The EUR/USD currency pair traded with a downward bias throughout Monday, although there were likely no solid reasons for the dollar to strengthen again.

Let's recall that over the weekend, Donald Trump once again announced that tariffs for all countries on his "blacklist" would be raised in the near future, while Elon Musk declared his readiness to launch an "American Party" to unseat both the Democrats and Republicans.

Trump's intention to raise tariffs can hardly be called news anymore. The world has already fully understood his strategy: he begins with threats, ultimatums, and demands. If the opponent agrees to his terms, he immediately praises their decision. If not, he escalates with further threats and imposes sanctions or tariffs.

Thus, the announcement of new tariff hikes on imports came as no surprise. The dollar rose slightly on Monday, but should we expect more from it when the news once again signals deteriorating global geopolitical conditions? As we've said many times, the dollar may strengthen occasionally simply due to profit-taking or the closing of long positions. But expecting more sustained growth is unrealistic. Last week, the market clearly ignored strong macroeconomic data from the U.S., including reports that reduced the likelihood of a Fed rate cut in July or September. Did that help the dollar much?

Therefore, if you see the dollar rising, it's likely just a result of profit-taking from short positions—nothing more. Especially since the announced tariff hikes are still not finalized. Although July 9 is tomorrow, and Trump already has three trade agreements in hand, the U.S. president made a calculated move: he declared that tariffs on countries that fail to reach a deal with him by July 9 will be raised—but will only take effect starting August 1. In other words, acknowledging the reality of a setback, Trump gave those countries extra time for further negotiations.

What does this imply? Trump cannot simply cancel his tariffs. He also cannot admit that his plan has failed, even partially. With only 3 out of 75 countries signing agreements, he needed more time—without showing weakness. After all, high import tariffs are not in the U.S. interest either, as they fuel inflation and create financial hardship for low-income households. And in the context of Musk's potential party launch, one might wonder where the dissatisfied electorate will shift its support.

Thus, it's fair to say Trump has extended the "grace period," and over the next three weeks, he is likely to increase pressure on trade partners, demanding better deals. New threats may also emerge.

Volatility and Technical Overview

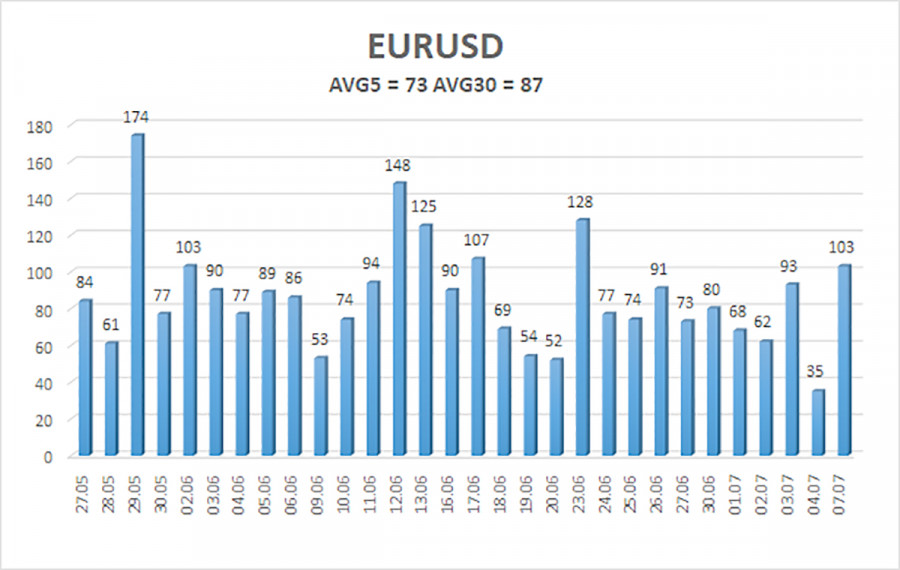

The average volatility for EUR/USD over the last 5 trading days (as of July 8) is 73 points, classified as "medium." We expect the pair to trade between 1.1623 and 1.1770 on Tuesday. The senior linear regression channel points upward, still indicating a bullish trend. The CCI indicator has entered the overbought zone and has formed several bearish divergences. However, within an uptrend, these typically signal a correction, not a reversal.

Nearest Support Levels:

- S1 – 1.1597

- S2 – 1.1475

- S3 – 1.1353

Nearest Resistance Levels:

- R1 – 1.1719

- R2 – 1.1841

- R3 – 1.1963

Trading Recommendations:

The EUR/USD pair remains in an uptrend. The U.S. dollar continues to be strongly influenced by Donald Trump's policies—both foreign and domestic. In addition, the market either misinterprets or ignores most data in a way that disadvantages the dollar. We continue to observe the market's complete reluctance to buy the dollar under any circumstances.

- If the price is below the moving average, small short positions may be considered, targeting 1.1623, though strong declines are unlikely under current conditions.

- If the price is above the moving average, long positions toward 1.1841 remain relevant in continuation of the trend.

Illustration Key:

- Linear Regression Channels: Help determine the current trend. If both channels point in the same direction, the trend is strong.

- Moving Average (settings 20.0, smoothed): Defines the short-term trend and the preferred trading direction.

- Murray Levels: Target zones for movements and corrections.

- Volatility Levels (red lines): Indicate the expected price range for the next 24 hours based on current volatility.

- CCI Indicator: Values below -250 indicate oversold; above +250 suggest overbought conditions—potential trend reversal zones.