U.S. Markets on a Seesaw: Volatile May Ends with a Strong Rally

Turbulent month, powerful close: The S&P 500 ended Friday's session nearly flat after a volatile day, yet still closed out its best monthly performance since November 2023. The Nasdaq followed suit, posting its strongest percentage gain since the same period.

Political Whiplash and Market Jitters

Throughout May, investors found themselves on edge as President Donald Trump's unpredictable trade rhetoric stirred uncertainty. His harsh statements toward China alternated with gestures toward negotiation, making market direction difficult to anticipate.

Despite the turmoil, stocks managed to rebound from April's lows. Contributing factors included solid corporate earnings and tame inflation data, both of which helped restore a cautious sense of optimism.

Morning Tension, Evening Hope

Friday began on a sour note. Trump took to his social platform, Truth Social, to sharply criticize China, accusing it of breaching trade agreements with the U.S. He also hinted at potential escalation in trade tensions.

But by the afternoon, the narrative shifted. Trump told reporters he planned to speak with Chinese President Xi Jinping and expressed hope for resolving key disagreements on trade and tariffs. Markets responded positively, trimming earlier losses.

Investors Weigh Data Against Rate Bets

May also proved to be a strong recovery month: the S&P 500 climbed roughly 6.2%, while the Nasdaq posted an impressive monthly gain of 9.6%. This rebound helped temper the anxiety caused by ongoing geopolitical tensions and shifting monetary expectations.

Inflation Gauge Reinforces Rate Cut Hopes

April's reading of the Personal Consumption Expenditures (PCE) index — the Fed's preferred inflation gauge — showed no signs of overheating. This further cemented expectations among traders that the U.S. central bank may proceed with a rate cut as early as September.

Tariff Debate Still Clouds the Outlook

Oxford Research estimates that the effective U.S. import tariff has ballooned from a modest 2–3% before Trump took office to around 15% today. A trade court had moved to reduce that to roughly 6%, but an emergency appeal has delayed implementation, keeping current duties elevated.

Market Snapshot

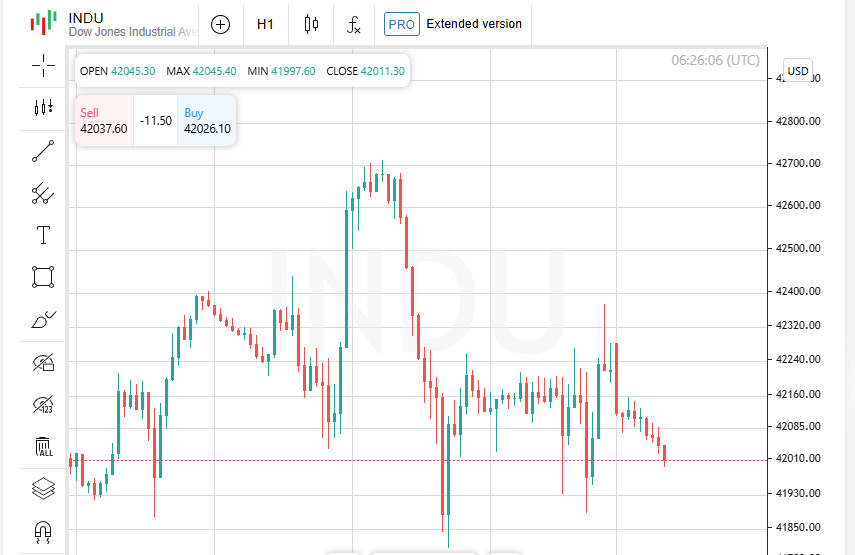

- Dow Jones Industrial Average rose by 54.34 points (+0.13%) to 42,270.07;

- S&P 500 dipped slightly by 0.48 points (–0.01%) to 5,911.69;

- Nasdaq Composite declined by 62.11 points (–0.32%) to 19,113.77.

Ulta Delivers a Beautiful Surprise

Shares of Ulta Beauty surged by 11.8% after the cosmetics retailer beat quarterly earnings expectations and raised its full-year profit guidance. The upbeat report boosted investor confidence, solidifying Ulta's position as a standout performer in the competitive beauty retail space.

Indian Markets Slide Amid Trade Jitters

Indian equities stumbled on Monday as losses in IT and metal stocks overshadowed stronger-than-expected domestic economic growth. Worries over a potential escalation in U.S. tariffs pressured investor sentiment despite positive GDP data.

India Index Summary

- Nifty 50 slipped 0.65% to 24,588.50;

- BSE Sensex dropped 0.72% to 80,865.54 (as of 10:08 a.m. IST).

Tariff Tensions Resurface

Market nerves flared up again after President Donald Trump threatened to double tariffs on imported steel and aluminum to 50% starting June 4. The warning reignited trade tensions, particularly impacting Asian markets sensitive to U.S. tariff decisions.

Sector Snapshot

- Nifty Metal index declined 0.7%;

- Nifty IT, with high U.S. exposure, fell 1%;

- HDFC Bank and Reliance Industries each dropped 1.5%;

GDP Upside Fails to Reverse Market Mood

Even India's better-than-expected March GDP growth — fueled largely by construction and manufacturing — wasn't enough to lift market sentiment. Selling pressure prevailed across most sectors, muting the positive macro narrative.

Domestic Growth No Match for Global Trade Uncertainty

Strong domestic fundamentals are offering little shelter from the global storm. According to V.K. Vijayakumar, Chief Investment Strategist at Geojit Financial Services, Trump's looming tariff hikes on steel and aluminum continue to inject volatility into the markets, overshadowing India's resilient economic growth.

Stock-Specific Setbacks Weigh on Sentiment

Mphasis dropped 3.1% after reports revealed the IT firm had lost long-time client FedEx, which had contributed 8% of its revenue.

Niva Bupa Health Insurance plunged 11%, its steepest decline since listing, following a $126 million block deal priced at an 11% discount, according to IFR.

Healthcare Names Buck the Trend

Apollo Hospitals gained 2.5% after exceeding Q4 profit expectations, fueled by strong demand for healthcare services.

AstraZeneca Pharma India surged 8.7% following a sharp profit increase in the March quarter, sending a positive signal to the market.

Broader Markets Show Resilience

While headline indices remained muted, broader market segments focused on domestic demand showed resilience:

- Mid-cap index rose by around 0.4%;

- Small-cap index also recovered, trading up 0.4%, erasing earlier losses

Schloss Bangalore Falters on Market Debut

Schloss Bangalore, owner of the luxury The Leela hotel chain, debuted with a 6.7% drop on its first day of trading — a disappointing IPO performance that hinted at tepid investor appetite.