The EUR/USD currency pair continued its upward movement on Wednesday, albeit with difficulty. The only event of the day was the inflation report, and the only intrigue was whether U.S. inflation would accelerate more than expected. Notably, the U.S. dollar has been rising for the fourth consecutive month, which is unsurprising. Since 2022, the market had anticipated aggressive and rapid rate cuts from the Federal Reserve, but that did not happen. In 2024, the Fed cut rates three times, by a total of 1%. For 2025, two cuts of 0.25% each are planned. This reality starkly contrasts with market expectations.

However, the market learns from its mistakes. Participants now expect fewer rate cuts from the Fed in 2025 than Jerome Powell has indicated or the latest dot-plot suggests. For rate cuts to be fewer, inflation needs to rise—preferably beyond forecasts and the Fed's expectations. Yesterday's inflation report showed an increase to 2.9%, but it was within the forecast range. Therefore, the dollar has not strengthened further... yet. The market had already priced in this report in advance, as it often does. Since inflation is rising (regardless), the Fed could potentially cut rates only once or not at all this year. And this is before Donald Trump has even taken office—under his administration, the consumer price index is likely to rise even further.

Thus, the underlying implications remain unchanged regardless of December's inflation figures. Yes, the dollar failed to strengthen on Wednesday, but is the downtrend over because of a slight rise in EUR/USD? No. Have the global factors changed? No. Yesterday was merely another correction, after which the decline may resume.

Trump is wary of a strong increase in inflation and has already informed his team that trade tariffs might be introduced slowly and gradually. However, this statement doesn't change the dynamics of the currency market. Recall that during his first term, Trump opposed a "strong" dollar because it reduces the competitiveness of American goods in global markets. Simply put, U.S. goods and raw materials become more expensive, and demand declines. On the contrary, Trump wants the U.S. trade balance to grow, not shrink. Currently, his actions seem to have the opposite effect.

We can expect to hear new statements soon from the former and future president of the U.S., suggesting that the Fed should lower interest rates to nearly zero in order to weaken the dollar. However, it is unlikely that Powell will yield to Trump's pressure a second time. As a result, Trump's inflation-boosting policies are more likely to lead to higher interest rates and a stronger dollar.

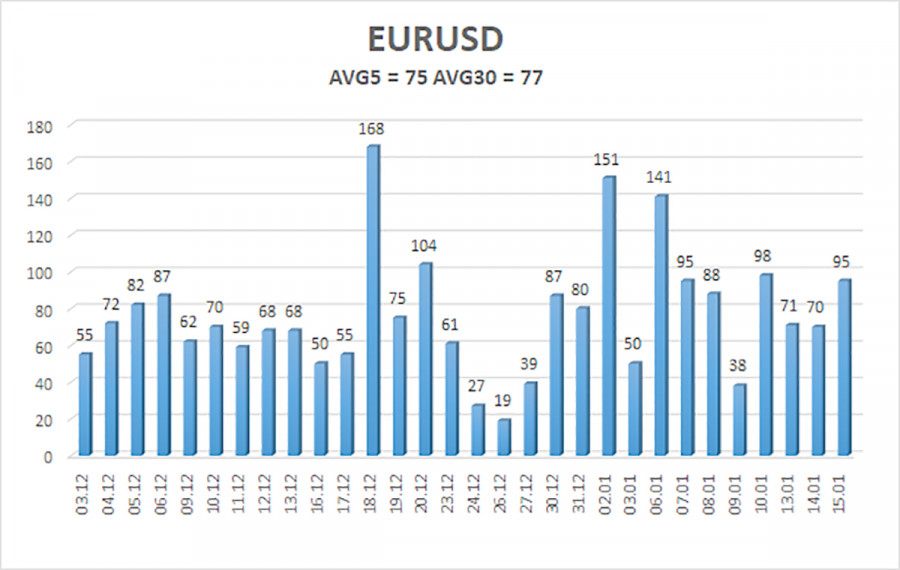

The average volatility of the EUR/USD currency pair over the last five trading days is 75 pips, which is categorized as "moderate." On Thursday, we anticipate that the pair will fluctuate between the levels of 1.0205 and 1.0355. The higher linear regression channel is currently directed downward, indicating the continuation of the global downtrend. The CCI indicator has recently entered the oversold territory twice, forming two bullish divergences. However, these signals indicate only a potential correction.

Nearest Support Levels:

- S1: 1.0254

- S2: 1.0193

- S3: 1.0132

Nearest Resistance Levels:

- R1: 1.0315

- R2: 1.0376

- R3: 1.0437

Trading Recommendations:

The EUR/USD pair is likely to maintain its downward trend, as recent months have consistently supported this bearish direction in the medium term. We believe that the overall bearish trend is not yet complete. The probability that the market has already factored in all future Fed rate cuts is high. As a result, the dollar currently lacks significant reasons for a medium-term decline, aside from purely technical corrections.

Short positions remain relevant with targets set at 1.0205 and 1.0193, provided that the price consolidates below the moving average. For traders who focus on "pure" technical analysis, long positions could be considered if the price rises above the moving average, with a target of 1.0437. However, any upward movement at this time should be viewed as a corrective phase.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.