On Monday, the GBP/USD currency pair declined moderately, which poses no threat to the British currency. The pound can easily afford to lose 100 or even 200 pips, and it still wouldn't significantly change the overall picture. However, the pound is not inclined to lose 100 or 200 pips for no reason.

On Monday, it was revealed that the UK economy grew by 0.7% quarter-on-quarter in the first quarter, as expected. Is it worth reminding ourselves of the results the U.S. economy showed during the same period? For many years, it was said that the U.S. economy was far stronger than those of the British or European countries, which supported the value of the dollar. However, Donald Trump's election to office led to a significant shift in the global economic landscape within just a few months. Now, the slowly growing British and European economies are showing higher growth rates. And that alone is enough to maintain demand for the euro and the pound.

Meanwhile, the U.S. president hasn't forgotten about his "One Big Beautiful Bill." Recall that this bill was presented as a tax reform aimed at lowering taxes for ordinary, hardworking Americans. But as soon as the first details emerged, it became clear that Trump had thought of everyone except ordinary working Americans. The bill includes drastic cuts to social programs such as Medicare, Obamacare, and Medicaid. It has been estimated that approximately 12 million low-income Americans could lose their health insurance. On the other hand, the American budget would save $1.1 trillion over the next 10 years.

Those who will suffer most are low-income individuals, pensioners, children, and people with disabilities. However, over 80% of Americans can expect a tax cut. The reality, though, is that the greatest benefits from this tax reform will go to those who can already afford to pay any amount of taxes. The lower-income population will hardly notice any tax relief. In practice, for 60% of the U.S. population, taxes will decrease by $10 per month, while for the wealthiest individuals, the decrease will be several percentage points.

It's also worth remembering that Americans will inevitably pay more for imported goods. Even simple movie outings may become more expensive, as Trump decided to impose tariffs on film studios that shoot their movies abroad. So, as expected, the rich will get richer, and the poor will end up paying 55% more for cheap Chinese goods.

Frankly, we didn't believe Trump would win the election until the very last moment. At the very least, because Americans already had a chance to get familiar with the Republican's style of governance four years ago. Still, America's problems are its own. Other nations have enough of their issues to worry about the American population as well. And the dollar will continue to fall — simply because it has no other choice.

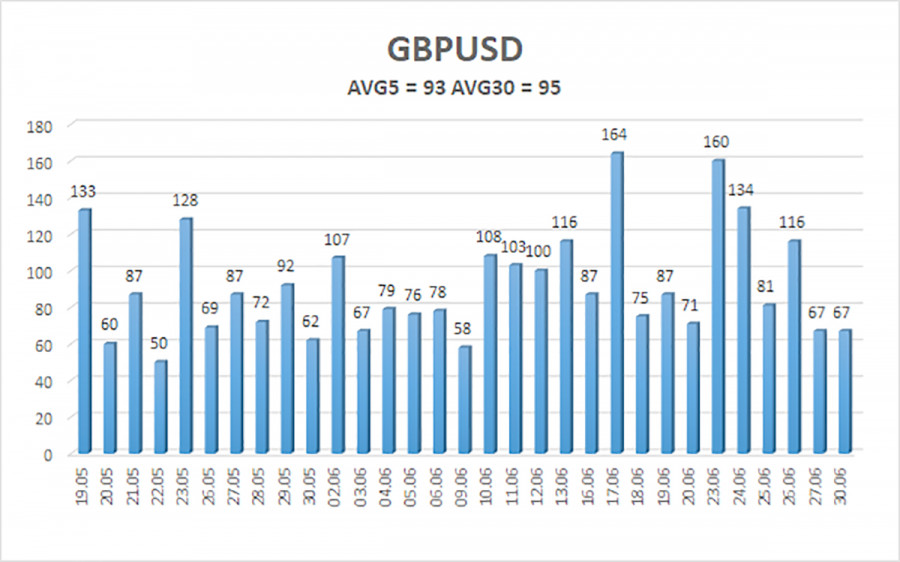

The average volatility for the GBP/USD pair over the last 5 trading days is 93 pips, which is considered "moderate" for this currency pair. On Tuesday, July 1, we expect movement within a range bounded by the levels of 1.3587 and 1.3811. The long-term regression channel is pointing upward, indicating a clear upward trend. The CCI indicator recently dipped into oversold territory, which ultimately triggered the resumption of the upward movement.

Nearest Support Levels:

S1 – 1.3672

S2 – 1.3611

S3 – 1.3550

Nearest Resistance Levels:

R1 – 1.3733

R2 – 1.3794

Trading Recommendations:

The GBP/USD pair maintains its upward trend and has completed another mild correction. In the medium term, Trump's policies are likely to continue putting pressure on the dollar. Thus, long positions with targets at 1.3794 and 1.3811 remain relevant as long as the price stays above the moving average. If the price moves below the moving average, short positions can be considered with targets at 1.3587 and 1.3550. However, as before, we do not expect a strong dollar rally. Occasionally, the U.S. currency may show brief corrections. For a sustainable rise, it needs real signs of the end of the global trade war.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.