Tech Titans Drive Wall Street to New Heights

The S&P 500 and Nasdaq indexes soared to all-time closing highs on Monday, lifted by a surge in mega-cap tech stocks. Investors are positioning ahead of a wave of earnings reports expected this week, hopeful that possible trade deals could cushion the blow from previous tariffs imposed by the Trump administration.

Alphabet and Tesla Kick Off Earnings Season

Shares of Alphabet, the parent company of Google, jumped 2.7 percent in anticipation of its quarterly earnings release scheduled for Wednesday. Alongside Tesla, also reporting midweek, Alphabet is among the first of the so-called "Magnificent Seven" to disclose its results. Their performance is likely to set the tone for the broader tech earnings season.

Tesla Slips, Apple and Amazon Climb

Tesla's stock dipped slightly by 0.35 percent. In contrast, Apple shares rose 0.62 percent, and Amazon advanced 1.43 percent, both contributing to the upward momentum of the major indices.

Verizon Surprises with Upbeat Forecast

Verizon shares surged over 4 percent after the telecommunications giant raised its full-year earnings guidance, delivering a positive surprise to the market.

Big Tech Expected to Fuel Earnings Growth

Market analysts anticipate that companies within the S&P 500 will report an average earnings increase of 6.7 percent for the second quarter. According to LSEG I/B/E/S data, much of that growth is expected to come from heavyweight technology firms.

US Markets Climb as Tariff Deadline Approaches

Since the beginning of the year, the S and P 500 has climbed roughly 8 percent, fueled by investor optimism that the economic fallout from looming tariffs may not be as severe as initially feared. This cautious confidence comes ahead of the August 1 deadline set by President Donald Trump for implementing new trade levies.

Trump Escalates Tariff Threats

The White House has ramped up pressure on trade partners, with Trump threatening to impose thirty percent tariffs on imports from Mexico and the European Union. Letters were also sent to other key nations, including Canada, Japan, and Brazil, warning of possible duties ranging from twenty to fifty percent. Though these developments stirred concerns, the market's overall reaction remains measured.

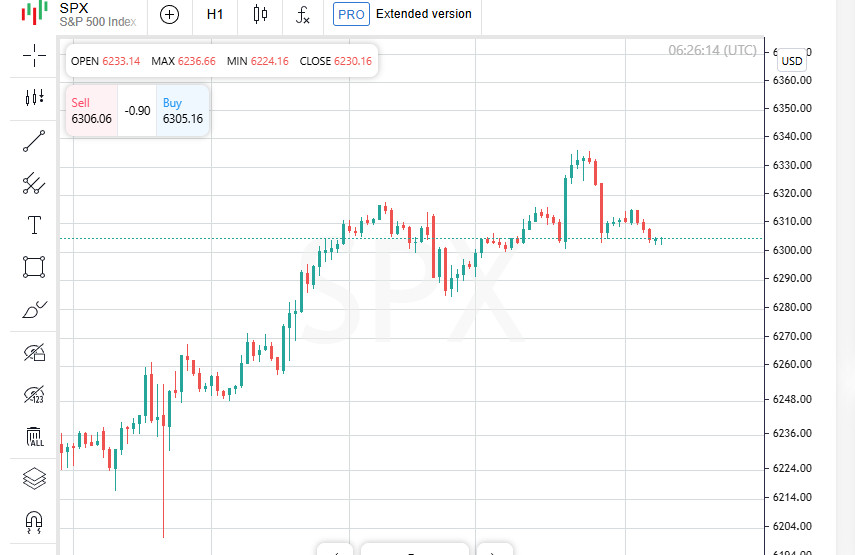

Slight Gains for S and P and Nasdaq, Dow Edges Lower

The S and P 500 rose by 0.14 percent, closing at 6305.60. The Nasdaq outperformed with a 0.38 percent increase, ending at 20974.18. Meanwhile, the Dow Jones Industrial Average slipped by 0.04 percent, settling at 44323.07.

Communications and Consumer Sectors Lead the Way

Seven out of eleven S and P 500 sectors ended the day in positive territory. Communication services led the gains with a 1.9 percent increase, followed by the consumer discretionary sector, which advanced 0.6 percent.

Nikkei Rallies, Dollar Slides Amid Tariff Uncertainty

In Asia, Japan's Nikkei index posted gains, providing relief following the pricing-in of election results. At the same time, the US dollar weakened as traders awaited further clarity on trade policies. Concerns about potential challenges to the independence of the Federal Reserve also linger in the background.

Asian Markets Retreat After Rally as Earnings and Trade Tensions Loom

Asian stocks pulled back on Tuesday after reaching their highest levels in nearly four years. With a wave of corporate earnings reports on the horizon and ongoing uncertainty surrounding trade talks between the United States and its global partners, investors opted for caution.

European Outlook Softens Ahead of Key Earnings

Across the Atlantic, markets also appear hesitant. Investors are waiting for major quarterly results from companies like SAP and UniCredit. In response, futures for the EUROSTOXX 50 and DAX fell by half a percent, while FTSE futures edged down 0.3 percent.

Asia-Pacific Index Slips After Reaching Peak

The MSCI index tracking Asia-Pacific equities, excluding Japan, climbed to its highest point since October 2021 during early trading but later declined by 0.4 percent. Despite the daily dip, the index has posted an impressive gain of nearly 16 percent since the beginning of the year.

Wall Street Remains on Record-Breaking Path

While other global markets waver, US stocks continue their upward trend. On Monday, both the S and P 500 and the Nasdaq closed at new all-time highs, driven by sustained investor enthusiasm for American equities.

Japan's Political Jitters Ripple Through Markets

Japanese markets reopened Monday after a weekend election that delivered a setback to the ruling coalition in the upper house of parliament. Although Prime Minister Shigeru Ishiba pledged to remain in office, initial optimism faded. The Nikkei index opened strong but reversed course by midday Tuesday, with investors digesting election outcomes that had largely been priced in.

Yen Rebounds as Dollar Retreats

The Japanese yen strengthened by one percent on Monday, regaining ground lost in previous weeks. It later eased slightly to 147.73 against the US dollar.

Trade Talks and EU Retaliation Measures Take Center Stage

With the August 1 deadline approaching, global focus is intensifying around tariff negotiations. The European Union is actively exploring broader countermeasures against the United States, as prospects for a swift trade resolution appear to be fading.