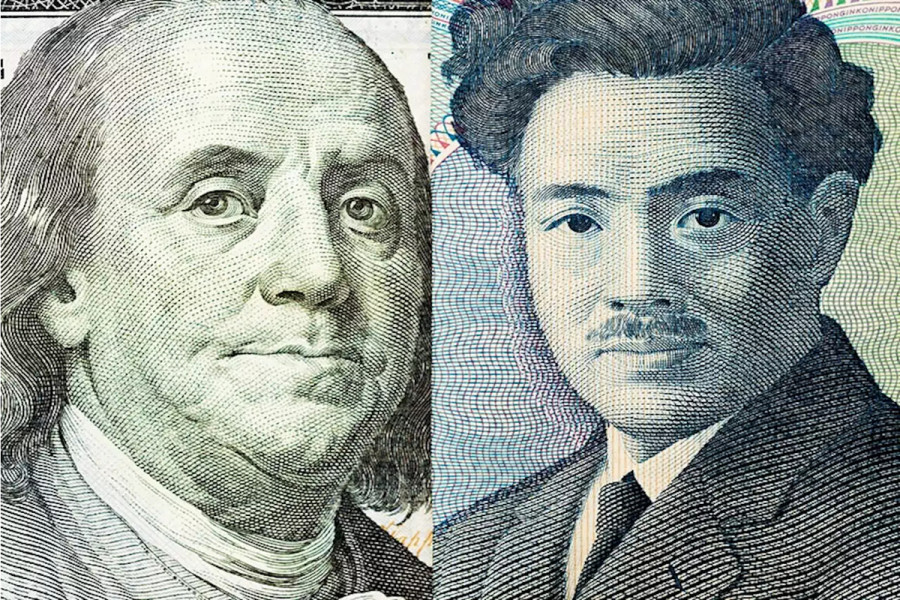

As we embark on a new trading week, the USD/JPY currency pair has taken a neutral stance, signaling a cautious sentiment among investors ahead of the Federal Reserve symposium in Jackson Hole scheduled for August 24-26. All eyes are on the Federal Reserve's Chairman, Jerome Powell, whose speech will likely be a pivotal factor affecting the USD/JPY's trajectory. What can we expect from Powell's statement and how might it sway the greenback?

USD/JPY trapped in a sideways channel

The onset of Monday saw the USD/JPY pair settle into a neutral zone, with both currencies evenly matched and displaying little momentum.

Several factors currently serve as drivers for the yen:

- Rising expectations of a potential change in the monetary policy of the Bank of Japan, propelled by July's unexpectedly high inflation figures. Last month, the Consumer Price Index (CPI) surged to an annualized 3.3%, surpassing the forecast of 2.5%.

- Traders' worries about Tokyo's intervention in the market, given that USD/JPY consistently trades above the significant 145.00 threshold, a level where intervention happened last year.

- Looming fears of a global recession, compounded by China's stuttering economic growth. Further fiscal stimuli from Beijing might boost the yen, given its export-dependent nature.

Worries about decelerating global growth also buoy the US dollar, given its reputation as a haven asset. Yet, the central divergence in the monetary policies of the Fed and the Bank of Japan (BOJ) remains the strongest catalyst influencing the greenback's movements against the yen.

Speculations have long surrounded the BOJ's monetary approach. Still, the regulator sticks to its dovish strategy, hinting that no change is coming anytime soon.

Regarding the Federal Reserve, most investors anticipate a pause in its rate-hiking cycle in September. Yet, there's growing chatter about another tightening episode by year-end.

The recently released minutes from the FOMC's July meeting suggest that a significant chunk of Fed officials perceive an escalation in inflation risks, potentially warranting more hawkish measures.

Strong US macroeconomic indicators further underscore the robustness of its economy. A consensus among experts posits that these factors might allow the Federal Reserve to maintain its hawkish stance longer than was previously expected.

The burning question traders grapple with is the time the Federal Reserve will need to sustain elevated rates. Until a clear answer emerges, the greenback's consolidation phase is likely to persist.

Forecasts suggest that significant volatility in the USD majors, including the USD/JPY pair, is expected this Friday following Jerome Powell's speech at the Jackson Hole symposium. The direction the US currency takes will largely depend on Powell's tone. If the market interprets his speech as hawkish, the dollar might receive a boost.

On the other hand, a dovish tone from the Fed Chair could send the greenback tumbling across the board, including against the yen.

What's the likely scenario?

The majority of economists surveyed by Bloomberg believe Powell won't declare the Fed's anti-inflation mission as accomplished on Friday.

Nearly 80% of respondents asserted that US consumer price growth will remain above target levels in the coming years, necessitating the Fed to maintain its hawkish stance, which typically implies higher interest rates.

Analyst Jerome Schneider believes that persistent inflation will leave the Federal Reserve with no choice but to keep rates above the 5% mark for several months to come. He predicts the regulator might only commence rate reductions around mid-2024 or later.

It's probable that Powell won't specify any exact timelines during his Jackson Hole symposium speech. However, he might subtly indicate that the Fed's tightening cycle is far from over.

"We expect the Fed Chair to strike a more balanced tone in Wyoming. He'll likely hint at the end of the tightening cycle but emphasize the need to keep interest rates elevated for longer," commented Anna Wong for Bloomberg Economics.

If investors receive compelling evidence suggesting prolonged high interest rates in the US, the dollar could gain strength across all fronts, with USD/JPY being the main winner.

In an optimistic scenario, the greenback might strengthen against the yen to 147 by the week's end, provided there's no intervention warning from the Japanese government.

Technical outlook

The daily chart reveals a bullish exhaustion for the USD/JPY pair. The fading momentum is evident in the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) indicator.

However, the pair remains above the 20-, 100-, and 200-day simple moving averages, indicating that buyers still dominate the market on a broader scale.

The most crucial zones to monitor now are support levels at 145.00, 144.00, and 143.20, and resistance levels at 145.50, 146.00, and 146.30.