US stocks retreat as weak earnings weigh and investors await Fed

US equities closed lower on Tuesday, with the S&P 500 and Nasdaq pulling back from record highs. Disappointing earnings reports from major corporations pressured the market as investors chose to remain cautious ahead of upcoming Federal Reserve policy announcements.

Dow dragged down by healthcare and aerospace

Several Dow Jones constituents, including UnitedHealth, Boeing and Merck, reported their quarterly results, and all three stocks ended the day in negative territory. UnitedHealth tumbled 7.5 percent after cutting its profit outlook, becoming the main drag on the index. Boeing shares dropped 4.4 percent even though the company's second-quarter loss was narrower than expected.

Merck delays HPV vaccine shipments to China

Merck also released its financial report and announced that shipments of its Gardasil HPV vaccine to China will remain suspended at least until the end of 2025 due to persistently weak demand. Its shares slid 1.7 percent following the update.

Tech giants take center stage this week

Investors are now turning their attention to upcoming earnings from mega-cap technology leaders including Meta, Microsoft, Amazon and Apple. Given their heavy weighting in the market, these results are expected to strongly influence trading sentiment.

Market close summary

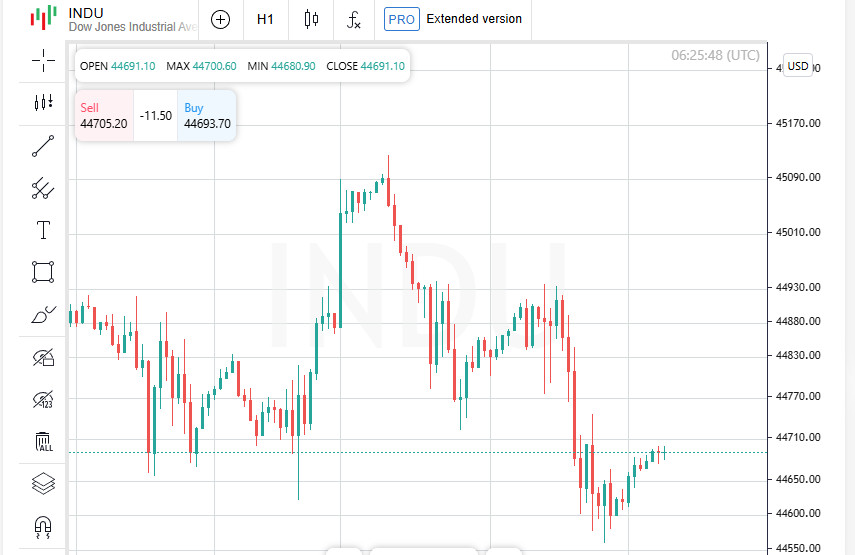

The Dow Jones Industrial Average fell 204.57 points, or 0.46 percent, to close at 44,632.99. The S&P 500 declined 18.91 points, or 0.30 percent, finishing at 6,370.86. The Nasdaq Composite dropped 80.29 points, or 0.38 percent, to 21,098.29.

UPS and Whirlpool drag down the transport index

Shares of United Parcel Service tumbled 10.6 percent after the delivery giant released its quarterly earnings report and once again declined to provide annual guidance on revenue and margins. The move heightened concerns that President Donald Trump's unpredictable trade policies are weighing heavily on the company's operations.

The drop in UPS shares contributed to a 2.3 percent decline in the Dow Jones Transport Average, marking its steepest single-day percentage loss since May 21.

Whirlpool cuts outlook and sees sharp selloff

Whirlpool stock plummeted 13.4 percent after the home appliance manufacturer lowered its annual profit and dividend forecasts. The company cited mounting pressure from increased imports by competitors ahead of Trump's planned tariffs.

Procter and Gamble raises prices but fails to impress

Procter and Gamble shares edged down 0.3 percent after the consumer goods maker, known for products such as dishwashing liquid and toilet paper, issued an annual outlook that fell short of market expectations. The company also announced it would raise prices on certain products to offset the impact of tariffs.

Investors eye Fed decisions and progress in trade talks

The Federal Reserve is widely expected to keep interest rates unchanged when it announces its decision on Wednesday. Investors will be closely analyzing remarks from Fed Chair Jerome Powell for clues on when potential rate cuts might begin.

Meanwhile, in Stockholm, the second day of trade negotiations between the United States and China concluded as the world's two largest economies continue efforts to resolve their ongoing dispute. President Trump said that, according to Treasury Secretary Scott Bessent, the meeting with Chinese officials was described as highly productive.

Cautious gains in Asia as investors await Fed policy signals

Asian stocks edged higher on Wednesday as investors took a guarded stance following yet another round of US-China trade talks that ended without a major breakthrough. Market participants are now focused on the upcoming US Federal Reserve policy announcement, seeking direction amid ongoing global uncertainty.

Taiwan lifts the region, while Japan and Hong Kong decline

The MSCI broad Asia-Pacific index gained 0.3 percent, buoyed by a rise in Taiwanese equities. In contrast, Japan's Nikkei dipped by 0.03 percent, and the Hang Seng index in Hong Kong fell 0.4 percent. Australia's market outperformed, climbing 0.7 percent.

Euro regains some ground

The euro advanced 0.2 percent to 1.1564 dollars, rebounding from its one-month low. The single currency found support on optimism surrounding trade discussions between the European Union and the Trump administration.

Packed economic calendar and tariff deadline ahead

Traders are bracing for a series of pivotal events in the coming days, including central bank decisions, corporate earnings releases, and key economic indicators. One of the most anticipated developments is President Donald Trump's upcoming statement on whether new tariffs will be imposed starting August first.

Fed expected to hold rates, but dissent may emerge

The Federal Reserve is widely projected to leave interest rates unchanged during Wednesday's policy meeting. However, some members of the central bank may push for a rate cut, citing signs of slowing growth.

Treasury yields fall as bond demand rises

US Treasury prices climbed ahead of the Fed meeting, pushing yields to their lowest levels in nearly four weeks. A strong seven-year bond auction helped ease recent concerns over waning demand for government debt.

Bank of Japan expected to stand pat on rates

The Bank of Japan is widely expected to keep its benchmark interest rate unchanged on Thursday. Market participants will be paying close attention to the central bank's commentary for clues on when the next rate hike might come. The path toward monetary tightening reopened after Japan and the United States reached a trade deal, giving the BOJ more flexibility.

Trade talks hit a stalemate

Global trade negotiations appear to be faltering as the deadline set by President Donald Trump to avert new tariffs draws near. Several countries are struggling to secure agreements with the US before the cutoff date.

US and China extend truce with little progress

On Tuesday, US and Chinese officials agreed to prolong their 90-day tariff truce, but no meaningful breakthroughs were announced. US authorities said President Trump must soon decide whether to extend the truce, which expires on August 12, or allow tariffs to escalate back into triple-digit territory.

India and South Korea brace for impact

India is preparing for the possibility that the United States could raise tariffs by 20 to 25 percent on certain exports. According to government sources, New Delhi has no plans to make fresh trade concessions ahead of the August 1 deadline. Meanwhile, in Seoul, three South Korean cabinet ministers met with US Trade Representative Howard Lutnick in a last-ditch effort to secure an agreement.

Oil prices inch higher amid uncertainty

Brent crude futures rose 14 cents, or 0.19 percent, on Wednesday to settle at 72.65 dollars a barrel as markets digested the latest geopolitical developments.