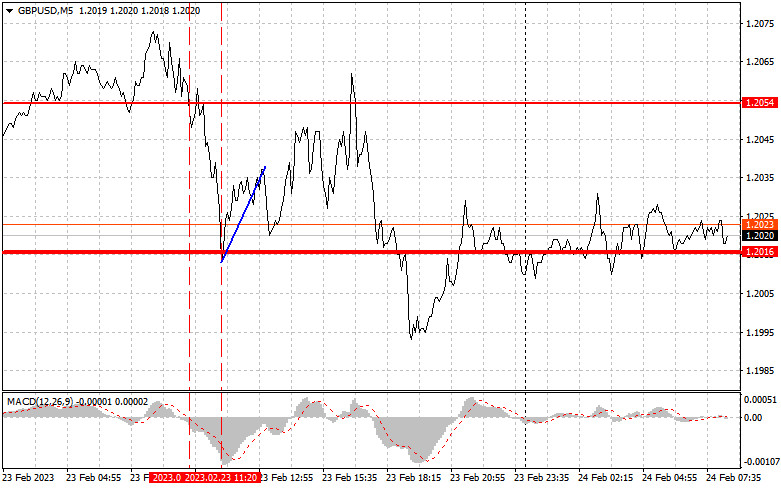

The MACD indicator fell significantly from zero at the time of the 1.2054 price test, thus there was no sell signal. Purchases for a rebound at the price of 1.2016 that I paid attention to in the afternoon generated roughly 20 points of profit. All 50 may be won by the one who persisted in the negotiation.

The Monetary Policy Committee member John Cunliffe's statement from yesterday had no impact, which resulted in the morning's sale of the pound. There are no data today either, thus Silvana Tenreyro, a member of the ILC for the Bank of England, will be the lone speaker receiving attention. I anticipate seeing a lot of interesting statistics in the second half, including strong data on housing sales in the main US market, changes in the level of household spending, and the main indicator of personal consumption expenditures, which may cause the dollar to strengthen again against the pound. The University of Michigan's consumer sentiment index and inflation expectations data are of secondary significance.

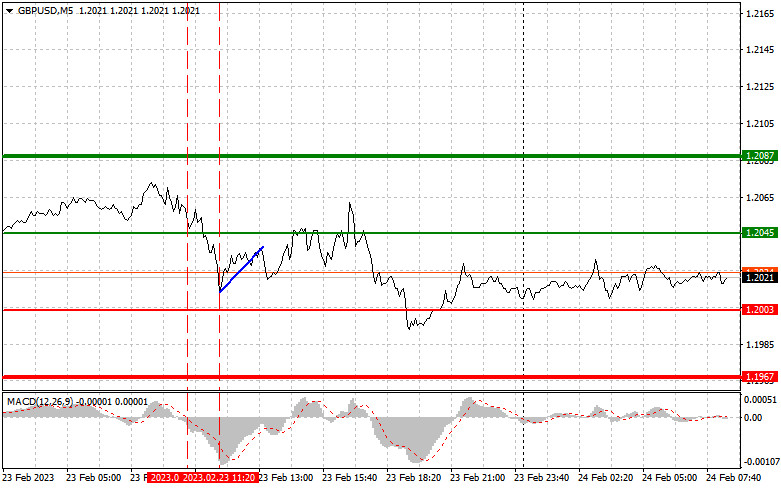

Buy Signal

Scenario #1: You can purchase the pound right now when it is at 1.2045 (green line on the chart) to increase to the level of 1.2087 (thicker green line on the chart). I advise closing purchases and starting sales in the opposite direction at 1.2087 (counting on a movement of 30-35 points in the opposite direction from the level). Only until the pound has stabilized above 1.2045 against the backdrop of profit-taking after the week is it possible to anticipate a further increase. Important! Make sure the MACD indicator is above zero and just starting to increase from it before making a purchase.

Scenario #2: If the price of 1.2003 is achieved, it is also viable to buy the pound today. However, at this time, the MACD indicator should be in the oversold area, limiting the pair's potential for further decline and causing a market upward reverse. Growth to the opposing levels of 1.2045 and 1.2087 is to be anticipated.

Sell signal

Scenario #1: The pound can only be sold today after reaching the 1.2003 level (the red line on the chart), which would cause a sharp decrease in the value of the pair. The 1.1967 level will be the primary objective for sellers, so I advise closing out any positions and starting new ones in the other direction at that point (counting on a movement of 20-25 points in the opposite direction from the level). If the pair doesn't increase in value throughout the first half of the day, pressure on the pound will resume. Important! Make sure the MACD indicator is below zero and just starting its decline from it before you decide to sell.

Scenario #2: It is also feasible to sell the pound today if the price reaches 1.2045, but at this point the MACD indicator should be in the overbought range, limiting the pair's potential upward movement and resulting in a downward market reversal. A decrease to the opposite levels of 1.2003 and 1.1967 is to be anticipated.

Listed on the chart:

The price at which you can purchase a trading instrument is shown by the thin green line.

As further growth is improbable beyond this level, the thick green line represents the predicted price at which you can place a take-profit order or set your profit levels.

The price at which a trading instrument may be sold is shown by the thin red line.

Given that an additional decrease is unlikely below this level, the thick red line is the predicted price at which you can place a take-profit order or fix your gains.

MACD signal. It's vital to follow overbought and oversold zones while entering the market.

Important. When deciding to enter the forex market, novice traders must be extremely cautious. To avoid being subjected to sudden variations in the exchange rate, it is recommended to avoid the market before the release of significant fundamental reports. Always use stop orders to limit losses if you choose to trade during the news announcement. Without stop orders, you run the risk of losing your entire deposit very rapidly, especially if you trade frequently but do not employ money management.

And keep in mind that a clear trading plan, such as the one I provided above, is essential for effective trading.

An intraday trader's spontaneous trading decisions based on the state of the market are initially a losing technique.