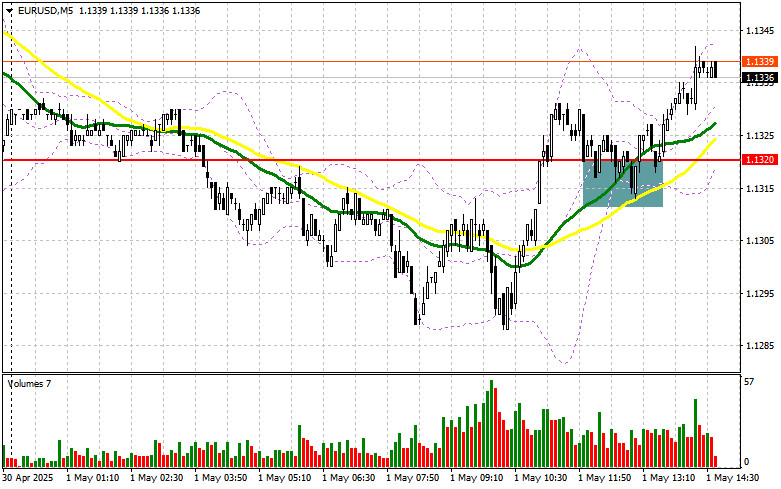

In my morning forecast, I focused on the 1.1320 level and planned to make market entry decisions based on it. Let's take a look at the 5-minute chart and see what happened. A decline followed by a false breakout around the 1.1320 level led to a good entry point for buying the euro, resulting in a 20-point rise in the pair. The technical picture was revised for the second half of the day.

To open long positions on EUR/USD:

