On Wednesday, the GBP/USD currency pair maintained its downward movement, which is corrective in nature and could end at any moment. The price remained below the moving average line, and there were no significant macroeconomic developments this week. However, market activity was supported by developments surrounding Donald Trump. On Monday, the market reacted to reports that the White House began sending notifications about upcoming tariff hikes to all countries that did not reach an agreement by July 9. As of July 9, it was confirmed that tariffs would be raised starting August 1 for only 15 countries. Trump did not clarify what would happen with the remaining countries, but it appears the administration intends to release further tariff information gradually—both to avoid shocking the markets and to maintain daily media presence.

On Tuesday, Trump announced tariff increases for South Korea and Japan, and later for 13 more countries, many of which are relatively small or have GDPs lower than that of Los Angeles. In any case, the tariffs are set to take effect on August 1, and until then, further changes are still possible.

On Wednesday, it was revealed that no trade deal with China has been finalized, as negotiations are still ongoing. This effectively cancels one of the three signed trade agreements. The deal with the UK was never in doubt, while the one with Vietnam attracted little attention. After three months of Trump's "grace period," it has become clear that none of the trade partners are in a hurry to meet the White House's demands. It could be said that these countries are more concerned about American consumers, who will ultimately bear the cost of higher prices for imported goods. Analysts estimate that the average tariff rate for American consumers now stands at nearly 18%—a record high for the past 90 years. In effect, this 18% acts as an import tax, regardless of what it is called.

This development aligns with earlier commentary. Trump promised tax cuts for Americans, but simultaneously reduced funding for healthcare and social programs while increasing military and immigration enforcement expenditures. This necessitated the passage of a broad legislative package that could not be blocked in parts. Additionally, he initiated a trade war, which is expected to result in American consumers paying around 18% more for all imported goods.

It's important to note that the current import tariff rates are not final. Trump continues to threaten further hikes. The two signed trade deals, reached after three months of negotiations, indicate that tariffs will remain in place regardless. For instance, the UK will pay a standard 10% on most goods, while Vietnam faces rates ranging from 20% to 40%. These duties are here to stay and will likely increase for countries that do not reach a deal. This does not even include sector-specific tariffs on semiconductors, automobiles, copper, steel, aluminum, pharmaceuticals, film products, and others. In this context, it is not surprising that the U.S. dollar is under pressure and likely to remain so.

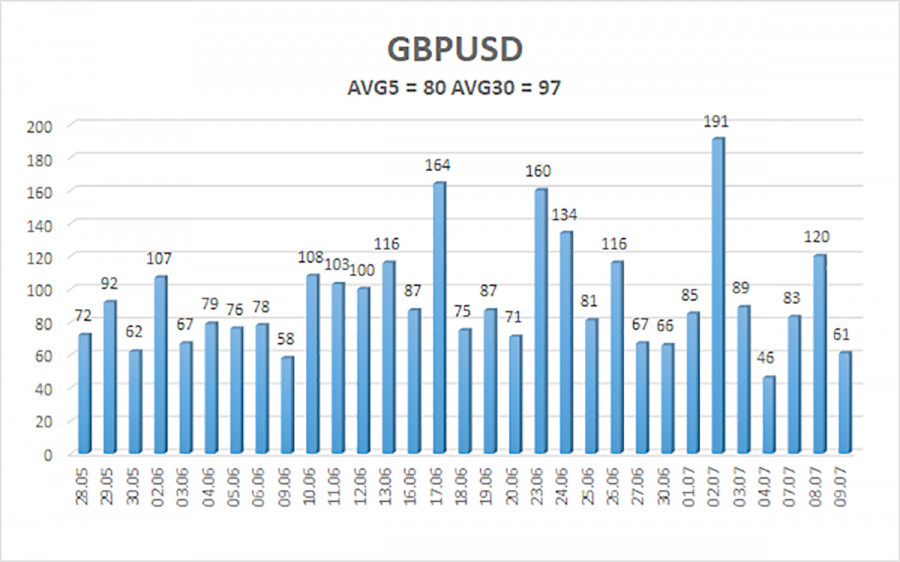

Average Volatility and Forecast (GBP/USD)

The average volatility of the GBP/USD pair over the past five trading days is 80 points, which is considered "moderate." On Thursday, July 10, movement is expected within the range defined by the levels of 1.3508 and 1.3668. The senior linear regression channel is pointing upward, indicating a clear uptrend. The CCI indicator has entered the oversold zone for the second time recently, again suggesting a possible resumption of the upward trend. A bullish divergence has also formed.

Nearest support levels:

- S1 – 1.3550

- S2 – 1.3489

- S3 – 1.3428

Nearest resistance levels:

- R1 – 1.3611

- R2 – 1.3672

- R3 – 1.3733

Trading Recommendations:

The GBP/USD pair continues a mild downward correction that may soon end. In the medium term, Donald Trump's policy is likely to keep pressuring the dollar. Therefore, long positions with targets at 1.3672 and 1.3733 remain relevant as long as the price is above the moving average. If the price stays below the moving average line, short positions toward 1.3550 and 1.3508 may be considered. However, a strong dollar rally is not expected under current conditions. The U.S. currency may experience occasional corrections, but a sustained recovery would require clear signs of the end of the global trade conflict.

Illustration Key:

- Linear regression channels help identify the current trend. If both are aligned in the same direction, the trend is strong.

- The moving average line (settings: 20.0, smoothed) shows the short-term direction and should be used as a guide for trading.

- Murray levels are target levels for movements and corrections.

- Volatility levels (red lines) represent the expected daily price range based on current volatility data.

- The CCI indicator entering the oversold (below -250) or overbought (above +250) zones suggests a possible trend reversal.