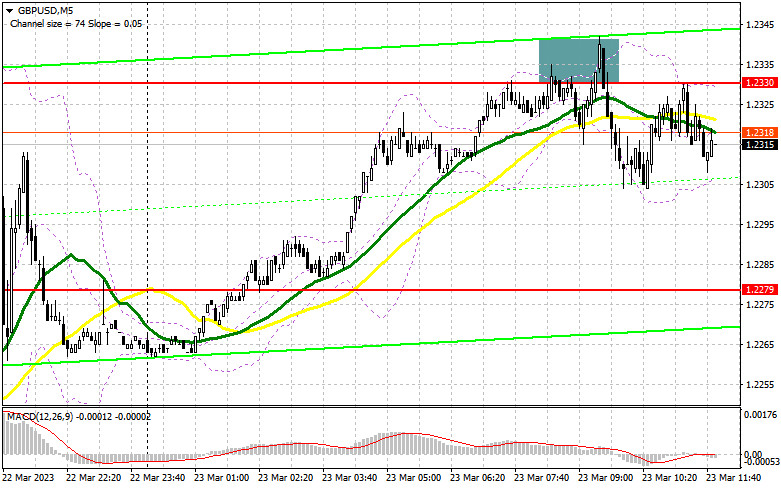

In my morning forecast I highlighted the level of 1.2330 and recommended making trading decisions with this level in mind. Let us have a look at the 5-minute chart and figure out what happened. In the first half of the day, GBP performed a false breakout of that level, falling by 20 pips afterwards. Then, pressure on the pair decreased. The technical situation and strategy remain unchanged.

When to open long positions on GBP/USD:

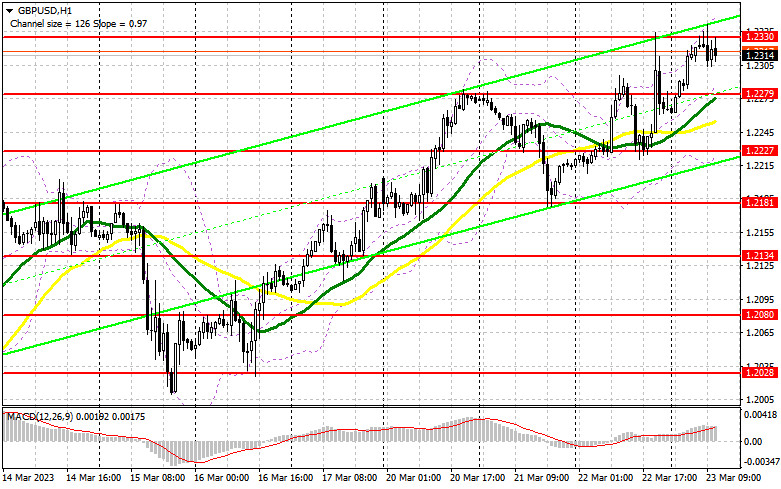

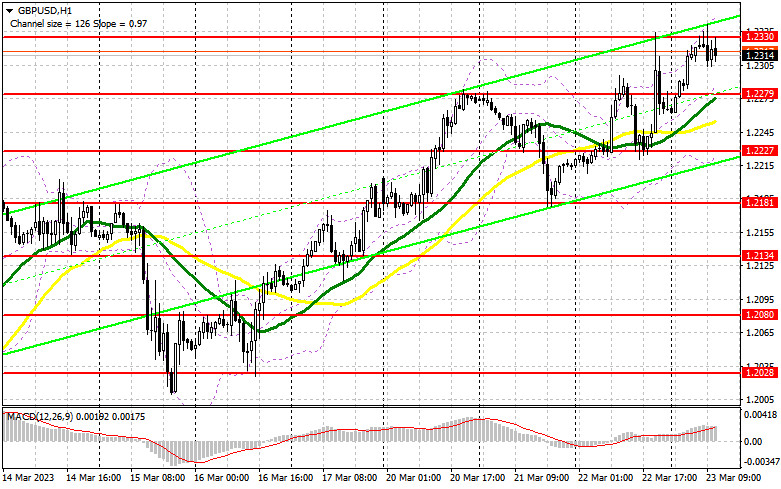

Obviously, everyone is waiting for the Bank of England to raise interest rates and the pound sterling to rise further amid hawkish comments by Andrew Bailey on inflation and the regulator's future policy. Therefore, no one is in a hurry to sell the pound, as there is no need to do so yet. The strategy remains unchanged. If the pound sterling declines after interest rates are increased, traders should open long positions near the support level of 1.2279 and only after a false breakout. This could create new entry points into long positions aiming at 1.2330. If the pair consolidates there and performs a downward retest of 1.2330, GBP/USD could reach a new monthly high of 1.2388. At this level, the bulls will again face serious problems. Following a breakout of this level, the pair could touch 1.2450 where I recommended taking profits. If bulls fail to push the pair to 1.2279, where bullish moving averages lie, the pressure on the pound will return. In this case, I would advise you not to hurry and open long positions only near the support level of 1.2227 and only after a false breakout of that level. You could buy GBP/USD immediately if it bounces off the low of 1.2181, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on GBP/USD:

Bears used their chance to begin a downward correction, but it did not lead to a major sell-off. In the second half of the day, they still need to hold the resistance level of 1.2330. A false breakout of this level will give an excellent signal to open short positions against the trend after the BoE announces its decision. GBP/USD could then slide to the nearest support level at 1.2279. At this level, bulls are likely to try to enter the market. Only a breakout and an upward retest of 1.2279 will increase the pressure on the pound, providing new entry points into short positions with a drop to 1.2227. A more distant target will be a low of 1.2181 where I recommend taking profits. If GBP/USD rises and bears are idle at 1.2330, which is likely, the pound sterling may rush to the new monthly high at 1.2388. Only a false breakout of this level will create an entry point for opening positions. If there is no downward movement there, you could sell GBP/USD immediately after it bounces from a high of 1.2450, keeping in mind a downward intraday correction of 30-35 pips.

Commitment of Traders (COT) report:

The Commitment of Traders (COT) report for March 7 showed that both long and short positions went up. However, this data is no longer relevant. After the cyberattack on CFTC, data has just begun to be updated, so the information from two weeks ago is not very helpful. I will wait for new data releases and then analyze more recent data. This week, besides the Fed meeting, there will be a meeting of the Bank of England, where quite important decisions on interest rates will be taken. The regulator is expected to maintain an aggressive pace of interest rate hikes, as the current drive against inflation has not brought many results so far. If the Fed softens its stance and the Bank of England does not, the pound sterling might continue to rise to new monthly highs. The latest COT report showed that short non-commercial positions rose by 7,549 to 49,111, while long non-commercial positions jumped by 1,227 to 66,513, bringing the negative non-commercial net position down to -17,141 from -21,416 the week before. The weekly closing price declined to 1.1830 versus 1.2112.

Indicator signals:

Moving averages

Trading is carried out above the 30-day and 50-day moving averages, indicating that the pound sterling is likely to rise further.

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If the pair increases, it will face resistance at 1.2345.

Description of indicators

• Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

• Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

• MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

• Bollinger Bands (Bollinger Bands). Period 20

• Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• Total non-commercial net position is the difference between the short and long positions of non-commercial traders.