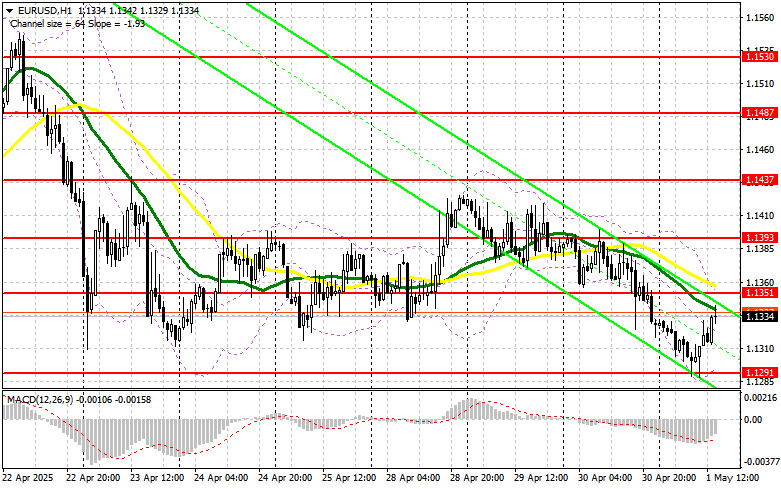

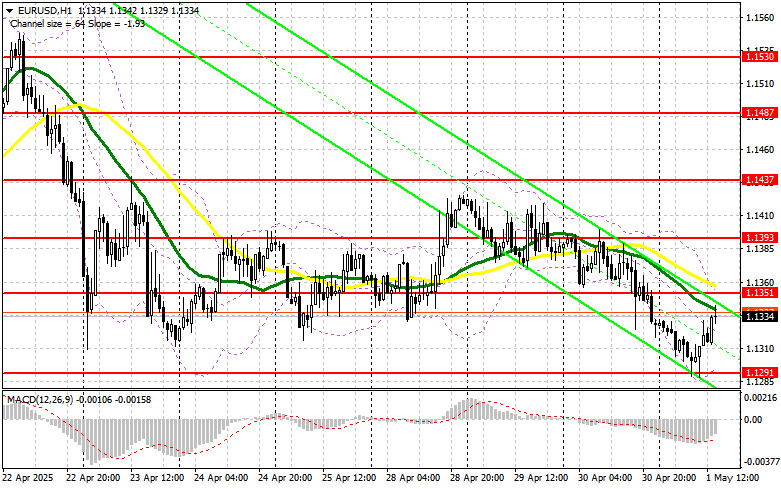

The second half of the day may be dominated by sellers, as we are expecting another round of important U.S. statistics. It will start with weekly data on initial jobless claims and end with the ISM Manufacturing Index for April. It's hard to predict how the market will react, but strong data could bring renewed pressure on the euro, leading to a new wave of EUR/USD declines — which I plan to capitalize on. I intend to act from a more significant support level at 1.1291, established in the first half of the day. A false breakout there will serve as a reason to buy EUR/USD in anticipation of a market rebound toward 1.1351. A breakout and retest of this range from above will confirm the right entry point for further growth toward the 1.1393 area. The furthest target will be 1.1437, where I plan to take profit. If EUR/USD drops and there's no activity around 1.1291, pressure on the pair will increase significantly, potentially leading to a sharper downward move. In that case, bears could reach 1.1250. Only after a false breakout form will I consider buying the euro. Otherwise, I plan to open long positions on a rebound from 1.1209, targeting a 30–35 point intraday correction.

To open short positions on EUR/USD:

If the euro rises on the back of weak U.S. data — which is also possible — bears will need to prove their presence around 1.1351. Only a false breakout there will be a reason to enter short positions against the trend, aiming for a drop to 1.1291 support. A breakout and consolidation below this range would be an ideal selling scenario with a move toward 1.1250. The furthest target will be the 1.1209 area, where I plan to take profit. A test of this level would break the bullish market structure. If EUR/USD continues rising in the second half of the day and bears fail to act at 1.1351 — where the moving averages currently align in favor of the bears — buyers may push for a breakout toward 1.1393. I will only sell there after a failed consolidation. Alternatively, I plan to open short positions on a rebound from 1.1393 targeting a 30–35 point downward correction.

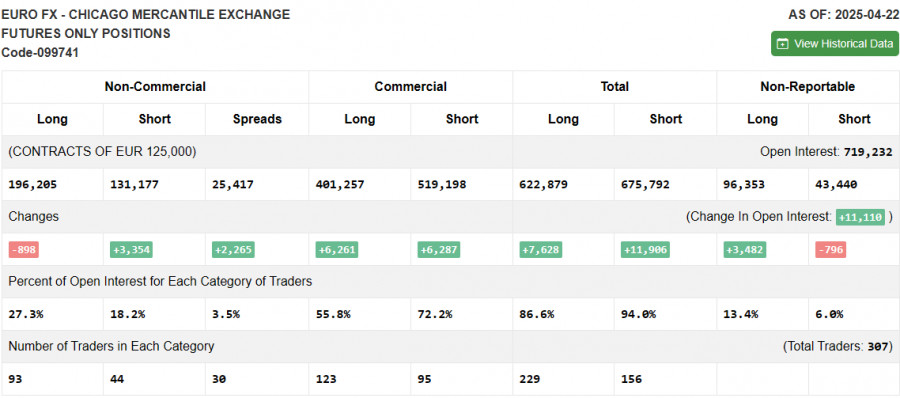

The COT (Commitment of Traders) report from April 22 showed an increase in short positions and a decrease in long ones. Given that the European Central Bank is practically openly signaling further rate cuts, this is currently preventing the euro from continuing its growth against the U.S. dollar. Loosening trade tensions from Donald Trump and a potential compromise with China are slowly bringing U.S. dollar buyers back to the market. In the near term, the most decisive factors will be U.S. Q1 economic growth figures and April labor market data. The COT report showed that long non-commercial positions fell by 898 to 196,205, while short non-commercial positions rose by 3,354 to 131,177. As a result, the gap between long and short positions narrowed by 2,493.

Indicator Signals:

Moving Averages Trading is occurring below the 30- and 50-day moving averages, which indicates further downside for the pair.

Note: The period and prices for the moving averages are based on the H1 chart and differ from the classic daily moving averages on the D1 chart.

Bollinger Bands In case of a decline, the lower boundary of the indicator around 1.1378 will act as support.

Indicator Descriptions: • Moving Average – smooths out price volatility and noise to identify the current trend. Period: 50 (marked in yellow on the chart); • Moving Average – another trend-smoothing indicator. Period: 30 (marked in green on the chart); • MACD Indicator (Moving Average Convergence/Divergence) – Fast EMA: period 12; Slow EMA: period 26; SMA: period 9; • Bollinger Bands – volatility bands based on a 20-period moving average; • Non-commercial traders – speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet specific requirements; • Long non-commercial positions – total long open positions of non-commercial traders; • Short non-commercial positions – total short open positions of non-commercial traders; • Net non-commercial position – the difference between non-commercial short and long positions.