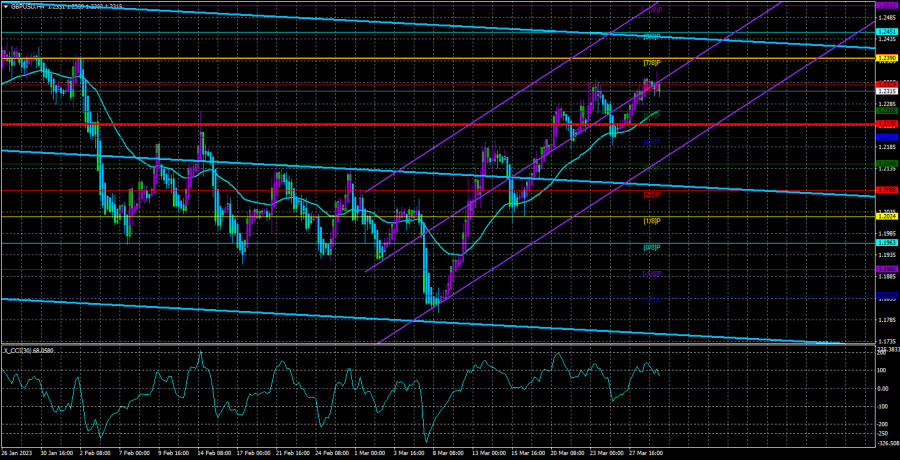

On Wednesday, the GBP/USD currency pair spent nearly the entire day near the crucial Murray level of "6/8" (1.2329). The upward movement last time concluded around this level, and a rebound from it could prompt a new fall in the pair, which we think is the most likely outcome. Even more than the euro, the price of the pound sterling has increased recently. Since the Bank of England can objectively increase its rate above the Fed rate in 2023, the issue may rest in market expectations and rates. However, the market might include such a possibility in the pair's present exchange rate. But even in this instance, the pound has already risen excessively, and on the 24-hour TF, it is still trading in the side channel between 1.1840 and 1.2440. As a result, even a strong movement like the one we've seen lately is meaningless. Nothing more than a series of "swings" in the side channel.

Both the macroeconomic and fundamental backdrops for the pound and the dollar have been missing so far this week. Yes, Andrew Bailey gave two speeches, but once again, he didn't say anything particularly original. He only stated that the rate would increase going forward, which the market could have known without him. Representatives of the Bank of England and the Fed made several statements, but they did not provide the market with any crucial information either. And if meetings between the two parties were conducted just a week ago, what crucial information can there be now? The following reports on inflation, nonfarm payrolls, and unemployment must now be received before there may be reasons for changing the monetary policy strategy. Perhaps members of the Fed monetary committee or the BA will have time to share this information with the market before the May meetings.

Everything happens following the technical picture on a 24-hour TF. After bouncing off the lower border of the 1.1840 side channel, the price has been steadily increasing toward the upper border for several weeks. Everything makes sense.

Positive news for the pound.

The pound will have to wait until Friday if macroeconomic data for the euro and the dollar start to come at least today, on Thursday. Even then, you will only be able to wait formally because the UK will only release one more or less important report on the fourth quarter's GDP. Although this report has a very strong message, it is uncommon for GDP statistics to cause a reaction in real life. We are not discussing a response to 20–30 points, of course. According to experts, the British economy won't grow by the conclusion of the third assessment, which will include the report. As a result, even on Friday, traders won't have anything to respond to.

If British Finance Minister Jeremy Hunt had at least mentioned interest rates, the economy, or monetary policy, it would have been possible to take notice of his speech. He only stated, however, that he would favor being a governor who lowered taxes as opposed to raising them. He further stated that increasing public debt cannot be used to pay for tax reductions. He claimed that Britain is currently becoming more stable and is beginning to pay off its obligations.

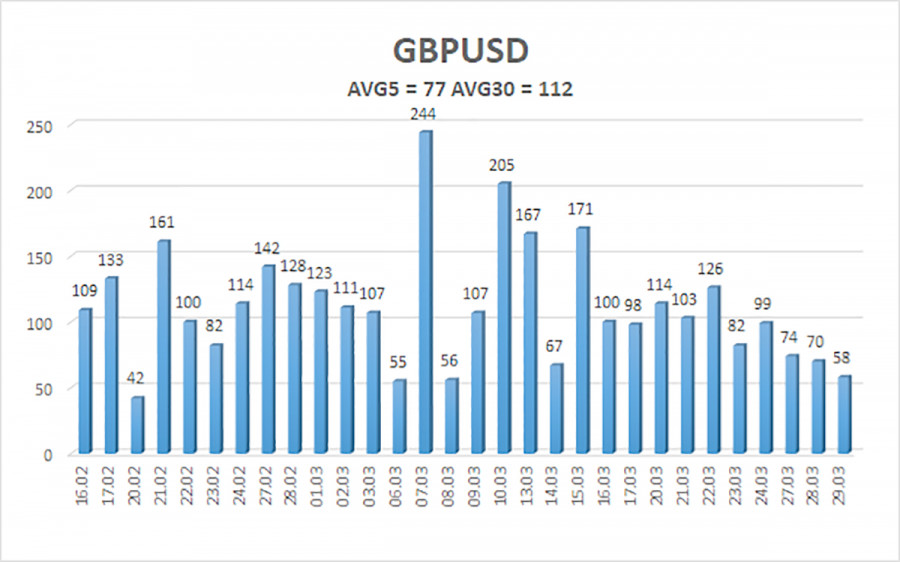

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 77 points. This value is "average" for the dollar/pound exchange rate. Therefore, on Thursday, March 30, we anticipate movement to remain inside the channel and be constrained by the values of 1.2238 and 1.2390. A new phase of corrective action is indicated by the Heiken Ashi indicator turning downward.

Nearest levels of support

S1 – 1.2268

S2 – 1.2207

S3 – 1.2146

Nearest levels of resistance

R1 – 1.2329

R2 – 1.2390

R3 – 1.2451

Trading Suggestions:

In a 4-hour time frame, the GBP/USD pair is attempting to maintain the upward trend. Until the Heiken Ashi indicator goes down, you can continue holding long positions with targets of 1.2390 and 1.2451. If the price is set below the moving average with targets of 1.2207 and 1.2146, short positions may be taken into account.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

The short-term trend and how to trade right now are determined by the moving average line (settings 20.0, smoothed).

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.