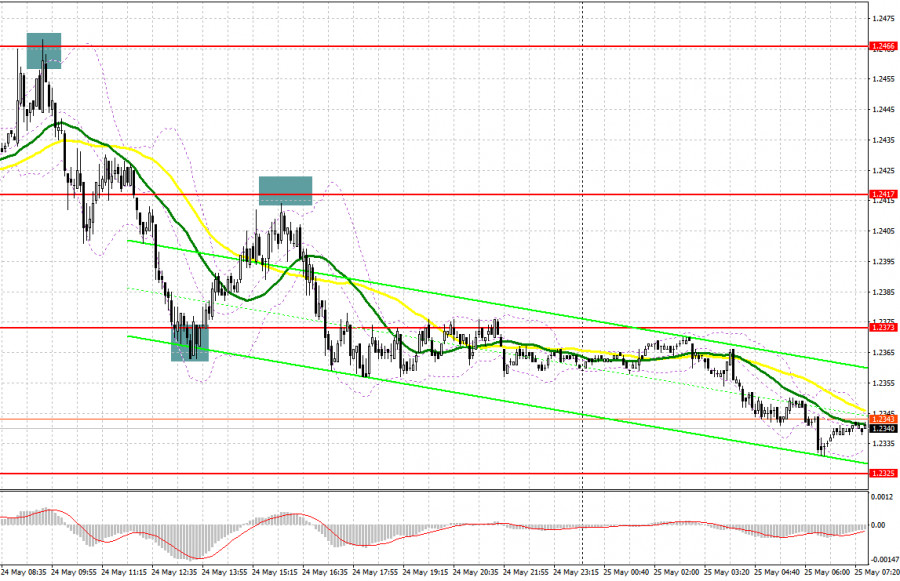

Yesterday, there were some great signals to enter the market. Let's have a look at the 5-minute chart and see what happened there. In my morning review, I mentioned the level of 1.2466 as a possible entry point. Growth and a false breakout after the UK report generated a sell signal. As a result, the price fell by more than 50 pips. Defending 1.2373 and the growth made it possible for traders to take around 30 pips more. We fell short to test 1.2417, where one could get an excellent sell signal.

For long positions on GBP/USD:

The pair remains significantly under pressure, as the UK inflation report came out yesterday, which turned out to be higher than economists' expectations. However, the bears were quick to take advantage of the lack of progress on the US debt ceiling, and in the afternoon there were rumors of a possible revision of the US credit rating. This only increased the demand for safe-haven assets. Today, the Confederation of British Industry retail sales figures will be released, which are unlikely to particularly help the pound with the bullish correction.

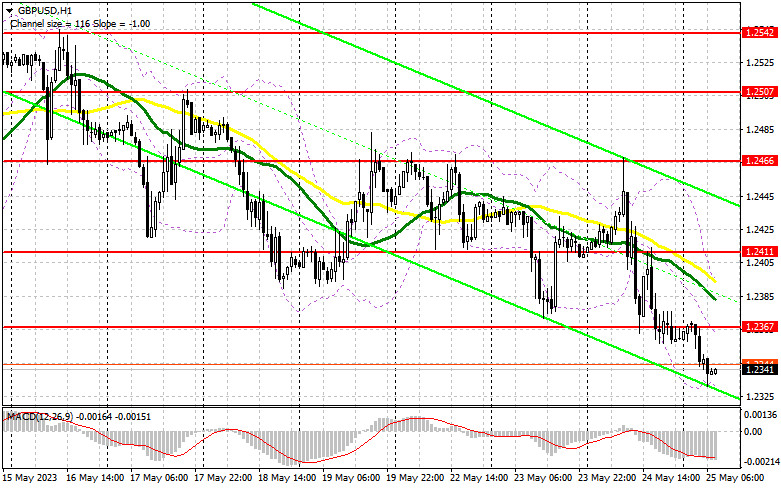

For this reason, I expect the pair to fall, and I only plan to act from the nearest support level of 1.2319. A false breakout will give a chance for the pair's recovery so it can move to 1.2367. A breakout above this range will provide another buy signal. In that case, we can talk about a surge towards 1.2411, where the moving averages favor the bears. This will limit the pair's potential for growth. The most distant target remains in the 1.2466 area, where I will take profit. If GBP/USD declines and there are no bulls at 1.2319, the bearish sentiment will persist. If that happens, I recommend postponing long positions until the price hits 1.2275. Buying will only be considered on a false breakout there. Opening long positions on GBP/USD immediately on a rebound can be done from 1.2234, keeping in mind an intraday correction of 30-35 pips.

For short positions on GBP/USD:

The bears are still holding the upper hand in the market and there's no hope for big buyers to return to the market. At best, the pair may trade higher as a reaction to the UK inflation report. However, this will serve as an opportunity to increase short positions from 1.2367, similar to yesterday's response after the news of sustained high price pressure. A false breakout will produce a sell signal, expecting further decline towards renewing the next monthly low at 1.2319. A breakout and an upward test of this range will increase the pressure on GBP/USD, forming a sell signal. As a result, the pair will fall to 1.2275. The most distant target is the 1.2234 low, where I will take profit.

If GBP/USD rises and bears are idle at 1.2367, and correction must occur at some point, it is best to hold back from selling until the pair tests a larger resistance level at 1.2411, where the moving averages are. A false breakout at that level will provide an entry point into short positions. If there is no downward movement at that mark, I would advise selling GBP/USD from 1.2466, expecting a rebound of 30-35 pips within the day.

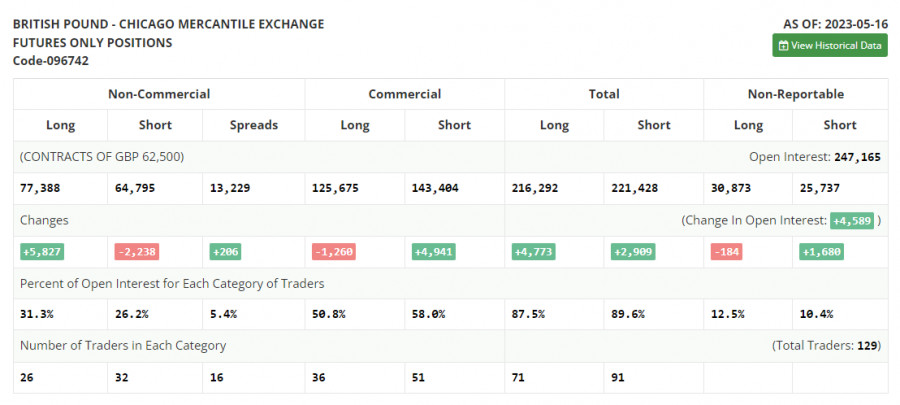

COT report:

According to the Commitments of Traders (COT) report as of May 16, there was an increase in long positions and a decrease in short positions. The correction in the British pound was quite significant, and the pair is trading at very attractive prices, which is reflected in the report. Once the issue of the US debt ceiling is resolved, I believe that the demand for risk assets will return, and the pound will be able to recover quite substantially. It is worth noting that the Federal Reserve plans to pause its cycle of interest rate hikes, which will also put pressure on the US dollar. The latest COT report states that short positions of the non-commercial group of traders decreased by 2,238 to 64,795, while long positions jumped by 5,827 to f 77,388. This led to an increase in the non-commercial net position to 12,593 compared to 4,528 the previous week. The weekly closing price declined to 1.2495 from 1.2635.

Indicator signals:

Moving Averages

Trading is carried out below the 30 and 50 daily moving averages. It indicates a further decline in the instrument.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the pair falls, the lower band of the indicator at 1.2335 will act as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.