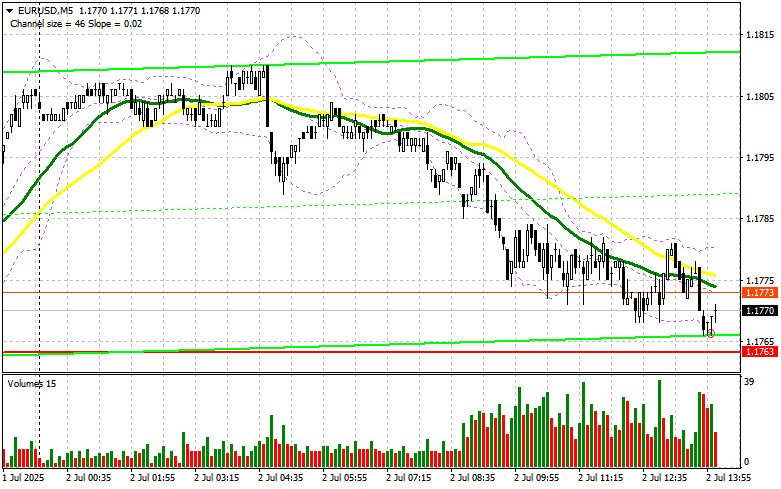

In my morning forecast, I highlighted the 1.1763 level and planned to make trading decisions based on it. Let's look at the 5-minute chart and see what happened. The pair did decline toward the 1.1763 level, but never actually tested that level, so I remained out of the market. The technical outlook for the second half of the day remains unchanged.

To open long positions on EUR/USD:

The eurozone unemployment rate for May came in above economists' expectations, reaching 6.3%, which may have put some pressure on the euro. In the second half of the day, pressure on the euro is likely to persist if the U.S. ADP employment data for June beats forecasts. If the pair declines on the back of labor market data, buyers will still be focused on the 1.1763 support level, which was not tested earlier. A false breakout at that level would be a signal to buy EUR/USD with the target of resuming the bullish trend and retesting the monthly high at 1.1825. A breakout and retest of this range would confirm the entry point and open the way to 1.1875. The furthest target would be 1.1903, where I plan to take profits. If EUR/USD falls and there is no bullish activity around 1.1763, pressure on the pair will increase significantly, potentially leading to a sharper decline. In that case, bears could push the pair down to 1.1715. Only after a false breakout there would I consider buying the euro. I plan to open long positions immediately on a bounce from 1.1676, aiming for a 30–35 point intraday correction.

To open short positions on EUR/USD:

Sellers are still reacting to the recent data, and a strong U.S. employment report may boost their confidence. However, if the American data disappoints, the euro may resume rising, so it's best not to rush into short positions. I will consider selling only after a false breakout around the 1.1825 level – the new monthly high. That would be a signal to open short positions, targeting support at 1.1763. A breakout and consolidation below that range would be a good selling opportunity toward 1.1715. The furthest target would be the 1.1676 level, where I plan to take profit.If EUR/USD continues to climb in the second half of the day and there is no bearish response at 1.1825, buyers may extend the bullish trend and push the pair to 1.1875. I will only sell there after an unsuccessful consolidation. I plan to open short positions immediately on a rebound from 1.1903, aiming for a 30–35 point downward correction.

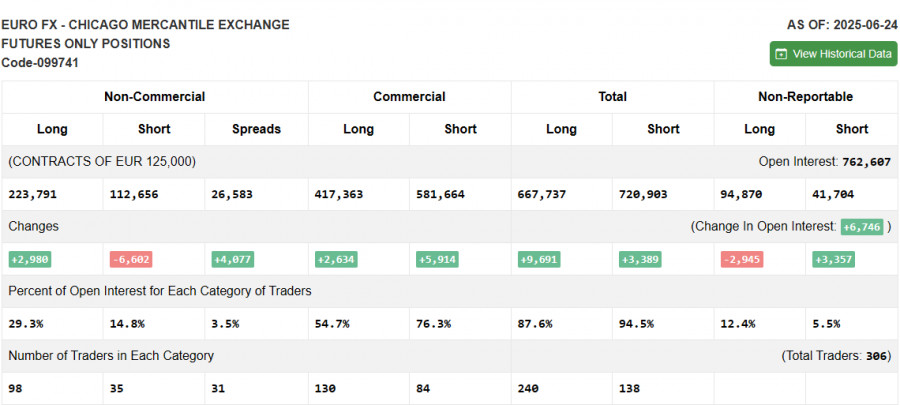

Commitment of Traders (COT) Report (as of June 24):

The latest COT report showed an increase in long positions and a reduction in short positions. The euro continues to be in demand, while the U.S. dollar is losing ground. Recent U.S. inflation and GDP data prompted a reassessment among market participants, with expectations shifting toward an earlier interest rate cut by the Federal Reserve, which continues to pressure the dollar. A series of important U.S. labor market reports is due soon and may further confirm the need for a more accommodative monetary policy. According to the COT report, non-commercial long positions rose by 2,980 to 223,791, while short positions fell by 6,602 to 119,258. As a result, the net long position increased by 4,077.

Indicator Signals:

Moving AveragesTrading is occurring around the 30- and 50-day moving averages, indicating difficulties in sustaining euro growth.Note: The moving average periods and prices are based on the author's analysis on the H1 chart and may differ from standard daily averages on the D1 chart.

Bollinger BandsIn case of a decline, the lower band near 1.1763 will act as support.

Indicator Descriptions:

- Moving Average: Identifies the current trend by smoothing out volatility and noise. Period – 50 (yellow on the chart); Period – 30 (green on the chart).

- MACD (Moving Average Convergence/Divergence): Fast EMA – 12; Slow EMA – 26; SMA – 9.

- Bollinger Bands: Period – 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using futures markets for speculative purposes and meeting specific criteria.

- Non-commercial long positions: Total long positions held by non-commercial traders.

- Non-commercial short positions: Total short positions held by non-commercial traders.

- Net non-commercial position: The difference between non-commercial long and short positions.