Trade Analysis and Guidance for the British Pound

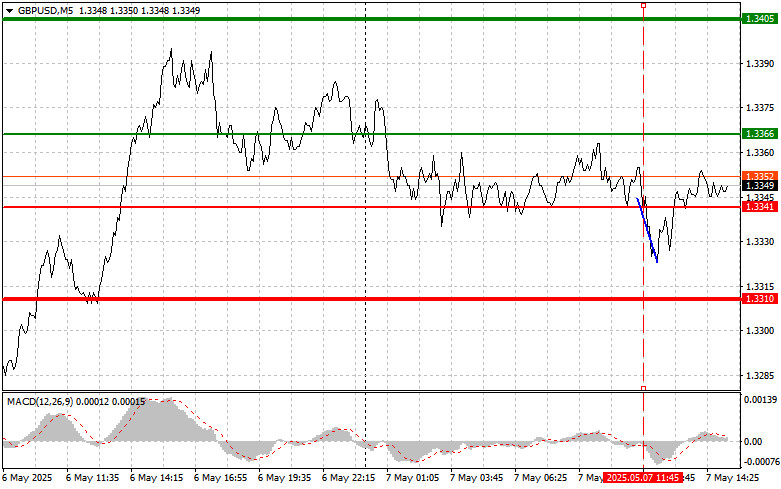

The price test at 1.3341 in the first half of the day occurred just as the MACD indicator began to move downward from the zero line, confirming a valid entry point for selling the pound. As a result, the pair declined by 20 points, after which market pressure subsided.

The UK construction PMI data offered no positive surprises. Uncertainty about the outlook for the British economy continues to weigh on the national currency, prompting investors to act cautiously. Weak performance in the construction sector—traditionally a bellwether for overall economic health—undermines hopes for a quick recovery.

In the near term, the pound's dynamics will depend on a range of factors, including macroeconomic data releases, statements from Bank of England officials, and decisions from the U.S. Federal Reserve. The second half of the day will focus on precisely that.

The FOMC's decision on the benchmark interest rate, its accompanying statement, and Jerome Powell's press conference are the key events ahead. The regulator is expected to leave rates unchanged. Still, even if the rate remains steady, investor attention will be focused on the tone of the statements and Powell's commentary. Markets will be looking for hints about the future path of monetary policy, especially in light of persistent inflation and a slowing, yet still strong, labor market. Any deviation from expectations could spark volatility in currency and stock markets.

As for the intraday strategy, I will mainly rely on the implementation of Scenarios #1 and #2.

Buy Signal

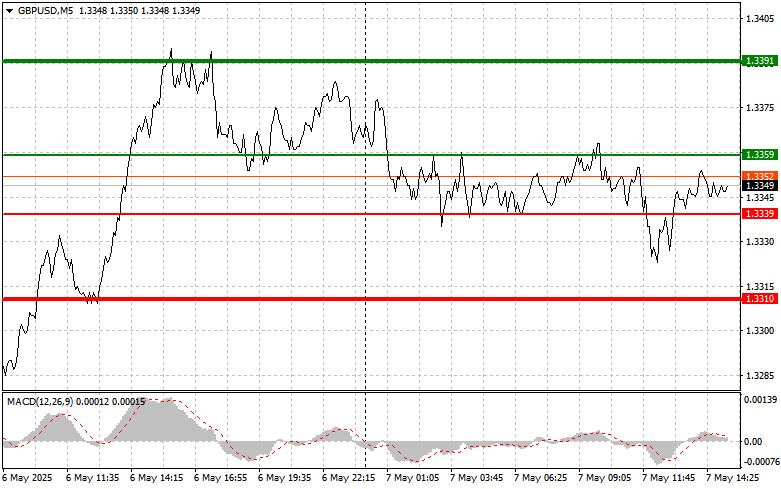

Scenario #1: I plan to buy the pound today when the entry point near 1.3359 (green line on the chart) is reached, targeting a rise to 1.3391 (thicker green line on the chart). Around 1.3391, I'll exit long positions and open shorts in the opposite direction (expecting a 30–35 point retracement). Pound strength today can only be expected after weak U.S. data. Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise.

Scenario #2: I also plan to buy the pound today if the price at 1.3339 is tested twice in a row while the MACD is in oversold territory. This would limit the pair's downward potential and result in a bullish market reversal. A move toward the opposite levels of 1.3359 and 1.3391 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound today after a break below 1.3339 (red line on the chart), which would lead to a rapid drop in the pair. Sellers' key target will be 1.3310, where I will exit short positions and immediately enter long positions in the opposite direction (expecting a 20–25 point retracement). Sellers will show up if the Fed adopts a dovish stance. Important! Before selling, make sure the MACD is below the zero line and just beginning to decline.

Scenario #2: I also plan to sell the pound today if the price at 1.3359 is tested twice in a row while the MACD is in overbought territory. This would limit the pair's upward potential and result in a downward market reversal. A move toward the opposite levels of 1.3339 and 1.3310 can be expected.

What's on the chart:

- Thin green line – entry price at which to buy the trading instrument

- Thick green line – estimated level to place Take Profit or manually close positions, as further growth above this level is unlikely

- Thin red line – entry price at which to sell the trading instrument

- Thick red line – estimated level to place Take Profit or manually close positions, as further decline below this level is unlikely

- MACD Indicator – when entering the market, use overbought and oversold zones for confirmation

Important: Beginner Forex traders must make entry decisions with great caution. It's best to stay out of the market before the release of major fundamental reports to avoid sudden price swings. If you choose to trade during news events, always set stop-loss orders to minimize losses. Without stop-losses, you could lose your entire deposit quickly, especially if you don't use money management and trade large volumes.

And remember, successful trading requires a clear trading plan, like the one outlined above. Making spontaneous trading decisions based on current market behavior is an inherently losing strategy for intraday traders.