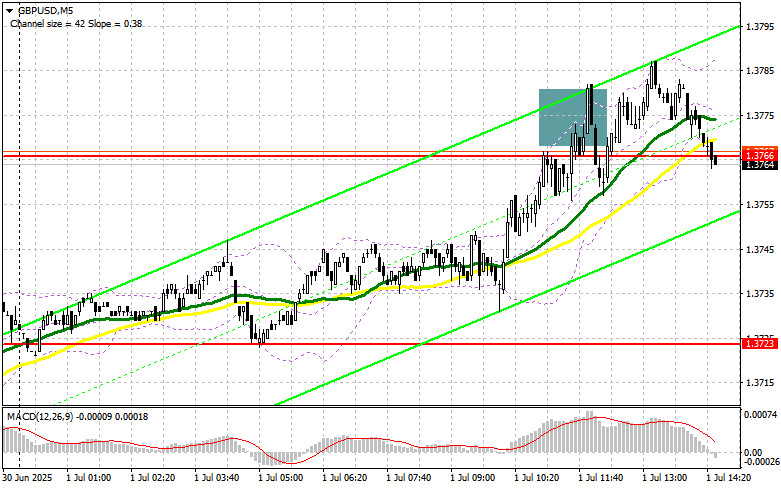

In my morning forecast, I focused on the 1.3766 level and planned to make trading decisions from that point. Let's look at the 5-minute chart and see what happened. A false breakout formed at that level, offering an excellent entry point for selling the pound; however, a significant downward move did not occur. The technical picture has been revised for the second half of the day.

To open long positions on GBP/USD:

The UK Manufacturing PMI matched economists' forecasts and remained below the 50-point mark, which limited the upward potential of the GBP/USD pair. In the second half of the day, we await a speech from Federal Reserve Chair Jerome Powell, along with the ISM Manufacturing PMI and the Job Openings and Labor Turnover Survey (JOLTS) from the U.S. Bureau of Labor Statistics. Only strong U.S. data is likely to reintroduce pressure on the pair—something I plan to take advantage of.

If GBP/USD declines, I will prefer to act near the new support at 1.3751. A false breakout there, similar to the one described earlier, would provide a good entry point for long positions with the target at the 1.3784 resistance level. A breakout with a retest from above would provide a new entry point for long positions, with a target of 1.3818. The furthest target will be the 1.3864 level, where I plan to take profit.

If GBP/USD falls and bulls show no activity near 1.3751 in the second half of the day, pressure on the pound could intensify. In that case, only a false breakout around 1.3713 would offer a suitable condition for opening long positions. Alternatively, I plan to buy GBP/USD on a rebound from the 1.3678 support level, targeting an intraday correction of 30–35 points.

To open short positions on GBP/USD:

Sellers have not yet made an appearance. Now the focus shifts to U.S. economic data. If the pair attempts another rise in the second half of the day, bears will need to assert themselves around the 1.3784 level. Only a false breakout there would provide a signal to open short positions, targeting a decline toward 1.3751.

A breakout and retest from below of this range would trigger stop-loss orders and open the path toward 1.3713. The furthest target will be the 1.3678 level, where I plan to take profit. If demand for the pound returns in the second half of the day and bears remain inactive around 1.3784, a stronger upward surge in GBP/USD cannot be ruled out. In this case, it would be better to delay short positions until a test of the 1.3818 resistance level. I will open short positions there only on a false breakout. If there is no downward move there either, I will look for short positions on a rebound from 1.3864, targeting a 30–35 point correction.

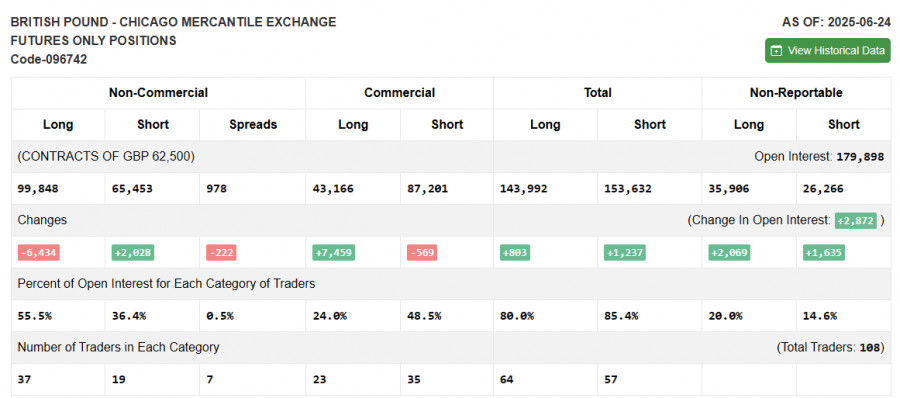

COT Report (Commitments of Traders) for June 24:

The report showed an increase in short positions and a decrease in long ones. The British pound continues to demonstrate strong bullish momentum, supported by recent UK GDP and inflation data. The prospect of the U.S. Federal Reserve cutting interest rates earlier than expected is negatively affecting the U.S. dollar. A series of upcoming U.S. labor market reports will determine the next direction for GBP/USD.

According to the latest COT report, non-commercial long positions decreased by 6,434 to 99,848, while non-commercial short positions rose by 2,028 to 65,453. As a result, the gap between long and short positions narrowed by 222.

Indicator Signals:

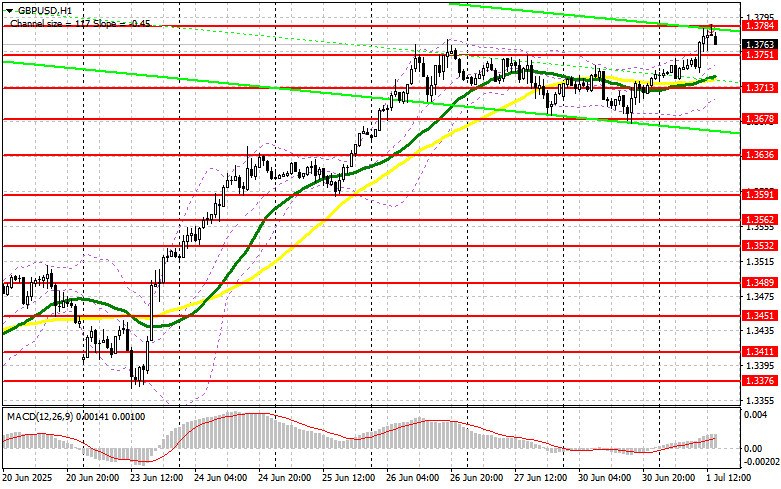

Moving Averages:Trading is above the 30- and 50-period moving averages, indicating continued upward movement.

Note: The periods and prices of moving averages are based on the author's analysis of the H1 (hourly) chart and may differ from the classic daily moving averages on the D1 chart.

Bollinger Bands:In the event of a decline, the lower band around 1.3713 will act as support.

Indicator Descriptions:

- Moving Average – smooths price volatility and noise to identify the current trend (50-period shown in yellow; 30-period shown in green)

- MACD (Moving Average Convergence/Divergence) – measures the convergence/divergence of moving averages. Fast EMA – period 12, Slow EMA – period 26, Signal SMA – period 9

- Bollinger Bands – based on a 20-period moving average and standard deviation

- Non-commercial traders – speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes

- Non-commercial long positions – total long open positions held by non-commercial traders

- Non-commercial short positions – total short open positions held by non-commercial traders

- Net non-commercial position – the difference between non-commercial long and short positions