Markets Take Pause After Record Rally

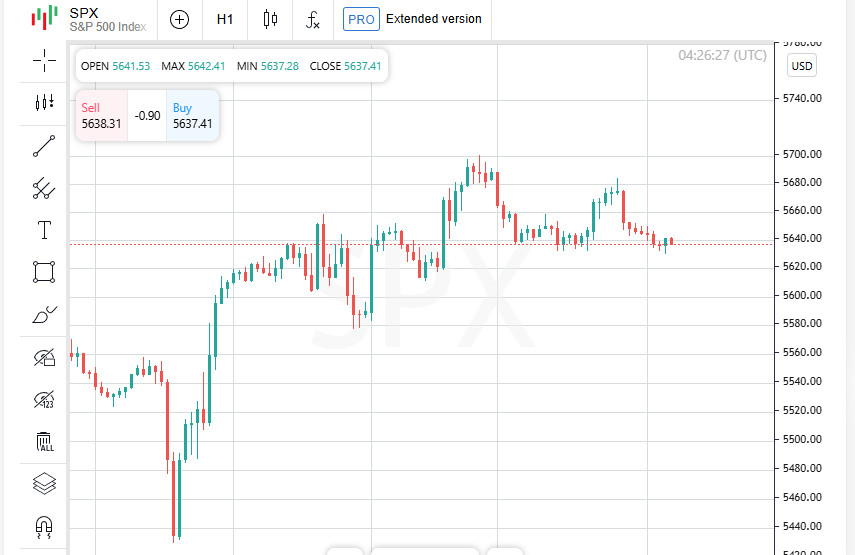

The S&P 500 Index slipped Monday, ending its most impressive run of gains in two decades. Investors are taking a wait-and-see approach ahead of a key Federal Reserve meeting later this week. Optimism has been dampened by President Donald Trump's surprise remarks about upcoming tariffs.

Nine Steps Up, One Step Back

The first warning signs were on April 2, when the Trump administration announced its first round of tariff measures. At that time, the S&P 500 index lost almost 15% in a short period. However, the markets soon recovered their losses: the index demonstrated steady growth for nine trading days in a row, reaching its best dynamics since 2004. Monday's decline was the first break in this growth.

A wave of correction covered all three key indexes

On Monday, the main Wall Street indexes ended trading lower, reflecting investor nervousness amid the White House tariff announcements and news from major corporations. The Dow's nine-day rally was interrupted, and the tech sector came under pressure again.

Trading day results:

- The Dow Jones Industrial Average fell by 98.60 points (-0.24%) and closed at 41,218.83, ending its longest positive streak since December 2023;

- The S&P 500 lost 36.29 points (-0.64%) and stopped at 5,650.38;

- The Nasdaq Composite fell by 133.49 points (-0.74%) to 17,844.24.

Hollywood is nervous

After President Trump's announcement of possible 100% tariffs on foreign films, shares of companies associated with the production and distribution of content went into the red. However, by the close of trading, some of them were able to partially recoup their morning losses.

- Netflix fell by 1.9%, which interrupted its 11-day rise;

- Amazon.com also fell 1.9%, continuing to weigh on Big Tech;

- Paramount Global lost 1.6%, reacting to the threat of media import restrictions.

Buffett steps down

Berkshire Hathaway Class B shares fell 5.1% after Warren Buffett, a symbol of resilience and long-term growth in the market, announced his intention to step down as CEO. The departure of the "Oracle of Omaha" was a significant moment, raising concerns among investors about the future of the company.

All eyes on the Fed

Market participants are focused on Wednesday, when the US Federal Reserve will publish its latest policy statement. According to analysts, the benchmark interest rate is likely to remain unchanged. But more importantly, what will Fed Chairman Jerome Powell say. His rhetoric will be closely analyzed for hints of a possible reversal in monetary policy. The regulator is expected to ease the rate by 75 basis points by 2025, with the first cut possible as early as July, according to LSEG, a platform that analyzes investor expectations.

Tariffs and Profits: Balance Sheet at Risk

As investors wait to hear from the Fed, they are increasingly worried about the potential impact of US tariff policy. Fresh earnings reports have come as a direct blow: Tyson Foods shares have fallen 7.7% after the meat producer missed revenue forecasts.

Experts say that new trade barriers could hamper international supply and put pressure on profitability, especially in sectors with high export dependence.

Deal of the Day: Skechers Surprises Wall Street

Unlike the food industry, the retail market has pleased investors. Skechers has become a real sensation of the day: the company's shares have soared by 24.3% after the announcement of the buyout of the brand by private equity firm 3G Capital. The deal is valued at $9.4 billion and has already earned the status of one of the largest M&A deals in the consumer sector this year.

Volatility without drama

Global stock markets demonstrated restrained dynamics on Tuesday. Indices fluctuated in a narrow corridor, and investors continued to digest the risks associated with US trade measures and the potential impact on global growth. Against this backdrop, the dollar began to recover recent losses, especially against the currencies of the Asian region.

Hong Kong sounds the alarm

The activity was especially noticeable on Tuesday in Hong Kong, where the currency regulator was forced to intervene. To protect the established currency corridor and prevent excessive strengthening of the Hong Kong dollar, the central bank spent $7.8 billion. This was the largest intervention in recent months.

Yuan and Taiwan dollar are among the leaders of growth

In mainland China, the yuan rose to 7.23 per dollar, reaching a maximum in almost two months - since March 20. The Taiwan dollar was even more explosive, settling at 30 per dollar on Tuesday morning, not far from a three-year peak of 29.59 set the previous day. The currency has gained an impressive 8% in two days.

Asian Stocks Lose Momentum

Despite the currency action, stock markets in the region were muted. MSCI's broad index of Asia-Pacific shares (excluding Japan) slipped 0.2%, with Japanese bourses closed for a national holiday.

- Taiwan's TWII index also fell 0.3%, reflecting a stronger local currency that could weigh on export competitiveness;

- In China, where trading resumed after the holiday, the CSI300 index opened slightly higher, reflecting cautious optimism;

- Meanwhile, Hong Kong's Hang Seng lost 0.2%, weighed down by currency interventions and growing uncertainty.

A ghost of a chance for dialogue

Amid all this turbulence, investors have a glimmer of hope for de-escalation: China is reportedly considering negotiations with the United States on tariffs. Washington has submitted a proposal, and Beijing is currently reviewing the terms of the dialogue, according to official sources. The news has become a focal point for markets that could shift the balance of power in the coming weeks.

Oil levels off after a slump

Oil prices showed signs of stabilization on Tuesday after a sharp plunge the previous day, when prices hit their lowest levels in four years. The main factor was the OPEC+ initiative to accelerate production increases, a move that has worried traders and analysts worried about a supply glut amid unstable demand.

While there were no sharp moves, the market remains jittery as investors continue to monitor the balance between supply and global economic risks, including the potential impact of a tariff war and a slowdown in industrial production.

Investors seek safety in gold

Amid market uncertainty and rising geopolitical risks, gold has once again become a magnet for investors. The precious metal hit a weekly peak on Tuesday, reflecting increased demand for safe haven assets. The increased interest in gold is due not only to volatility in commodity markets, but also to expectations about the Fed's future actions and a global economic slowdown.

Analysts say that if uncertainty persists, gold demand could continue to rise, especially given the weakening dollar and signs of falling Treasury yields.