The GBP/USD currency pair continued to trade with moderate restraint on Tuesday, remaining near its highest levels in three years. This has been the case for the fifth month in a row for the pound sterling. Corrections have been rare and relatively shallow, suggesting that the market only occasionally takes profits on long positions before resuming purchases.

And it's not the dollar being bought—it's the British pound. The U.S. dollar has lost much of its appeal in recent months. A particularly notable event is the dollar's failure to strengthen following the escalation of the war between Israel and Iran. This conflict is not just a military or geopolitical concern—it carries major implications for global oil prices. Iran can block the Strait of Hormuz, through which one-fifth of the world's oil supply passes daily. Oil prices have already surged, and while both sides seem open to a ceasefire, the conflict continues.

However, a ceasefire seems unlikely unless Donald Trump gives his approval. Just yesterday, the U.S. President posted on his social media platform urging all civilians—not just American citizens—to leave Iran immediately. Tehran has refused Trump's demands to halt all nuclear development, even peaceful ones. After setting two negotiation deadlines, Trump now appears prepared to strike Iran militarily—at least, that's the message conveyed by his recent remarks.

Meanwhile, during the G7 summit in Canada, Trump succeeded in signing his first trade deal. There was little suspense surrounding this agreement, as the UK was the only country so far to reach terms with Washington. The outlines of the deal had been known for weeks, but several outstanding issues needed to be resolved before signatures could be finalized. Now that Trump and Prime Minister Keir Starmer have signed the deal, Trump can claim his first victory in the Trade War out of a possible 74. How many more will follow remains uncertain.

It's worth noting that the UK and U.S. are friendly nations with relatively low trade volumes. Trump primarily focuses on bigger rivals such as the EU, China, and Canada. However, major economies understand that they, too, hold bargaining power and are not willing to blindly follow Trump's lead. Negotiations with these nations are progressing slowly and are expected to drag on for many months or years. In less than a month, Trump's "grace period" will expire, forcing him either to reinstate original tariffs or extend the current "tariff holidays."

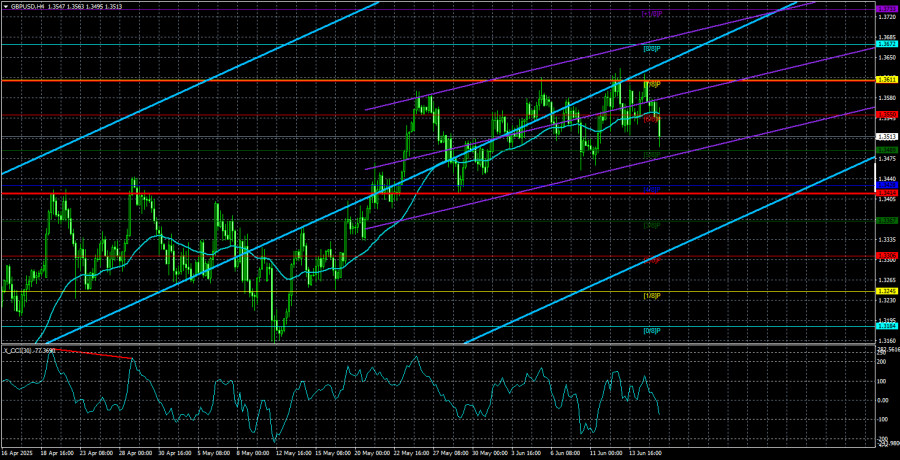

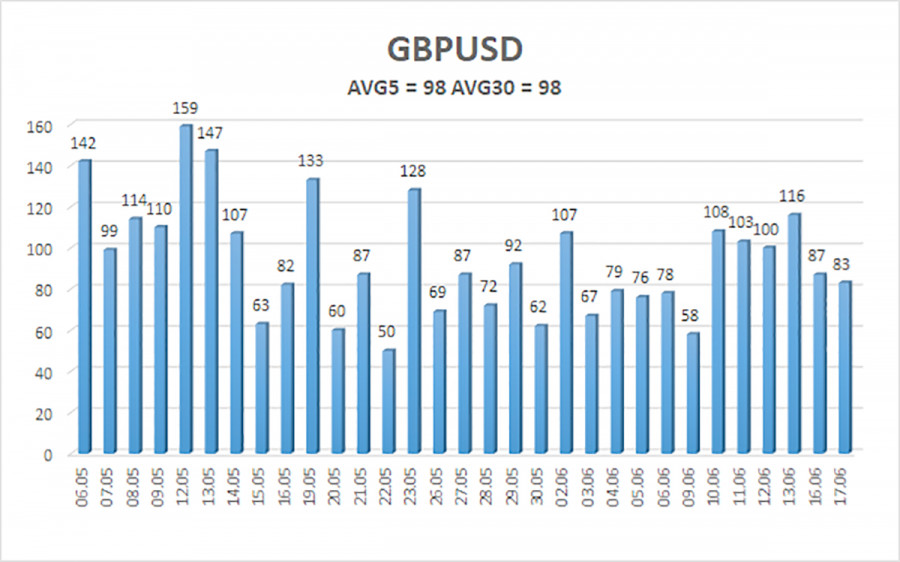

The average volatility for the GBP/USD pair over the last five trading days is 98 pips, which is considered "moderate" for this currency pair. For Wednesday, June 18, we expect the pair to move from 1.3414 to 1.3610. The long-term regression channel is trending upward, confirming a strong, bullish trend. The CCI indicator has not recently entered extreme zones.

Nearest Support Levels:

S1 – 1.3489

S2 – 1.3428

S3 – 1.3367

Nearest Resistance Levels:

R1 – 1.3550

R2 – 1.3611

R3 – 1.3672

Trading Recommendations:

The GBP/USD pair continues its upward trend, with ample news to support this direction. The market interprets each new decision from Trump negatively, and there's very little positive news coming from the United States. As such, long positions with targets at 1.3611 and 1.3672 are much more relevant if the price remains above the moving average. A move below the moving average allows for short positions with targets at 1.3489 and 1.3428, although the probability of growth remains much higher than that of decline. The dollar may occasionally show minor corrections, but a more substantial rally would require clear signs of ending the global trade war.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.