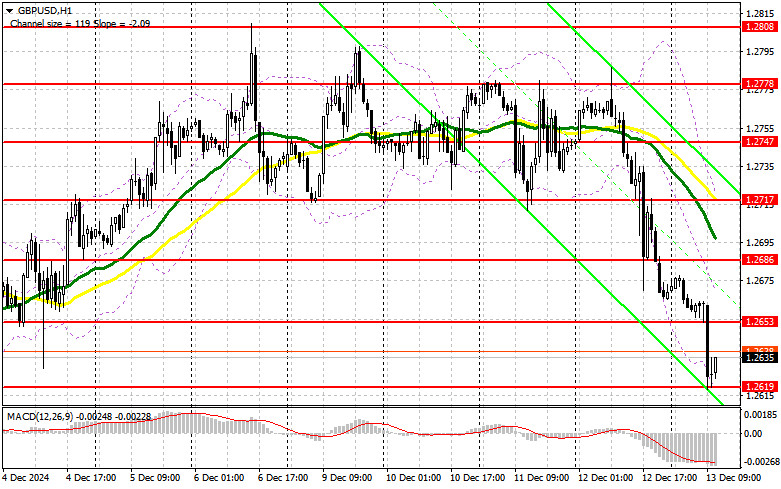

In my morning forecast, I focused on the 1.2637 level and planned trading decisions based on it. Let's look at the 5-minute chart to analyze what happened. A decline followed by the formation of a false breakout around 1.2637 provided an excellent entry point for buying the pound, but the pair failed to show any significant growth.

To Open Long Positions on GBP/USD:

News that the UK's GDP contracted last month, rather than growing as expected, triggered an active decline in the British pound, continuing yesterday's downward trend. In the second half of the day, market direction is unlikely to change significantly due to the absence of major statistics. Against this backdrop, I anticipate sustained pressure on the pair.

If GBP/USD declines, only a defense of the 1.2619 support level will offer a chance for recovery. A false breakout at this level will provide a good entry point for buying, targeting a return to the 1.2653 resistance, formed in the first half of the day. A break and retest of this range from above will open the way to new long positions, aiming for 1.2686, where buyers encountered difficulties earlier today. The ultimate target will be the 1.2717 area, where I will lock in profits.

If GBP/USD declines further and there's no bullish activity near 1.2619, buyers will lose momentum entirely. In this case, only a false breakout around the next support level at 1.2591 will offer an opportunity to open long positions. I will buy directly on a rebound only from the 1.2567 minimum, targeting an intraday correction of 30–35 points.

To Open Short Positions on GBP/USD:

If the pound continues its upward correction, protecting the 1.2653 resistance will be a priority for sellers. A false breakout at this level will provide a good entry point for short positions, targeting the 1.2619 support, which is a new weekly low. A break and retest of this range from below will lead to further selling, opening the way to 1.2591, which would significantly undermine the bulls' positions. The ultimate target will be the 1.2567 area, where I will lock in profits.

If demand for the pound returns in the second half of the day and GBP/USD rises without bearish activity at 1.2653, buyers will gain a good chance for end-of-week growth. Bears will have no choice but to retreat to the 1.2686 resistance, where moving averages favor sellers. I will sell there only after a false breakout. If no downward movement occurs, I will look for short positions on a rebound near 1.2717, targeting an intraday correction of 30–35 points.

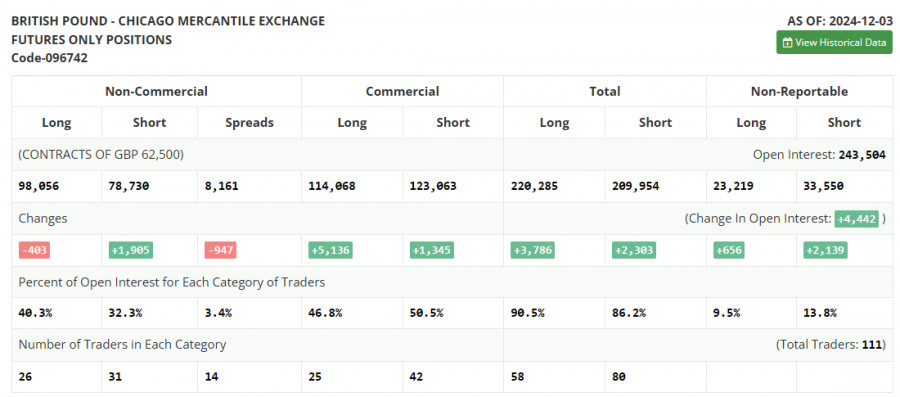

Commitment of Traders (COT) Report:

The December 3 COT report showed a reduction in long positions and an increase in short positions. How the Bank of England proceeds with interest rates remains uncertain. However, in the event of further weak GDP data expected soon, the prospect of rate cuts will come back into focus, exerting pressure on the British pound against the U.S. dollar. If this does not occur, buyers will have a chance for a larger GBP/USD rally.

The latest COT report indicates that non-commercial long positions decreased by 403 to 98,056, while non-commercial short positions increased by 1,905 to 78,730. The net difference between long and short positions narrowed by 947.

Indicator Signals:

Moving Averages:

Trading is conducted below the 30- and 50-day moving averages, indicating continued downward pressure on the pair.

Note: The period and prices of moving averages are analyzed on the H1 hourly chart and differ from the general definition of moving averages on the D1 daily chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator around 1.2619 will act as support.

Indicator Descriptions:

- Moving Average (MA): Smooths market volatility and noise, identifying the current trend. Periods: 50 (yellow on the chart) and 30 (green on the chart).

- MACD (Moving Average Convergence/Divergence): Fast EMA: Period 12, Slow EMA: Period 26, SMA: Period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators like individual traders, hedge funds, and institutions using the futures market for speculative purposes.

- Non-commercial long positions: Total long open positions of non-commercial traders.

- Non-commercial short positions: Total short open positions of non-commercial traders.

- Net non-commercial position: The difference between short and long positions of non-commercial traders.