In my morning forecast, I focused on the 1.0888 level and planned to use it as a decision point for entering the market. Let's look at the 5-minute chart and analyze what happened. A breakout and subsequent retest of 1.0888 provided a strong entry point for selling the euro in line with the downward trend, leading to a drop of more than 40 points. The technical outlook has been revised for the second half of the day.

To open long positions on EUR/USD, yesterday's discussions about the Fed being forced to continue cutting interest rates in the U.S. did not help the euro continue its rise. Meanwhile, many market participants have shifted their attention to the European Central Bank and its potential rate cuts, which seem more likely given the latest inflation figures for the eurozone. In the second half of the day, we expect U.S. data on initial jobless claims, the Philadelphia Fed manufacturing index, and the current account balance. Strong U.S. data would strengthen the dollar against the euro. If the pair corrects further, only a false breakout around the 1.0827 support level would justify new EUR/USD buy positions, aiming for a bullish continuation toward 1.0888. A breakout and retest of this range would confirm a correct buy entry, targeting 1.0952 (the monthly high). The ultimate target would be 1.0997, where I plan to take profit. If EUR/USD declines and lacks buying interest at 1.0827—which is more likely—the pair will continue to correct downward. In this case, sellers will aim for 1.0770, and only after a false breakout at this level will I consider buying the euro. I plan to open long positions on a direct rebound from 1.0743, aiming for a 30–35 point intraday correction.

To open short positions on EUR/USD, sellers successfully broke the key 1.0888 support level, which has now turned into resistance. I recommend focusing on this level. If the pair reacts negatively to the data and EUR/USD rises, a false breakout at 1.0888 will provide a good short entry, aiming for a correction down to 1.0827. A break and consolidation below this range would offer another suitable sell setup, targeting 1.0770, marking a substantial correction in the pair. The ultimate target for shorts would be 1.0743, where I plan to take profit. If EUR/USD rises during the U.S. session and bears fail to show strong resistance at 1.0888, buyers may push the pair higher. In that case, I will delay short positions until 1.0952, where I will sell only after a failed consolidation. I plan to sell directly from 1.0997, targeting a 30–35 point downward correction.

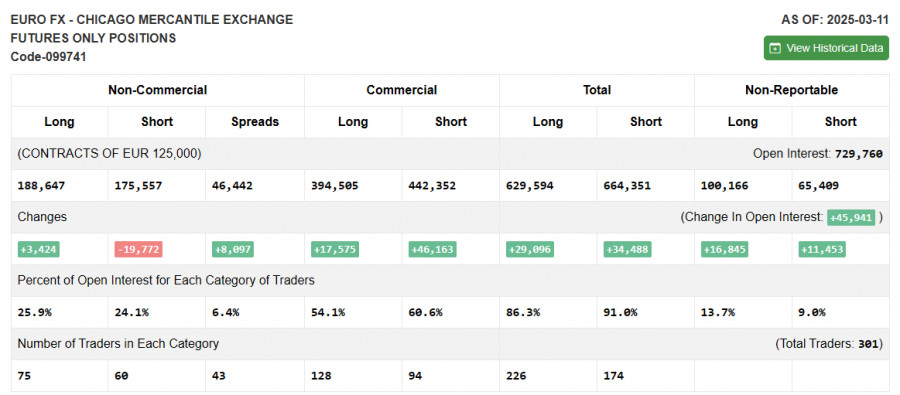

The COT report (Commitment of Traders) for March 11 showed an increase in long positions and a significant reduction in short positions. More traders are eager to buy the euro, while sellers are quickly exiting the market. Germany's fiscal stimulus policy and ECB support measures have boosted demand for the euro. Additionally, progress in resolving the Ukraine conflict adds further optimism. The upcoming Fed meeting will be crucial—if the Fed's stance is more dovish than expected, the dollar could weaken further. The COT report shows that non-commercial long positions increased by 3,424 to 188,647, while non-commercial short positions decreased by 19,772 to 175,557. As a result, the gap between long and short positions expanded by 8,097.

Indicator Signals:

Moving Averages: Trading is occurring below the 30- and 50-day moving averages, indicating a bearish trend.Note: The author uses the H1 chart to analyze moving averages, which differs from their classic interpretation on the D1 chart.

Bollinger Bands: If the pair declines, support will be provided by the lower Bollinger Band at 1.0849.

Indicator Descriptions: • Moving Average (MA): Determines the current trend by smoothing out volatility and noise. 50-period MA (yellow on the chart), 30-period MA (green on the chart). • MACD (Moving Average Convergence/Divergence): Fast EMA – period 12, Slow EMA – period 26, SMA – period 9. • Bollinger Bands: 20-period setting. • Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculation. • Non-commercial long positions: The total long open positions held by non-commercial traders. • Non-commercial short positions: The total short open positions held by non-commercial traders. • Non-commercial net position: The difference between short and long positions held by non-commercial traders.