The EUR/USD currency pair continued trading sluggishly and reluctantly on Tuesday. The market continued anticipating new tariffs from Donald Trump, even though the macroeconomic background was very strong yesterday. While there was some response from the market, the volatility fell short of expectations. The dollar still struggles with any upward movement. The market seems to buy the U.S. currency occasionally (apparently when there's no alternative), but the growth is weak even then.

Yesterday's European data was difficult to interpret unambiguously. Manufacturing PMIs in Germany and the EU rose but mainly stayed within forecasted ranges. There's little reason for a market reaction when actual values match expectations. A more significant report on eurozone inflation showed a decline from 2.3% to 2.2% y/y, which could have triggered euro selling. At the same time, however, eurozone unemployment unexpectedly fell from 6.2% to 6.1%. As a result, one key report offsets the other. The euro slightly dropped for formality's sake, but that was the extent of Tuesday's movement in the first half of the day.

We believe that inflation in the EU nearing the European Central Bank's target opens the door for further monetary easing. Everything is currently lining up in the ECB's favor. Inflation is close to the target level (unlike in the UK or the U.S.), which allows for rate cuts. Economic growth remains weak, calling for softer monetary policy. Donald Trump may introduce tariffs that could drive inflation higher, but Europe isn't expecting a strong acceleration. The prevailing sentiment is: "Don't count your chickens before they hatch." Only once new tariffs are imposed will assessing the potential damage and adjusting the monetary approach make sense. Until then, there's no reason to panic.

Thus, we believe the market again missed a good opportunity to push EUR/USD lower. The euro has corrected by about 220 pips after falling 700–800, but that is not enough to consider the correction convincing. The market no longer reacts to Trump's tariffs with heavy dollar sales like before but is also not eager to buy the dollar. On higher timeframes, the downtrend remains, which implies strong and sustained dollar growth—but this requires both technical and fundamental justification. At the very least, Trump must stop introducing new tariffs weekly. Overall, the likelihood of the pair moving toward parity still exists, but close monitoring of the market's reaction to the U.S. president's actions is essential.

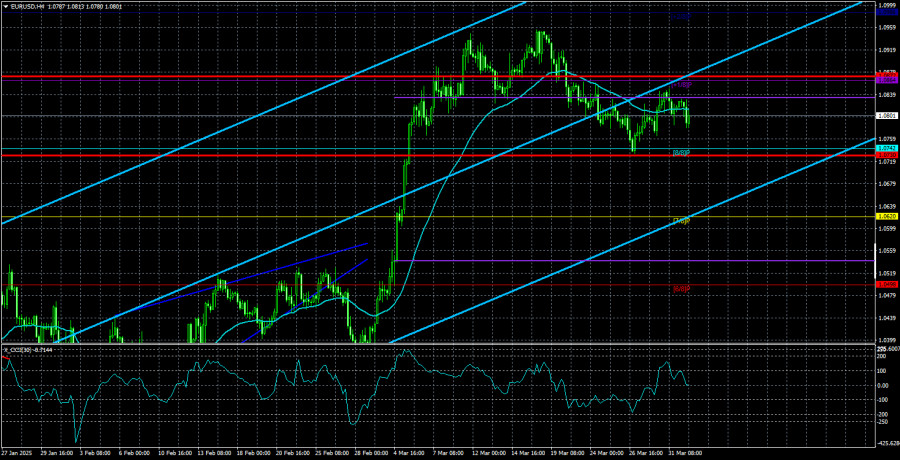

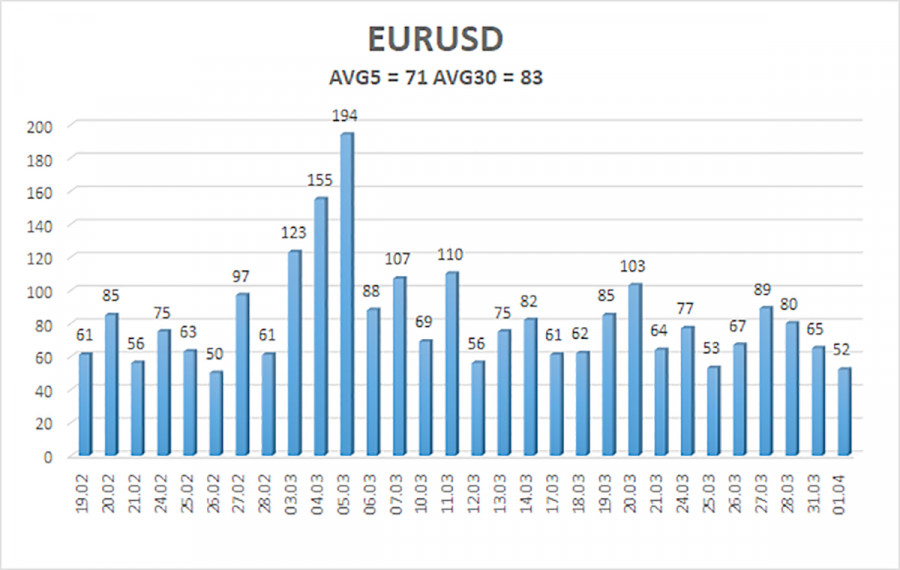

The average volatility of the EUR/USD currency pair over the last five trading days (as of April 2) is 71 pips, which is considered "moderate." We expect the pair to trade between 1.0730 and 1.0872 on Wednesday. The long-term regression channel has turned upward, but the broader downtrend remains intact, as seen in higher timeframes. The CCI indicator has not recently entered overbought or oversold territory.

Nearest Support Levels:

S1: 1.0742

S2: 1.0620

S3: 1.0498

Nearest Resistance Levels:

R1: 1.0864

R2: 1.0986

Trading Recommendations:

EUR/USD continues a weak downward correction. For months now, we've maintained that the euro should decline in the medium term—and this outlook remains unchanged. Aside from Trump, the dollar still has no reason to fall in the medium term. However, Trump alone may be enough to keep pressure on the dollar, as nearly all other factors are being ignored.

Short positions remain much more attractive, targeting 1.0315 and 1.0254. However, it's difficult to say whether the Trump-driven rally has ended. If you trade purely on technical signals, long positions can be considered if the price is above the moving average, targeting 1.0864 and 1.0872.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.