Trade Analysis and Tips for the Japanese Yen

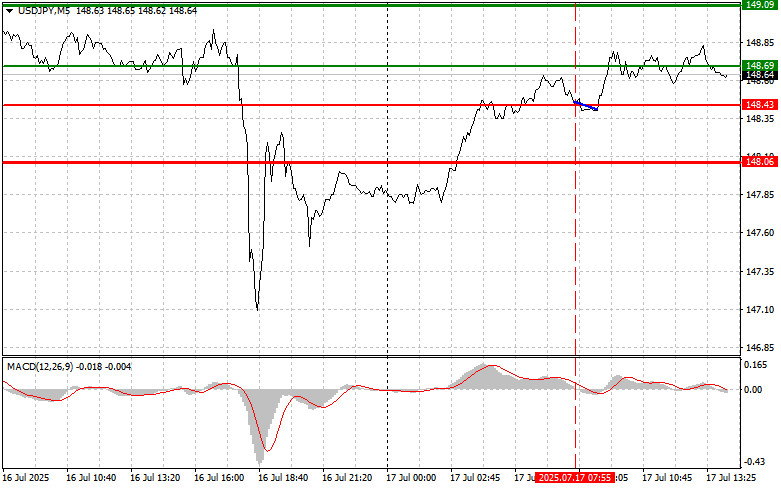

The price test at 148.43 coincided with the moment when the MACD indicator had just begun moving downward from the zero line, confirming a correct entry point for selling the dollar—though a significant drop in the pair never materialized.

The focus will now shift to data such as initial jobless claims, June retail sales, and the Philadelphia Fed Manufacturing Index. These indicators will act as a stress test to assess the current health of the U.S. economy. A decrease in initial jobless claims is interpreted as a positive sign, highlighting labor market stability and ongoing economic growth. A noticeable increase in June retail sales would signal resilient consumer spending, which is the main driver of the U.S. economy.

Speeches from Federal Reserve members Adriana D. Kugler and Mary Daly will receive special attention, given the lack of consensus within the committee on interest rate policy. Their remarks may reveal internal disagreements and give investors greater clarity on the Fed's future monetary policy path.

A key factor will be their assessment of current inflation and forward-looking forecasts. If Kugler and Daly express concern about persistently high inflation, it may reinforce expectations for a continued tight monetary policy stance. On the other hand, an emphasis on signs of slowing inflation or risks to economic growth could weaken the dollar and renew interest in riskier assets.

As for intraday strategy, I will focus on executing Scenarios #1 and #2.

Buy Signal

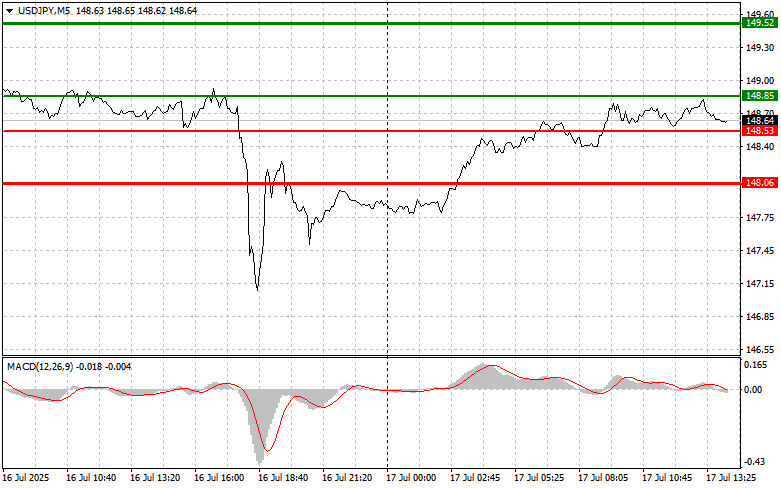

Scenario #1: I plan to buy USD/JPY today upon reaching the entry point around 148.85 (green line on the chart), aiming for growth toward 149.52 (thicker green line). At 149.52, I will exit long positions and open short ones in the opposite direction, targeting a 30–35 point retracement. A continued upward trend would support the pair's growth. Important: Before buying, ensure that the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy USD/JPY today if the 148.53 level is tested twice consecutively, while the MACD indicator is in the oversold zone. This would limit the pair's downward potential and trigger a reversal to the upside. Growth toward 148.85 and 149.52 can then be expected.

Sell Signal

Scenario #1: I plan to sell USD/JPY today after a breakout below the 148.53 level (red line on the chart), which could lead to a quick decline in the pair. The main bearish target will be 148.06, where I plan to exit short positions and immediately open long positions in the opposite direction, targeting a 20–25 point rebound. Downward pressure on the pair may return if U.S. data turns out to be particularly weak. Important: Before selling, ensure that the MACD indicator is below the zero line and just beginning to fall from it.

Scenario #2: I also plan to sell USD/JPY today if the 148.85 level is tested twice consecutively, while the MACD indicator is in the overbought zone. This would cap the pair's upward potential and trigger a reversal to the downside. A drop toward 148.53 and 148.06 can then be expected.

Chart Notes:

- Thin green line – entry price for buying the instrument

- Thick green line – suggested price for setting Take Profit or manually locking in gains, as further growth beyond this level is unlikely

- Thin red line – entry price for selling the instrument

- Thick red line – suggested price for setting Take Profit or manually locking in gains, as further decline beyond this level is unlikely

- MACD Indicator – when entering the market, it's essential to consider overbought and oversold zones

Important: Beginner traders in the Forex market should exercise great caution when entering trades. It's best to stay out of the market ahead of major fundamental data releases to avoid sharp price swings. If you choose to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit—especially if you don't use proper money management and trade large volumes.

And remember: successful trading requires a clear trading plan—like the one outlined above. Making impulsive decisions based on current market conditions is a losing strategy for intraday traders.