In the foreign exchange market, the US dollar continues to challenge and outstrip the euro. While the euro did experience some uplift after recent statistics from the eurozone, this success was fleeting. Meanwhile, the greenback fortifies its standing and prepares for further advances.

Market analysts note that recent reports from the eurozone have showcased a robust reaction from the EU economy to tightening monetary policies enacted by the European Central Bank (ECB). It's worth recalling that the eurozone has seen a deceleration in the growth of the money supply (to 1.9% YoY against an expected 2.1% YoY). At the same time, the rise in interest rates hinders the growth of new loans, which have reached their lowest level since 2017.

In light of these circumstances, experts claim that the euro is oversold against the US dollar. This supports the single European currency, much like the ECB's hawkish stance on inflation. Both the European and American regulators are aiming for a target inflation rate of 2%.

In the near term, the euro is likely to remain under pressure as markets anticipate a pause in the ECB's rate hiking cycle. Previously, similar sentiments were prevalent towards the US Federal Reserve, being accentuated against a backdrop of slowing global economic growth.

Given the current scenario, analysts anticipate a decline in the EUR/USD pair in the medium to long-term planning horizons. The pair's target for the coming weeks is a range of 1.0470 to 1.0500.

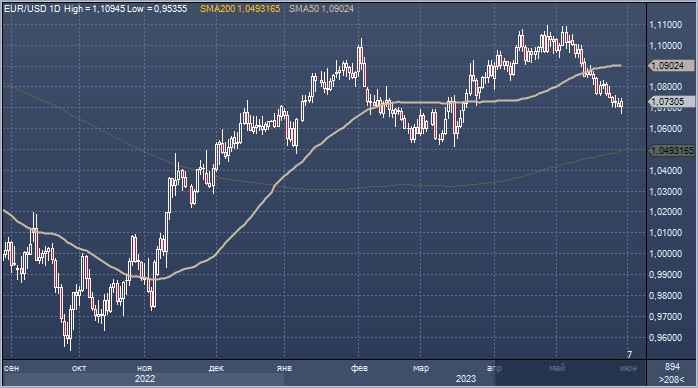

At the start of this week, EUR/USD managed to break through the level of 1.0700, setting a new low for March. This was followed by a sharp rise to 1.0745, which ended in a decline. On Wednesday morning, May 31, EUR/USD was trading around 1.0678, making an effort to win back previous losses.

According to the technical chart, the instrument currently has limited upward potential. At present, the pair is striving to break through a critical Fibonacci retracement level of 61.8%, while remaining below the 20- and 100-day simple moving averages. Analysts estimate that the technical indicators of the EUR/USD pair are close to oversold levels, showing no significant momentum, which suggests a lack of buyer interest.

The pair's bullish potential is also limited. Market observers note a continued bearish bias in the EUR/USD pair, with the moving averages staying above the current price level. The pair's technical indicators are pointing upwards. The recent recovery in the EUR/USD pair may merely represent corrective growth, and if the pair does not escape the current price range, a decline is anticipated.

The US dollar has reaped benefits from the recent drop in the EUR/USD pair, facilitating its rise to fresh local highs. However, experts advise against a euphoric reaction, arguing that the current surge in USD is likely to be a temporary phenomenon rather than a robust upward trend. Notwithstanding, favorable factors for the dollar persist, including the resolution of the US debt ceiling issue and rising short-term bond yields.

Preliminary forecasts suggest that a substantial correction awaits the EUR/USD pair in early June, with a return to the 1.0900 mark. Later, the pair is projected to spiral downwards. By the end of the current year, many analysts anticipate the pair's return to parity, where EUR/USD will approach the 1.0000 level.

Given the circumstances, economists at MUFG Bank are confident that the greenback has more room for growth. In their view, the dollar will receive support from the strong NonFarm payrolls report from the US, slated for release on Friday, June 2nd.

Currency strategists at Jefferies also perceive more opportunities for dollar growth following the release of new economic data. Analysts estimate that positive labor market reports in the US will prompt the Fed to raise the key rate in June. As a result, current macro data will provide market participants with hope for a continuation of rate hikes in the US.

The market's focus is sharply on the final resolution of the issue regarding the US debt ceiling. The US Congress is due to sign the relevant bill by the end of this week. Both Democrats and Republicans harbor doubts about the deal, but its conclusion is critically important to solving the debt ceiling issue. This will allow the American economy to avoid a severe shock, experts are convinced.

Despite confidence in a further rally of the US dollar following the publication of the US labor market report, Jefferies analysts recommend buying USD "on any attempts of a dip, recorded after Friday's data". In addition, market participants assess the likelihood of a 25-basis-point rate hike by the Fed at the June FOMC meeting as very high. Experts believe that a strong employment report in the US will bolster these expectations and contribute to dollar growth in the near term.