The EUR/USD currency pair began a new upward cycle on Monday. At this point, no one is likely surprised by another drop in the U.S. dollar. The market started selling off the greenback even before the release of the only somewhat significant event—the ISM Services PMI from the U.S.- ultimately preventing the dollar from falling further. Thus, yesterday, we witnessed perhaps the first instance in a long time where a macroeconomic report was actually priced in—the ISM index came out better than expected.

Over the past three weeks, some market participants may have started to believe that the worst was behind the dollar. Donald Trump hasn't introduced new tariffs for three weeks, he's been actively discussing the possibility of reducing tariffs on China with the media, and he continues to promote trade agreements with various countries worldwide. Of course, Trump's words should be taken with a grain of salt. For example, we all know that no trade negotiations with China are taking place, yet Trump insists that a deal will be reached within a few weeks. So, we remain skeptical about any meaningful easing of global trade tensions.

Monday once again proved that the dollar can fall indefinitely. Let's not forget: we're still in the play's first act, titled "Donald Trump – President of the United States." Many more dramatic developments lie ahead. Given how Trump has begun his term—with bold, sweeping actions—it's safe to assume he'll continue making decisions that will shock the markets. So yes, the stock market may have recovered from its previous plunge, and U.S. Treasury bonds might be seeing stronger demand, but the world has not forgotten Trump's tariffs on virtually everything. And the "world" means consumers—who increasingly try to avoid American goods.

For instance, since Trump launched his tariff war, Elon Musk's Tesla has seen its global sales drop by 70%. Worldwide, movements like "Don't Buy American" continue—not as public protests, but through social media campaigns. Still, consumer sentiment around the world is easily discernible. When people in various countries realize their quality of life is declining because of U.S. policies, what reaction can one expect? The U.S. economy shrank by 0.3% in the first quarter of 2025, and that may be just the beginning. Trump talks about a "short recession," but we believe it could be prolonged. In Trump's approach to "carrot and stick" diplomacy, the carrot is missing—so in cases of non-compliance, he may simply keep imposing sanctions and tariffs. For example, the U.S. President has said that if Moscow refuses peace with Kyiv, he will impose 500% tariffs on all countries that buy energy resources from Russia.

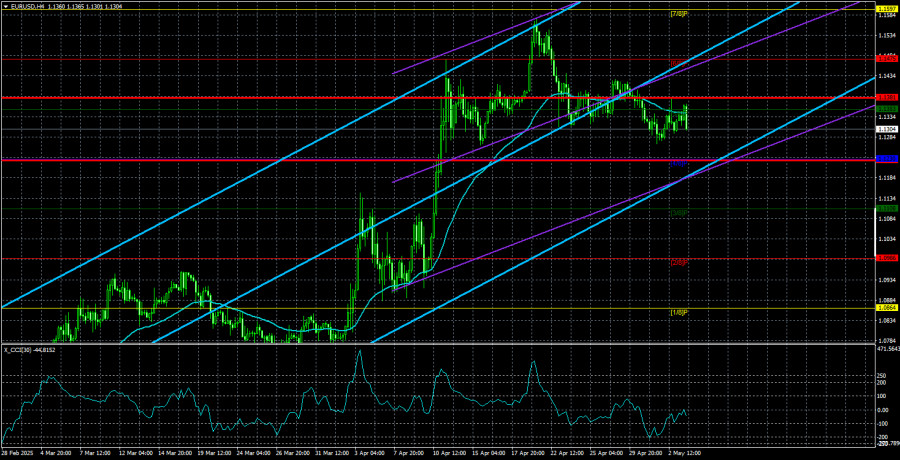

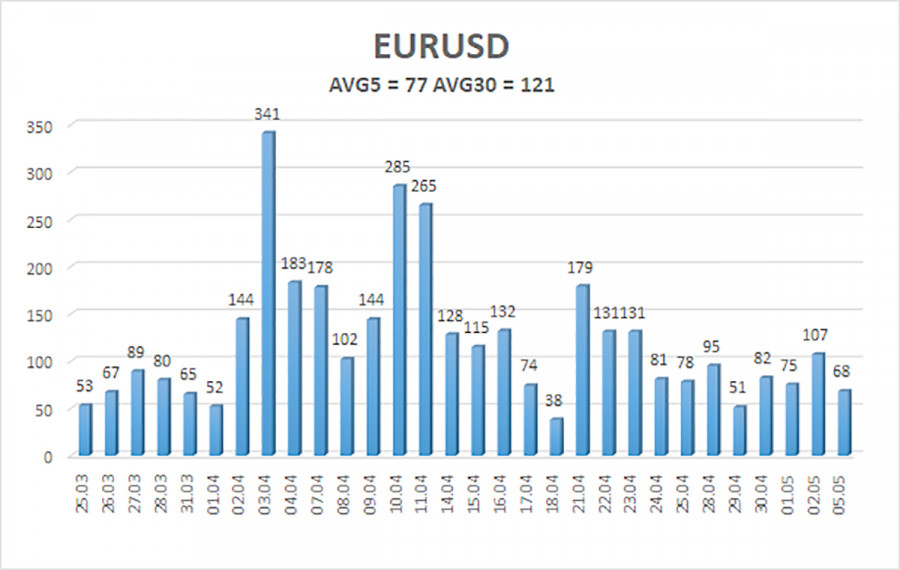

As of May 6, the EUR/USD pair's average volatility over the last five trading days is 82 pips, which is considered "average." We expect the pair to move between the levels of 1.1227 and 1.1381 on Tuesday. The long-term regression channel points upward, indicating a short-term bullish trend. The CCI indicator has entered the overbought zone thrice, resulting in only a minor correction.

Nearest Support Levels:

S1 – 1.1230

S2 – 1.1108

S3 – 1.0986

Nearest Resistance Levels:

R1 – 1.1353

R2 – 1.1475

R3 – 1.1597

Trading Recommendations:

The EUR/USD pair has started a new wave of downward correction within the overall uptrend. In recent months, we've repeatedly stated that we expect a medium-term decline from the euro, and that view remains unchanged. Aside from Donald Trump, the dollar still lacks any fundamental reason for a medium-term rally. Yet that single factor alone may continue to drag the dollar downward as the market ignores all other influences.

If you trade based on pure technicals or by following the "Trump factor," then long positions are relevant as long as the price remains above the moving average, with a target at 1.1475. If the price drops below the moving average, short positions become relevant, with targets at 1.1230 and 1.1227. Believing in a strong dollar rally right now is extremely difficult, but a rebound remains possible.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.