The EUR/USD currency pair showed absolutely nothing on Monday. Yesterday, we warned that the events calendar was empty, with no minor reports or publications. Therefore, it is unsurprising that the pair stayed in one place all day, demonstrating a staggering volatility of 38 points. With a range of less than 40 pips, trading even on the 5-minute timeframe made no sense. We have previously warned that volatility has significantly decreased in recent months, so it is best to trade in a medium-term style (as we still have a trend). Although the pair has fallen for three consecutive weeks, we are not surprised by this market situation. Before that, the pair rose for two months without sufficient grounds. What we see now is just a debt return to the US dollar.

Thus, the technical picture stayed the same at the end of Monday. An upward correction could have started, but the Memorial Day celebrations in the United States discouraged traders from entering the market. As before, an upward correction is brewing, but the dollar should continue to appreciate in the medium term. There is no basis for the euro to resume its upward trend in the same medium term. Consolidation should begin in the pair, which may last until central banks start hinting at imminent monetary policy easing. Or until inflation in the EU or the US slows down to the point where the market expects a reduction in key interest rates soon.

Democrats and Republicans have reached an agreement, and there are no "buts"

As we have already written, Joe Biden has agreed with Republicans. Congress must approve the bill by June 1, and we believe it will be passed. We have repeatedly warned that the US debt issue is not a problem. Neither for the American economy nor for the dollar. Considering that the dollar has been actively rising in the last three weeks, it is obvious how the market was "concerned" about a possible default. Today, some experts expressed yet another round of "doubts." Any probabilities are being thrown around, such as "Congress's inability to accept the proposed plan." If Congress makes any amendments to the proposed document, they will be minor. The most important thing is that there will be no default, and when the new law is finally passed is irrelevant. Treasury Secretary Janet Yellen expects the Treasury to run out of money by June 5 (not by the 1st as previously stated), so politicians have an additional five days. There is no doubt that they will use them wisely and continue to trade. But again, all these negotiations no longer have any impact. If Biden has reached an agreement with McCarthy, everything else is irrelevant.

Thus, everything now allows the dollar to continue to appreciate. The European currency can only count on a technical correction. In theory, it can be predicted on a daily timeframe. For example, it may start if the price rebounds from the Fibonacci level of 38.2% (1.0608). Or near the previous local minimum (for the 24-hour timeframe). For now, it is unknown how the bulls will behave if the pair consolidates above the 4-hour timeframe moving average - for a long time, any consolidation below the moving average meant only one thing: the pair would continue to rise. But in any case, crossing the moving average line will warn traders of a possible change in the short-term trend.

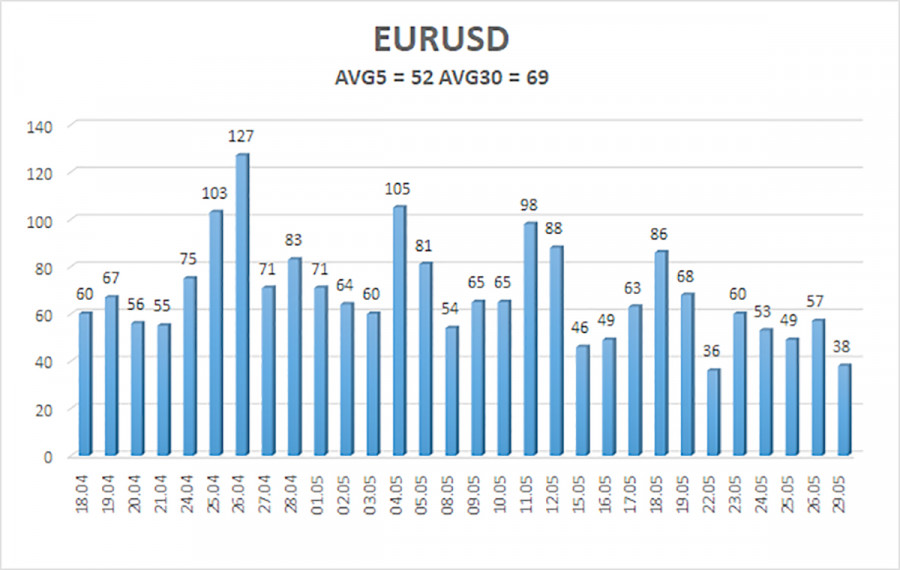

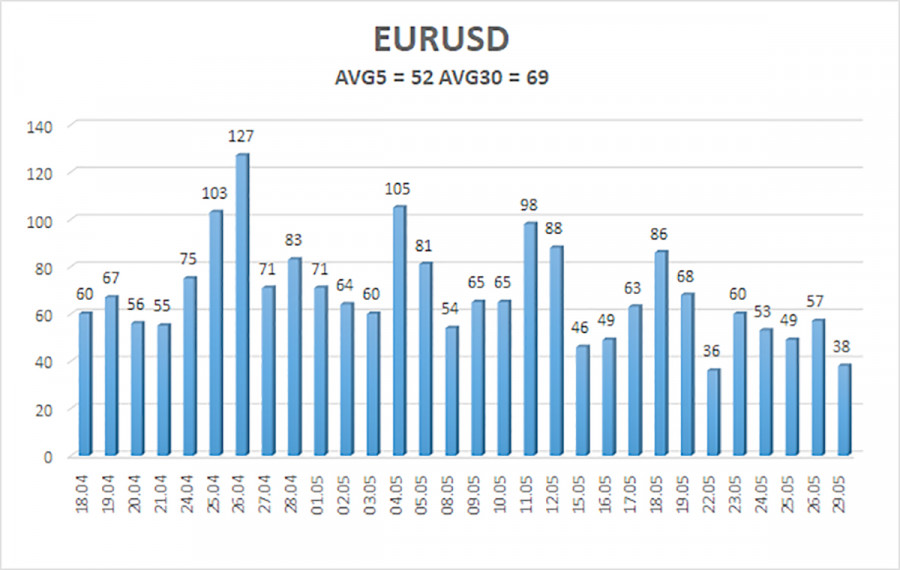

The average volatility of the euro/dollar currency pair over the last five trading days as of May 30 is 52 pips and is characterized as "average" (although it is already "non-tradable"). Thus, we expect the pair to move between the levels of 1.0661 and 1.0765 on Tuesday. The reversal of the Heiken Ashi indicator upwards will indicate a new phase of the corrective movement.

Nearest support levels:

S1 - 1.0681

S2 - 1.0620

Nearest resistance levels:

R1 - 1.0742

R2 - 1.0803

R3 - 1.0863

Trading recommendations:

The EUR/USD pair continues its downward movement. It is advisable to remain in short positions with targets at 1.0681 and 1.0661 until the price consolidates above the moving average. Long positions will become relevant only after the price is firmly above the moving average line with a target of 1.0864.

Explanation of illustrations:

Linear regression channels - help determine the current trend. If both channels point in the same direction, it indicates a strong trend.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction for trading.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - probable price channel in which the pair is expected to trade in the next 24 hours based on current volatility indicators.

CCI indicator - its entry into the oversold region (below -250) or overbought region (above +250) indicates an approaching trend reversal in the opposite direction.